-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBaht Gains Despite BoT's Suggestion That It Will Stick With Gradual Approach To Tightening

Spot USD/THB trades -0.065 at THB35.820, the baht is the best performer in emerging Asia. Technically, bears look for a dip through Nov 15 low of THB35.530 towards the 200-DMA/Aug 11 low at THB35.173/35.160. Topside focus falls on the 100-DMA, which kicks in at THB36.674.

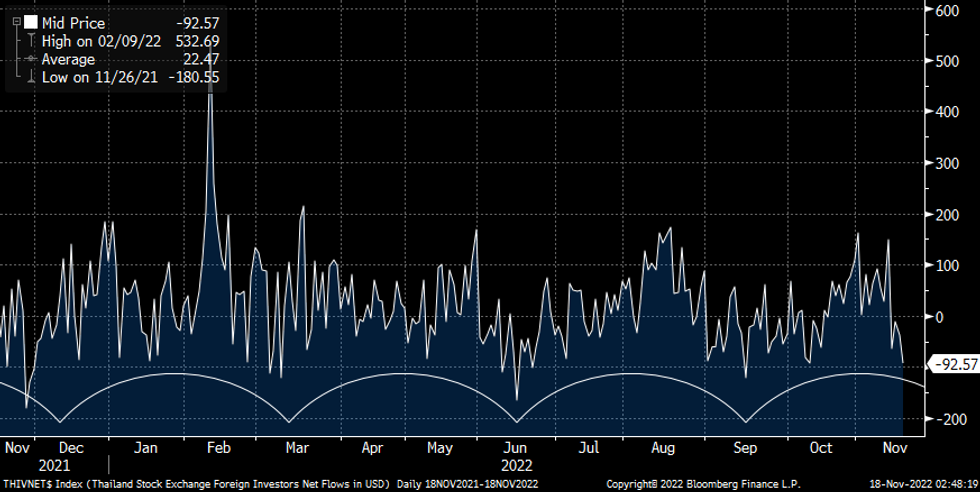

- Outflows of foreign capital from Thailand's equity market continued Thursday, with offshore investors shedding a net $92.57mn in Thai stocks, the largest net drain since Sep 15. This is consistent with tentative cyclical analysis, suggesting that outflows may continue in the near term. The SET index fell 0.31% on the day, briefly piercing its 50-DMA on fairly low turnover.

- BoT Asst Gov Piti hinted that the central bank will stick to its "measured and gradual" approach to monetary tightening. He told the audience of a BBG event to expect "continuity," adding that the next rate decision will match market view. Core CPI inflation may peak in late 2022/early 2023 and the current baht levels are "acceptable," with the exchange rate acting as a shock absorber.

- The BoT will publish its weekly update on foreign reserves later today. Next week's data highlights include GDP (Monday) and customs trade balance (Wednesday). In yesterday's comments, BoT's Piti said Q3 GDP growth may print above +3.0% Y/Y and "confirm that we're taking off."

- In the meantime, PM Prayuth will participate in a suite of events surrounding the APEC summit in Bangkok today.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.