-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Fed & U.S. Fiscal Matters Set To Headline

- U.S. fiscal matters continue to headline in discussions before a heavy day of Fedspeak on Wednesday. U.S. President Biden set to speak on infrastructure.

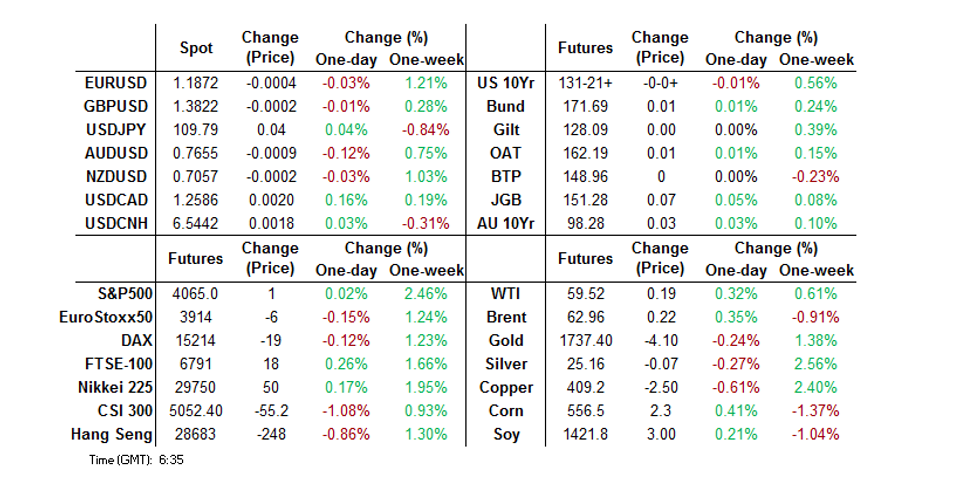

- U.S. Tsy yields consolidate in Asia.

- European vaccine issues and wider spread COVID pockets garner attention.

BOND SUMMARY: Mixed Core FI Trade In Asia

T-Notes dealt around unchanged levels for the duration of Asia-Pac trade, operating around late NY highs, last -0-01+ at 131-20+. Cash Tsys print around 0.5bp cheaper across the curve. Flow was headlined by a 10.0K block seller of the TYM1 133.00 calls, with a lack of notable headlines evident. The minutes from the most recent FOMC decision and a deluge of Fedspeak headline locally on Wednesday.

- A fairly sedate Tokyo session saw the super-long end of the curve experience some outperformance, with the bull flattening theme extending during the afternoon session. The move initially came on the back of the spill over from U.S. Tsy trade during NY hours. Futures traded either side of unchanged, with the firming of the super long end adding support during the Tokyo afternoon, the contract last deals +4. 5-25 Year BoJ Rinban operations were upsized, in line with the Bank's already delivered April Rinban outline, with the offer to cover ratios sliding vs. the previous operations in the respective buckets (which would have provided another leg of support). 5-Year JGB supply headlines locally on Thursday.

- YM unchanged, XM +2.5 as we head towards the Sydney close. There was a little bit of pre-auction auction concession for XM, before it became apparent that the pricing component of the ACGB Dec '30 auction was firm, with the weighted average yield printing 0.74bp through prevailing mids at the time of supply, although the cover ratio softened vs. the previous offering, even as the notional amount on offer moderated. The 7- to 12-Year sector of the ACGB curve has outperformed in cash trade.

FOREX: Rangey After Big Moves

Narrow ranges for major FX in the Asia-Pac time zone, a brief dip lower in the greenback was reversed, DXY emerges from the Asia session marginally higher.

- AUD and NZD both lost some ground, Australian data earlier saw IHS Markit Australia March Services PM rise to 55.5 vs 53.4 in Feb, while Australia ANZ Consumer Confidence fell to 107.7 from 112.3 previously. AUD down around 9 pips. NZD was slightly more resilient, shedding 5 pips, supported by a gain in GDT prices overnight.

- JPY heads in to Europe slightly weaker, unable to maintain earlier strength. USD/JPY dropped as low as 109.58 before recovering. The pair last up 6 pips but still holding most of yesterday's decline. Japan PM Suga says a snap election before the end of September is a possibility.

- GBP is higher, GBP/USD gaining around 5 pips after reports that UK will start the rollout of the Moderna COVID-19 vaccine from today.

