-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI US MARKETS ANALYSIS - Biden Withdrawal Improves Dems Odds

MNI (LONDON) - Highlights:

- Biden withdrawal improves Democrats' odds, but Trump lead remains

- EUR/JPY sales define early FX trade, while China rate cut fails to support AUD

- Equities stabilise off lows, tech names outperform

US TSYS: Modestly Flatter Curves On Biden Withdrawal vs PBOC Rate Cut

- Treasuries have seen two-way trade overnight following President Biden yesterday ending his re-election campaign and the PBOC cutting its seven-day reverse repo rate for the first time in almost a year.

- The net reaction for the curve though is a modest flattening in a mild paring of “Trump trade” steepening and with yields mostly a little lower on the day. The flattening came first with the Asia open before intraday steepening after the PBOC that has since been reversed.

- Cash yields sit between 0.5bp higher (2s) and 2bps lower (20s and 30s). 2s10s at -29.1bp is off Friday’s intraday high of -25.3bps but only back to initial post-CPI levels.

- TYU4 trades at 110-28+ (+ 02) on middling volumes of 305k. It earlier tied with Friday’s low of 110-25 but remains above support at 110-15+ (20-day EMA).

- The pullback therefore persists but a bullish backdrop remains with resistance seen at 111-13+ (Jul 16 high).

- Today’s particularly thin docket should see flow and headlines in the driving seat (and with earnings still in focus), whilst some may look ahead to tomorrow’s 2Y supply. Last month’s 2Y auction came in almost in-line but with the bid-to-cover of 2.75x the highest since Aug 2023.

- Data: Chicago Fed national activity index Jun (0830ET)

- Bill issuance: US Tsy $76B 13W, $70B 26W Bill auctions (1130ET)

STIR: Marginal Increase In Fed Rates After Biden Withdrawal and PBOC Rate Cut

- Fed Funds implied rates are unchanged for July and September meetings and beyond that just 0.5bp higher in an extension of Friday’s increase.

- The PBOC surprisingly cutting its seven-day reverse repo rate is one factor at play whilst investors continue to grapple with implications from Biden ending his re-election campaign.

- Cumulative cuts from 5.33% effective: 1bp Jul, 25bp Sep, 40bp Nov, 62bp Dec and 79bp Jan.

- It follows last week’s almost clean sweep of stronger than expected data but one that was overshadowed by the prior week’s CPI/PPI plus Powell’s comments on greater dual mandate progress.

- Ahead of today’s particularly light docket with the FOMC in media blackout, see the latest macro recaphere.

EZ Q1 Deficit Falls To 3.2% of GDP

The provisional Q1 Eurozone deficit (seasonally adjusted) fell to 3.2% of GDP (vs 4.0% in Q4 2023). This came as total expenditure fell to 49.4% of GDP (vs 50.7% prior) while revenues dropped a lesser extent to 46.2% (vs 46.7% prior).

- The fall in these ratios reflected falls in absolute seasonally adjusted revenue/expenditure as well as a rise in nominal GDP.

- Of the largest Eurozone countries, the deficit rose in Germany to 2.8% of GDP (vs 2.5% prior), fell in France to 5.6% (vs 5.9% prior) and was constant in Spain at 3.2%. The Italian Q1 data was released by ISTAT earlier this month, with the non-seasonally adjusted deficit rising to 8.8% of GDP (vs 7.4% prior).

- The EC forecasts the Eurozone-wide budget deficit to ease to 3.0% of GDP in 2024 (vs 3.6% in 2023), and overall Government debt to GDP to rise to 90% (vs 88.6% in 2023).

- On Friday, the European Council is set to confirm Excessive Deficit Procedures against seven EU countries (including France, Italy and Belgium), after the European Commission proposed the notion in its Spring Package on June 19.

Overall EZ Debt Ticks Higher In Q1

Overall Government debt to GDP rose slightly to 88.7% (vs 88.2% in Q4 ’23), reflecting a rise in total debt securities (to 83.9% vs 83.4% prior).

- The highest levels of debt were recorded in Greece (159.8%), Italy (137.7%), France (110.8%) and Spain (108.9%).

- Compared with Q4 2023, total Government debt rose in 15 Eurozone countries, and fell in 5,

- We will follow-up with further notes on the above later today.

