-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBayer Continues Drift Wider

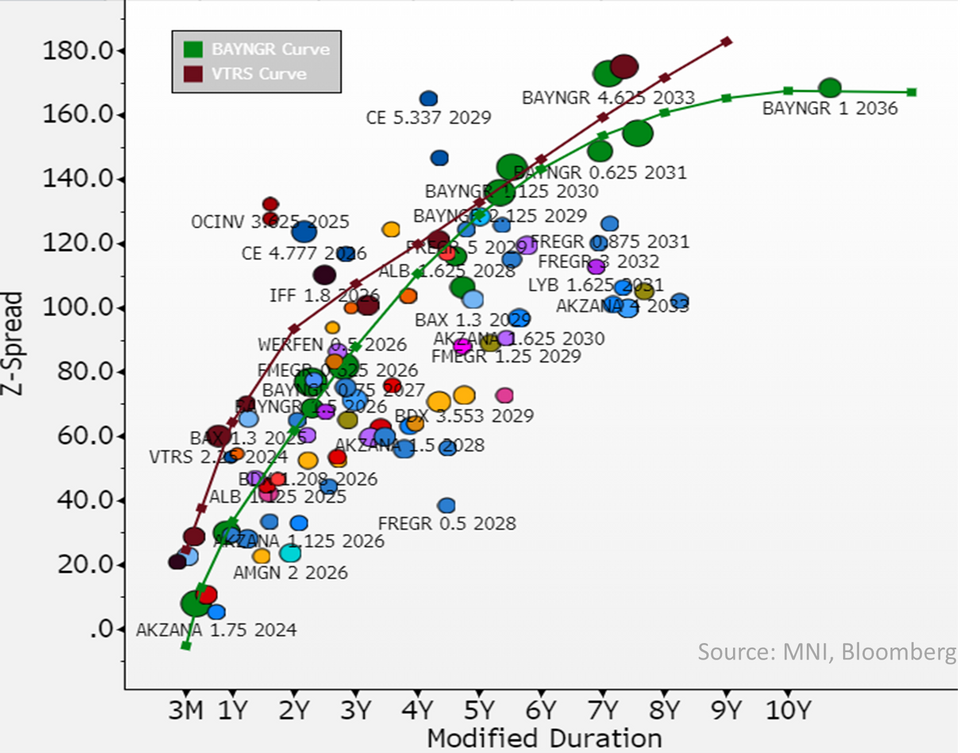

Bayer Snr Lines (Baa2 Neg, BBB Pos) are continuing to drift wider today (+2-9bps) - its now trading in line with pharama Viatris (Baa3 Stable, BBB- Neg) - $ curve already trades firmly wider to VTRS. The one-way moves wider follow Friday’s court loss with a record $2.25b pay-out verdict - Bayer will appeal the decision - but concerns are the verdict will lead to more losses against Bayer with higher pay-outs with the remaining claims more spread out among US state courts

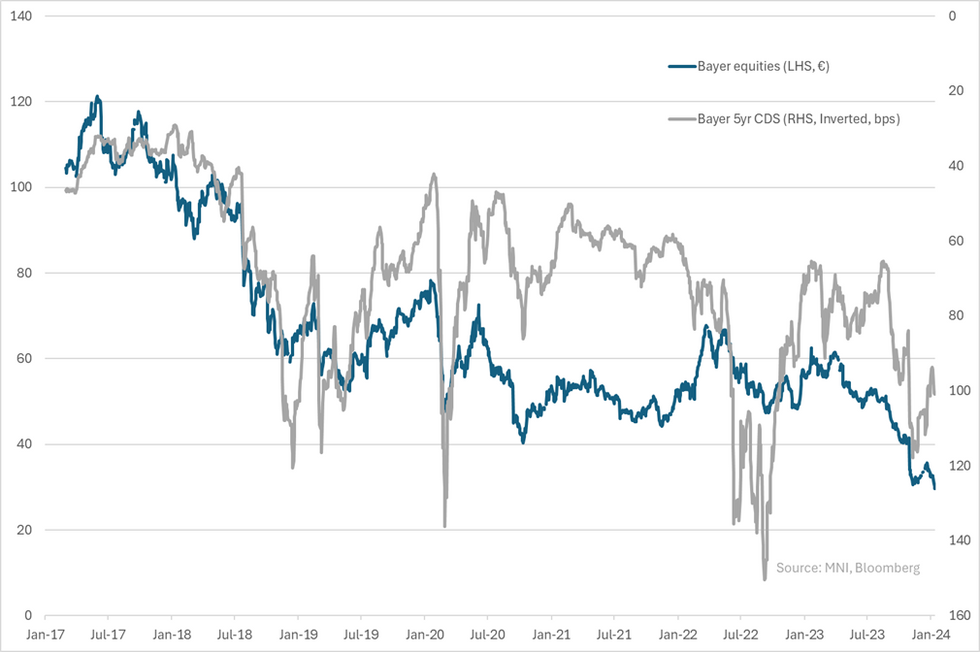

5yr € CDS basis looks flat, but the Jan 29's do trade tight vs. its curve. CDS also looks to have lagged the most recent moves in equities but there have been analyst comments that dividends may be cut to keep up with the litigation costs. Bayer paid out €2.4b in dividends in FY22 (from €13.5 in EBITDA) – we don’t see drastic changes in DPS among consensus yet (bbg). On flipside analyst comments around business separation (including selling the crop or consumer business to raise cash) seem to have wavered with most recent news.

As a rehash of the most recent rating action, Moody kept Bayer's rating unch in Nov (after Asundexian drug failure & $1.5b jury verdict) but downgraded the outlook to neg adding "We could downgrade Bayer's ratings if financial payouts from ongoing litigation would be materially higher than what Bayer has currently provided for and, as a result of higher payouts, if debt/EBITDA were to remain above 4.0x and RCF/net debt below 15%."

Moody's inferred provisions from company; €2-3bn for litigation payouts in FY23 with Moody's noting; "its highly likely that Bayer will appeal any unfavorable trial outcomes. Bayer's remaining litigation provisions amount to around €7 billion as of September 2023". Bbg reported earlier this week that it had $6b remaining in provisions for claims (of the total $16b).

For now credit investors seem to be pricing in a downgrade - risk events ahead include a potential Australian court decision that heard closing arguments on Tuesday for a case with 1,000 claimants - settlement (if any) is (reportedly) expected to be lower in $ value than the large US settlements. Bayer reports FY23 results in early March (alongside its capital markets day), Viatris in late Feb.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.