- PBOC fixed USD/CNY at 6.5384, 7 pips below sell side estimates. Offshore yuan has weakened but holds most of yesterday's gains. USD/CNH last up 26 pips, recovering after breaking below yesterday's nadir.

FOREX OPTIONS: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E775mln), $1.1825-35(E1.3bln), $1.1850(E1.1bln-EUR puts), $1.1925-35(E915mln), $1.1940-50(E743mln)

- USD/JPY: Y107.95-05($893mln), Y108.15-25($1.2bln), Y109.00($1.4bln), Y109.75($500mln), Y109.80-85($510mln), Y109.95-110.00($2.9bln, mainly USD puts)

- EUR/GBP: Gbp0.8550-55(E950mln-EUR puts)

- AUD/USD: $0.7450(A$709mln), $0.7610-20(A$591mln), $0.7705-20(A$732mln)

- USD/CNY: Cny6.60($1.7bln-USD puts)

ASIA FX: Markets Play Catch Up After Overnight USD Decline

A brief dip lower in the greenback was reversed, DXY emerges from the Asia session marginally higher, most EM Asia FX gain though after a big move lower for the greenback yesterday.

- CNH: PBOC fixed USD/CNY at 6.5384, 7 pips below sell side estimates. Offshore yuan has weakened but holds most of yesterday's gains. USD/CNH last up 26 pips, recovering after breaking below yesterday's nadir.

- SGD: Singapore dollar is higher, USD/SGD down around 6 pips, running into bids around 1.3380. SGD is at a one month high here, markets look ahead to the MAS monpol statement which is expected in the next week.

- TWD: Taiwan's Foreign Minister said Taiwan is considering opening a travel bubble with other countries, while also raising the prospect of a trade deal with the US.

- KRW: Won is stronger, the best performer in Asia. Gains were helped by a beat from Samsung at its Q1 earnings and a wider current account surplus, but tempered by another uptick in coronavirus cases.

- MYR: Ringgit is stronger, the government yesterday announced it had relaxed regulatory conditions for some firms to boost the economy, markets await foreign reserves data later today.

- IDR: Rupiah is stronger, gaining for a third day, BI Deputy Gov Waluyo said yesterday the bank would continue to stabilise rupiah in line with fundamentals

- PHP: Peso is stronger, gains more muted than other pairs after weak inflation data yesterday sparked speculation the BSP has further room to cut.

- THB: Baht has moved higher, BOT released the minutes of the latest meeting and said it stands ready to use additional policy tools if needed, and noted the economy could perform below forecasts.

ASIA RATES: Yields Generally Lower, India Bucks The Trend After RBI

Bonds supported after a decline in US yields spurred by strong data.

- INDIA: The RBI kept rates on hold as expected and outlined an accommodative stance on monetary policy until growth was anchored. Bonds sold off after the announcement, markets looking to the speech from RBI Governor Das at 0730BST/1200IST for any details on bond market support. Yields came off highs after the RBI pledged to ensure ample liquidity.

- INDONESIA: Bonds supported, curve bull steepens. Another disappointing auction yesterday with eh government only selling IDR 7.3tn against a reduced IDR 10tn target, sale is usually around IDR 30tn. Space supported after BI Deputy Gov Waluyo said the bank has scope to keep loose mon pol. Markets await a greenshoe option auction today.

- SOUTH KOREA: Futures higher in South Korea, curve flattens as the BoK auction KRW 2.1tn 2-year MSB's. Some caution after an uptick in the number of COVID-19 cases prompted talk of a fourth wave. South Korean Finance Minister Hong was on the wires, he noted that the IMF report that upgraded global growth forecasts meant that growth in South Korea could also rise above forecasts, and that a recovery expectation could increase caution on inflation. Data last week showed March CPI rose 1.5% y/y, up from February's 1.1% gain and the fastest since January 2020.

- CHINA: The PBOC matched maturities with injections again today, the twenty second straight session of matching maturities, while the bank hasn't injected funds since February 25. Overnight repo rate is steady, last up 3.5bps at 1.805%, 7-day repo rate is up 7.7bps at 1.8772%. China's Securities Depository and Clearing Corp has confirmed that lower rated corporate bonds insured by hedging tools can be used as collateral for repos.