WHITE HOUSE: Betting Markets Shift Slightly Towards Dems As Biden Exits Race

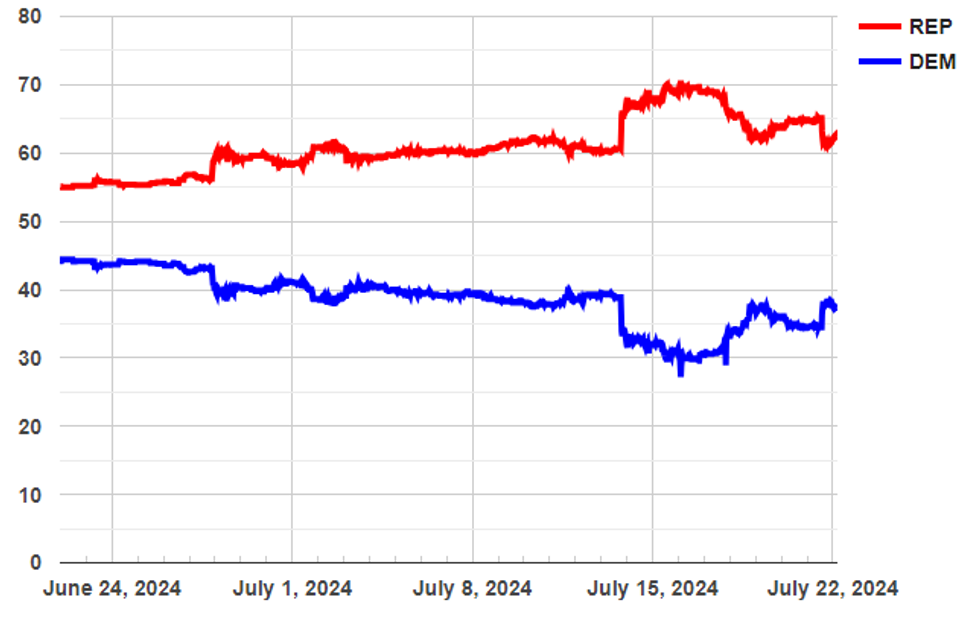

The withdrawal of President Joe Biden from the election race, announced on 21 July, has seen a small shift in political betting markets. The seemingly likelihood (but not a guarantee) that Vice President Kamala Harris will be the Democratic party nominee has seen the implied probability for Republican nominee former President Donald Trump fall from 65.1% on 21 July prior to Biden's announcement to 62.5% at the time of writing. The implied probability of the Democrats retaining the White House has risen from 34.5% to 37.1% according to data from electionbettingodds.com.

- The relatively small shift in betting market probabilities could be seen as highlighting the baked-in expectations that Biden would withdraw from the contest after weeks of increasing pressure following his disastrous debate performance in June.

- Betting markets show widespread expectation that, following Biden's endorsement and the confirmation that she will run, Harris will end up as the Democratic party nominee with an 85.0% implied probability. In second place is former First Lady Michelle Obama with a 5.9% implied probability.

- There is likely to be a wait-and-see phase in betting markets as bettors wait to see the first opinion polls on the election with Harris as the presumptive Democrat nominee. There have been numerous polls carried out to date asking voters of hypothetical Trump vs. Harris scenarios, but there could be a shift in mentality or stance towards the VP now that she holds the position of presumptive nominee.

Chart 1. Political Betting Markets, Implied Probability of Win by Party, %

Source: electionbettingodds.com

Source: electionbettingodds.com

GBP Net Position Surges to Longest on Record in Outright Terms

- The GBP net long position surged further in Friday's CFTC report, as markets added a net 48k contracts, or 9.6% of open interest. This puts the net long at its largest on record - clearing the comparable levels seen in 2007. As a % of open interest, the GBP long has hit 47.4% - the highest of all currencies in the CoT data.

- The shifts in GBP positioning come despite the relatively contained shifts in policy expectations (2024 cumulative cuts pricing was rangebound in the latest week), but may represent a prolonged reaction to the election, the improved growth outlook among the sell-side, and the particular strength for GBP against the EUR and JPY in recent weeks.

- Markets aggressively trimmed the NZD net position, halving the outright long from over 25k contracts to 12.5k. This trims the position as a % of OI to 20.6% from 43.5% and represented the largest one-week move in the latest CFTC report. The data is accurate as of the Jul 16th close, so would capture the below-expected Q2 CPI release.

- EUR and AUD positions inched to net long from neutral, CAD and CHF shorts deepened, while MXN long saw a modest trim. Full data here:

EUR/JPY Sales Set the Theme, But Recent Ranges Respected

- JPY markets saw early interest as EUR/JPY sales put the currency at the top of the G10 table. Order- and flow-driven pickups in volumes across JPY futures at the European open helped set the theme, but the price action stopped short of testing any major levels. For now, Y170.00 remains the bear trigger for EUR/JPY.

- Markets are still trying to parse the implications for Biden's withdrawal from the Presidential race. While the odds of a Democratic White House have inched higher over the weekend, Trump still remains a comfortable leader in betting markets, resulting in minimal fallout for equities or the broader dollar.

