-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessAnother Blow To PM Johnson's Position Following Poor By-Election Results

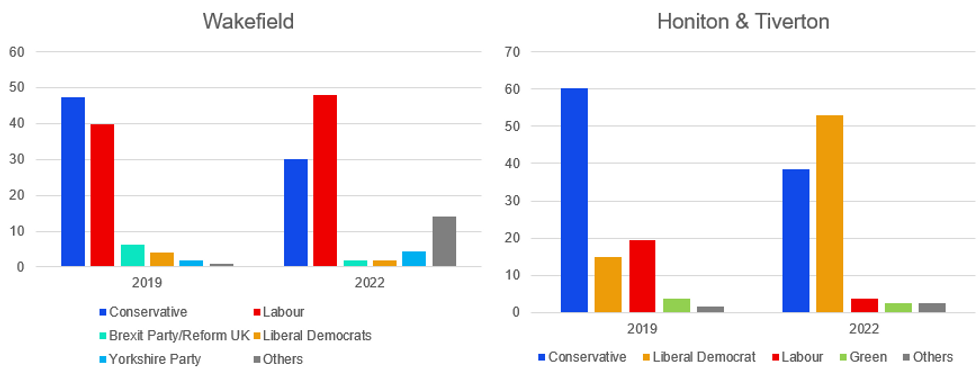

Prime Minister Boris Johnson's position is set to come under increasing pressure in the days and weeks ahead as he deals with the fallout of two parliamentary by-election losses on the same day. Following the loss of Wakefield in northern England to the centre-left Labour Party, and Honiton & Tiverton in southwest England to the centrist Liberal Democrats, Conservative Party chairman Oliver Dowden unexpectedly resigned.

- In his resignation letter Dowden, who backed Johnson for the Conservative leadership in 2019, stated that grassroots party members were "distressed and disappointed" by a slew of by-election losses. Adding that “We cannot carry on with business as usual. Somebody must take responsibility”. Observers have seen the last comment as a potential attack on Johnson over the 'partygate' scandal that has damaged the Conservatives' standing.

- The by-election losses were significant. Wakefield formed part of the 'red wall' of seats won from Labour for the first time in generations in 2019, and Labour's easy winning back of the seat will concern freshman MPs in northern English seats that Johnson is not the electoral draw he once was. In Tiverton and Honiton, the Liberal Democrats scored a major win, overturning a 24k+ vote majority in a result that will concern heartland southern England Conservative MPs

Source: Returning officers, MNI

Source: Returning officers, MNI

- Betting markets show little clarity in when they believe Johnson will leave office. Data from Smarkets shows an implied probability of 37.6% that Johnson leaves office in 2024 or later, 35.7% that he leaves in 2022, and 31.3% that he leaves in 2023 (sums to more than 100% due to bookie's over round).

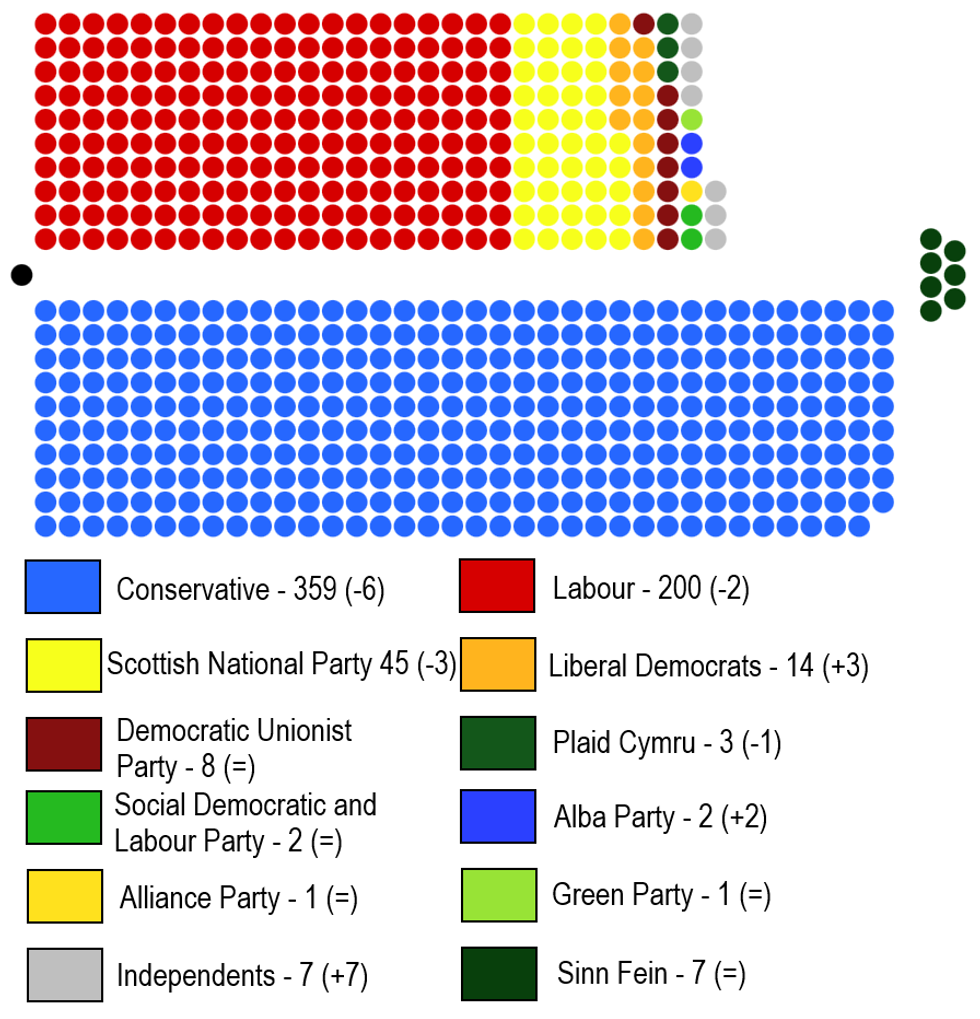

Chart 2. House of Commons, Seats, Chg from 2019 GE in brackets

Source: House of Commons, MNI. Sinn Fein do not sit in parliament and as such are placed as crossbenchers.

Source: House of Commons, MNI. Sinn Fein do not sit in parliament and as such are placed as crossbenchers.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.