EQUITIES: Some Up, Some Down

A mixed picture in Asia-Pac markets after a negative lead from the US in lacklustre trade with the lowest volumes of 2021 so far despite the IMF upgrading global growth forecasts. Indices in Japan are in minor positive territory, recouping some of yesterday's losses, tech sector leads the way higher after Toshiba said it had received a proposal to go private in a $20 billion deal. Chinese bourses are the laggards, the CSI 300 nursing losses of over 1% for the second session, consumer staples weigh. Hang Seng Index lower as markets reopen after a three-day trading pause. US futures are mixed, Dow & S&P futures in minor positive territory, Nasdaq lower.

GOLD: No Decisive Move

A slightly lower DXY and mixed U.S. real yields have allowed bullion to nudge higher over the last 24 hours or so, although bulls haven't been able to force a test of key resistance in the form of the Mar 18 high. Spot last deals just shy of $1,740/oz, a little off of Tuesday's best levels.

OIL: Treading Water

WTI & Brent have added $0.30 during Asia-Pac hours, after retreating from highs into the US close yesterday.

- There are a number of factors that could engender optimism for bulls; the IMF upgraded its global economic growth forecast for the second time in three months predicting growth of 6% this year, up from the 5.5% pace estimated in January. Meanwhile US API stockpile data yesterday showed a decline in inventories. Headline crude stocks fell 2.62m bbls in the latest period, though downstream products saw builds, a 4.85m bbl gasoline stockpile increase and a 2.81m bbls gain in distillate stocks tempered optimism following the report. Markets also digest a cordial first round of discussions between the US and Iran over the nuclear deal, the two sides will meet again on Friday.

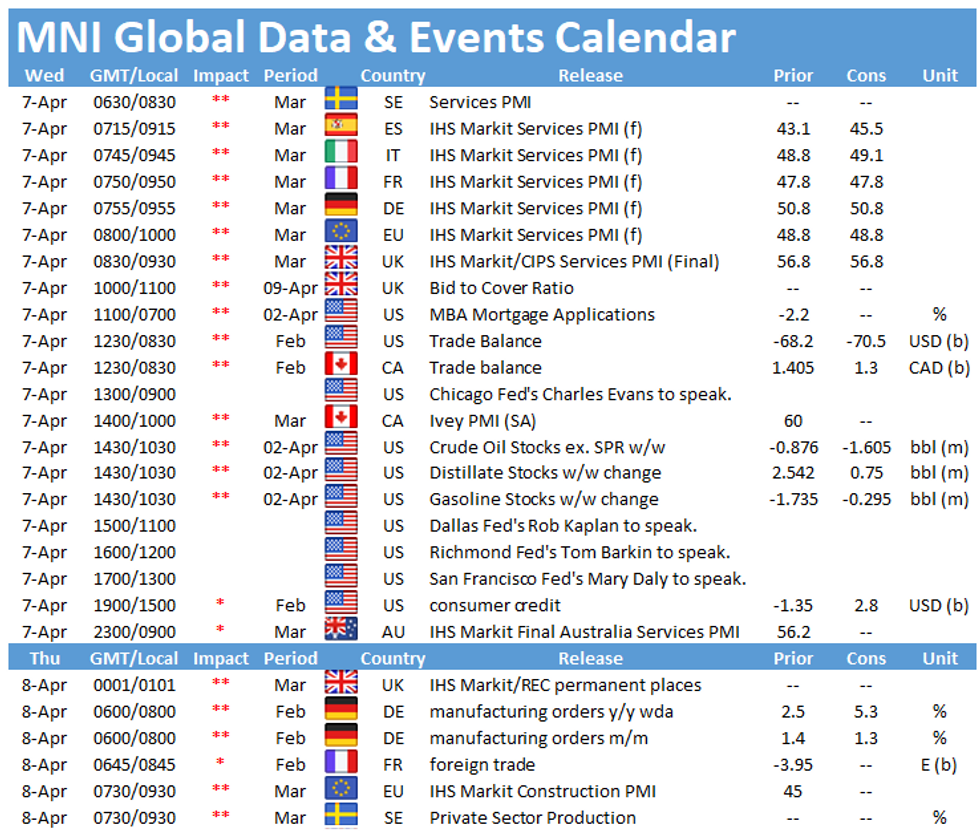

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.