- Meanwhile, GBP trades well - but is yet to challenge nearby resistance against the EUR and USD. Friday's CFTC release showed the market's net long GBP position reaching the highest level on records stretching back over 25 years - as the post-election outlook improves and the odds of a BoE rate cut as soon as August remain too close to call.

- Monday's schedule is typically quiet, with just the Chicago Fed National Activity Index on the docket - and no central bank speakers of note. This keeps focus on bigger events later in the week, specifically the flash PMI releases from across Europe and the US as well as the Bank of Canada rate decision on Monday.

Sizeable Strikes and Quiet Calendar Could Keep Focus on Pipeline

With the data and news schedule pretty quiet so far Monday, markets may watch today's expiry pipeline carefully - with sizeable strikes rolling off close to spot in EUR/USD, GBP/USD, EUR/GBP and AUD/USD:

- EUR/USD: $1.0845-50(E675mln), $1.0925(E527mln)

- GBP/USD: $1.2940(Gbp504mln), $1.2975-85(Gbp656mln)

- EUR/GBP: Gbp0.8466-75(E926mln)

- AUD/USD: $0.6700(A$796mln)

Tech Bounce Aids Recovery Off Last Week's Lows

- The e-mini S&P inches to a new daily high as markets continue to reverse the Friday leg lower, but the index will need a further 30 points to challenge the Friday high. A close higher today would snap the losing streak posted off the Tuesday cycle high at 5721.25 - intraday levels of note include 5631.62.

- It's unlikely Biden's withdrawal from the race has triggered the recovery off lows for equities this week - betting markets have shifted slightly to acknowledge Harris' nomination and likely candidacy, but Trump's comfortable lead remains - and news of Biden's stepping down across the tail-end of last week did little to prop up headline indices.

- Outperformance in tech names (the laggards and drivers of the sell-off last week) are bouncing well: the NASDAQ-100 mini is higher by 0.8%, while Europe's tech sector in the Stoxx600 leads, higher by 1.3% at pixel time.

- Earnings season continues apace this week, with Tuesday particularly busy - highlights include:

Monday - Verizon

Tuesday - General Motors, Lockheed Martin, Coca-Cola, General Electric, Visa, Alphabet, Tesla

Wednesday - AT&T, IBM, Ford

Thursday - AbbVie, American Airlines, Baker Hughes

Slip Lower in E-Mini S&P Last Week Appears to Be a Correction

- A bull cycle in Eurostoxx 50 futures remains intact, despite the pullback in prices into the Friday close. The move lower last week undermines the bullish theme somewhat, with price having traded through the 50-day EMA, and the bear trigger has been tested at 4860.00, the Jun 14 low. Clearance of this level would expose 4846.00, the Apr 19 low and a key reversal point. For bulls, a move higher and a break of 5087.00, the Jul 12 high, would again highlight a bullish theme.

- The broader trend condition in S&P E-Minis is bullish and the slip lower into last week’s close appears to be a correction. The recent rally to cycle highs confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. MA studies are in a clear bull-mode set-up too, highlighting positive market sentiment. Sights are on 5741.34, a Fibonacci projection. Firm support is at 5486.11 the 50-day EMA.

Recent Sell-Off in WTI Futures Results in Breach of 50-Day EMA

- Weakness into the Friday close keeps the focus pointed lower for WTI futures. The 50-day EMA gave way during the sell-off late last week, opening the potential for further losses toward 76.95 - the Jun 13th low on the continuation contract. Initial key resistance to watch is $83.58, the Jul 5 high, and a break and close above this level is needed ahead of any test on the 84.36 bull trigger.

- The trend condition in Gold remains bullish, despite the fade off the mid-week highs. The broader gains last week reinforce current conditions, and keep the M/T trend pointed higher. The yellow metal has breached key resistance and the bull trigger at $2450.1, the May 20 high. This confirms a resumption of the medium-term uptrend and opens the $2500.00 handle next. Moving average studies are in a clear bull-mode set-up, highlighting a rising trend. Initial support is at $2382.6, the 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 22/07/2024 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 22/07/2024 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 23/07/2024 | 0700/0900 | ECB's Lane at ECB/IMF conference in Frankfurt | ||

| 23/07/2024 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 23/07/2024 | 1100/0700 | *** | Turkey Benchmark Rate | |

| 23/07/2024 | 1230/0830 | ** | Philadelphia Fed Nonmanufacturing Index | |

| 23/07/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 23/07/2024 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 23/07/2024 | 1400/1000 | *** | NAR existing home sales | |

| 23/07/2024 | 1400/1000 | ** | Richmond Fed Survey | |

| 23/07/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 23/07/2024 | 1700/1300 | * | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.