-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBoT Set To Leave Interest Rates Unchanged Despite Lingering Discomfort With Baht Rally

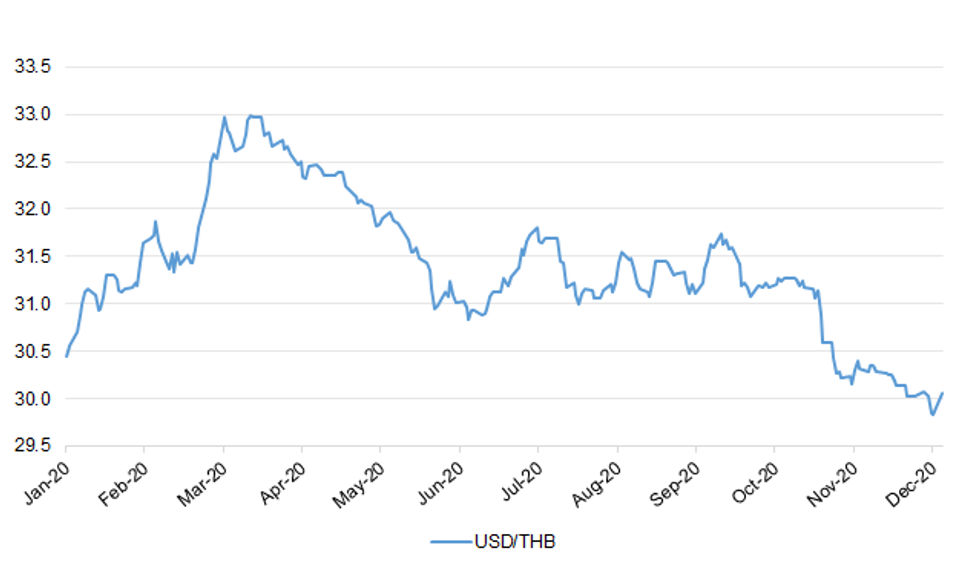

The Bank of Thailand is expected to leave interest rates on hold at its final meeting of 2020 on Wednesday but may communicate a sense of discomfort with the exchange rate. Focus will fall on whether policymakers will take any steps beyond jawboning to curb THB strength.

- In a speech delivered earlier this month, BoT Gov Sethaput warned that 2021 economic growth may miss expectations as the recovery in the key tourism sector may take some time "even if we have the vaccine," although an above-forecast Q3 GDP might mean that policymakers will have to revise estimates for the 2020 economic performance higher. A combination of better than expected Q3 GDP and a worrying outlook for 2021 should prompt policymakers to try and save policy ammunition for a later date.

- Meanwhile, the BoT will undoubtedly find the baht's continued appreciation disconcerting. It has been a worry for a while, with BoT Gov recently reiterating that a strong THB weighs on economic recovery. In November, the BoT left its policy rate unchanged at a record low of 0.50%, but minutes from the meeting revealed that policymakers agreed to consider additional steps to make sure that the exchange rate does not inhibit economic recovery.

- Days after the November meeting, the BoT announced measures to cap baht appreciation. The central bank focused on relaxing rules on capital outflows, with further measures (including restrictions on capital inflows) remaining on the table.

- That being said, the BoT faces pressure from abroad to pare back direct FX interventions, after U.S. Treasury added Thailand to its watchlist for currency manipulation last week. In a statement released after the decision, the BoT insisted that its interventions aimed at reducing FX volatility rather than giving Thailand an unfair advantage over its trading partners. Coming under U.S. Treasury's scrutiny reduces the incentive for direct FX interventions, so the BoT may opt for either mere rhetoric or additional indirect measures, while it awaits clarity on the incoming Biden administration's tolerance for more aggressive currency policy.

- Another conundrum is provided by the recent outbreak of Covid-19 in Samut Sakhon, a seafood/m'fing hub, which resulted in the implementation of lockdown measures across the province and deliberations on widening restrictions. That being said, this will not alter the central bank's view that fiscal policy should now take over in fuelling economic recovery.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.