-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Barry Callebaut (BARY; Baa3/BBB) FV and notes on the co

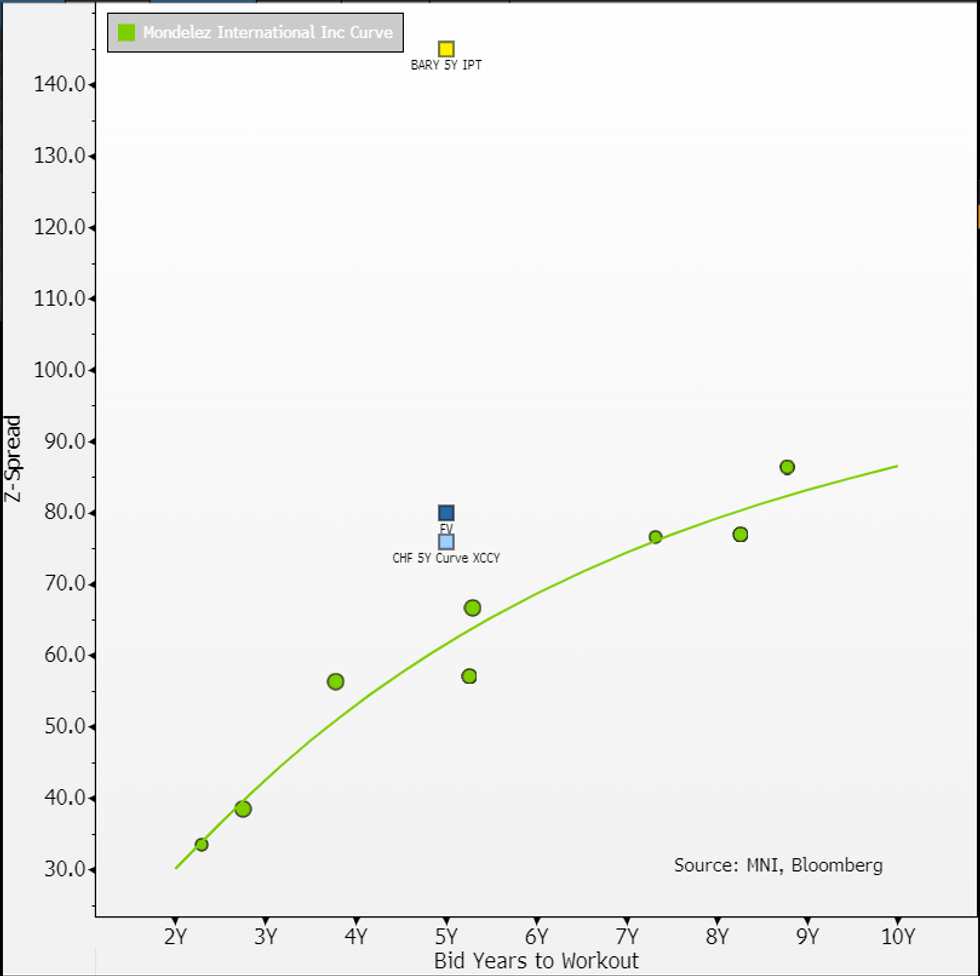

€benchmark 5Y IPT +140 vs. FV +80 (-60)

Cheap view on the deal (valid Z+100 & above). Not as exciting as PostNL in spread/carry but the NIC is sizeable and value there vs. other consumer sectors - 5Y curve levels below for widest IG names in each (ex. distressed); rotating out of grocers, brewers, food retailers (incl. Mondelez) & BAT screens attractive. Fundamentals further down.

- Brewers: Asahi Z+72

- Grocers: Tesco Z+85

- Food/drink: JDE Peets Z+98

- **Cheap view >=Z+100

- Services (ex Post): Securitas Z+102

- Tobacco: Imperial/Altria Z+125

- Apparel: PVH Z+130

Nestle (Aa3/AA-) & Mondelez (Baa1/BBB; S) are the comps, latter used given similar rating. Barry has a curve in Swiss Francs, it did a 2/6/10y last month - the lines are -12/-6/-6 tighter since. The curve's 5Y on XCCY Z-spread is marked below (comes out at Z+76). This is likely refi for the €450m line that rolled off late last month.

