-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

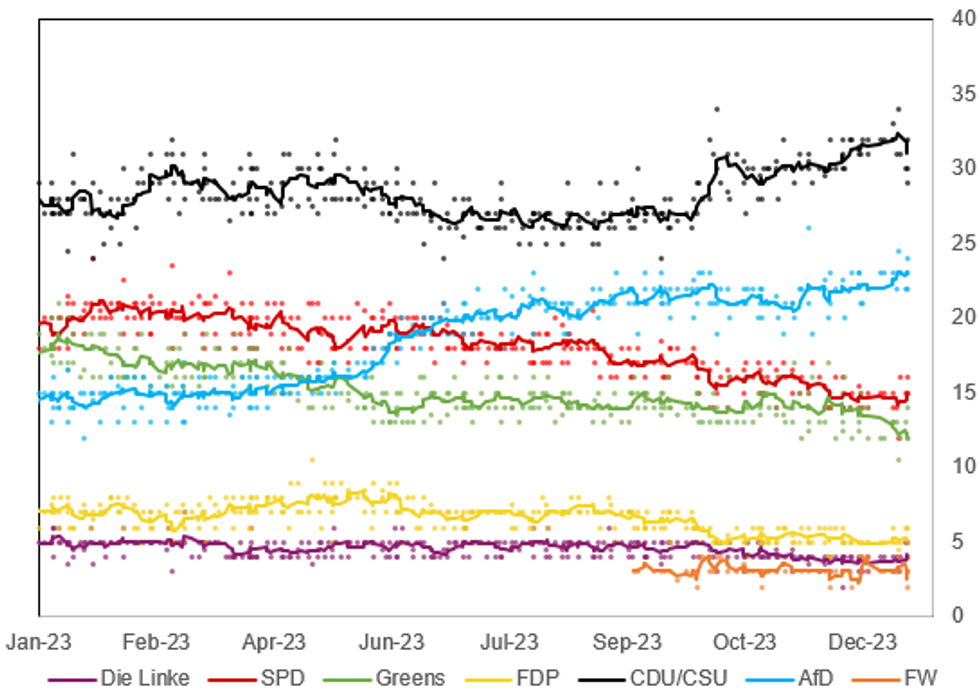

Free AccessAfD Hits New High In YouGov Poll, But BSW Poses Threat In EP Elections

The right-wing nationalist Alternative for Germany (AfD) hit a record high in opinion polling by YouGov carried out 3-8 Jan, with support hitting 24%, just 5% behind the centre-right Christian Democratic Union (CDU) on 29%. The next federal election is not due until Oct 2025, but the European Parliament elections on 9 June will act as a key indicator of whether the AfD's surge in support over the latter half of 2023 can convert into votes at the ballot box.

- The electoral system used by Germany in EP elections, and the fact that the country's seat total (96) is close to 100, means that a party's nationwide vote share is often very close to the number of seats won. In 2019, the AfD came in fourth with 11.0% of the vote, resulting in 11 MEPs. As such, should polling for the AfD be reflected at the ballot box it could more than double the party's representation.

- There is a potential obstacle for a number of parties, but perhaps most notably the AfD, in the form of thenew partylaunched by far-left lawmaker Sahra Wagenknecht on 8 Jan. Bündnis Sahra Wagenknecht (Alliance Sahra Wagenknecht, BSW) sits as a populist left-wing party. In this instance the political spectrum forms a horseshoe, with BSW and AfD at different ends, but relatively close on some policies including a reducing immigration, ending costly environmental policies, and halting weapons supplies to Ukraine.

Source: Forsa, INSA, FGW, YouGov, Walhkreisprognose, Infratest dimap, Ipsos, GMS, Verian, Allensbach, MNI

Source: Forsa, INSA, FGW, YouGov, Walhkreisprognose, Infratest dimap, Ipsos, GMS, Verian, Allensbach, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.