1CHF=€1.03

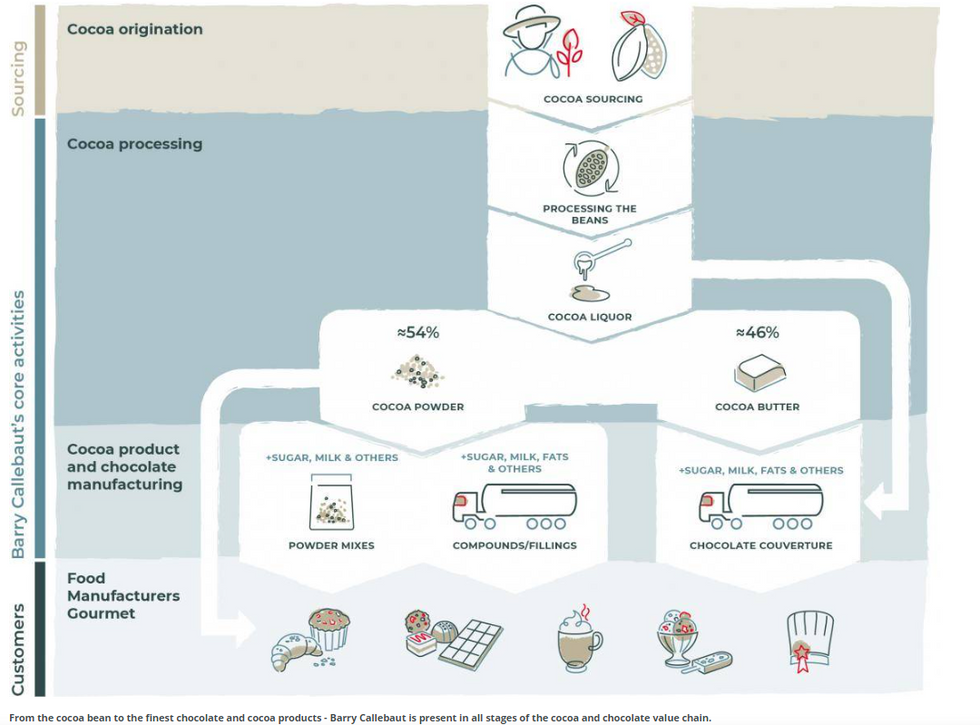

- Below image shows where Barry sits in the cocoa farming to retailing process. It is exposed to raw prices but it says cost-plus pricing model passes it on to customers. It also hedges. We are not doubting its assurances; FY24 (12m ending August) guidance was reaffirmed at 1H results for flat volume & flat recurring EBIT (i.e. excluding its capex program) on constant currency basis. Given 1H showed +0.7% volume its indicating to 2H slow down.

- It's been on a debt raising flurry this year (CHF1.3b in francs this year) and that is on negative working capital (it has 12-18 month cycle between Cocoa contract/purchase & customer sales). This should reverse eventually & see cash hit the balance sheet. The temporary rise in leverage has been cleared by Moody's. It sees rising cocoa prices as potential positive in fact, as smaller players struggle to manage the rising WC requirements. Barry is far from small; it says it has a 21%/largest share in cocoa & chocolate with only 2 other competitors with more than 10% share.

- The main concerns are 1) demand destruction from end-consumer on rising cocoa prices 2) its businesses who are clients/retailers refusing to face the falling margins on cocoa products & attempting to re-negotiate pass-through costs. We don't have firm view on either, both are resolved if cocoa prices fall.

- It runs net debt at CHF2.6b (up from 1.6b last year) with cash & eqv's of 430m. Against consensus FY24 CHF800 EBITDA leaves it 3.3x levered. Moody's sees its adj. gross leverage hitting 4.5x to end FY24 (August). Its maturities are well spread out (for now) at 300-400m/yr. Presentation seems to imply this will be a €500m line.

- Note its inventories that can be traded on commodity exchanges and are referred to as readily marketable inventories (RMI) in reports. It totals €2.4b and is a source of cash for it. Adj. for them, net debt sits at 300m.

- Please note FCF would have been -40m even ex. the WC/cocoa price drag. That's on its "BC next level" capex program - costs expected to total CHF500m over next 2 years. Note opex from this is excluded in "normalised EBIT" . Benefits expected to flow through mostly in FY25/26. Moody's sees net positive from the program.

- On Cocoa prices {QC1 Comdty; ticker} weather is hard for us to predict. Reactive supply boost is the argument for prices to come down - right now the global cocoa market has a reliance on West Africa. International Cocoa Organization pegs Ivory Coast at 40% & Ghana at 13% of producer output. Ecuador at 10% & Brazil 5% are the other 2 main countries. Bloomberg article here highlighting some of the efforts underway to increase and diversify supply (including from Barry).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.