-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

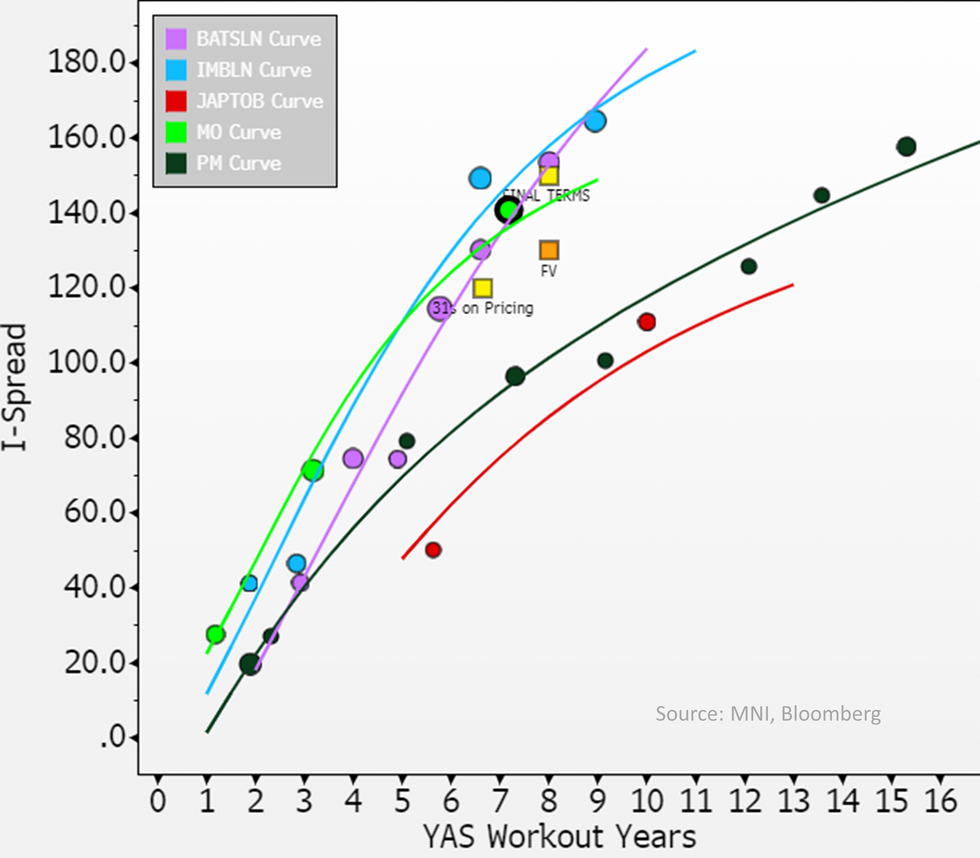

Free AccessBritish American Tobacco (BATSLN; Baa2 Pos, BBB+ S, BBB+ S)

Our FV on the 8Y/'32 deal at MS+130 with a NIC of 20bps has been priced out on a continued sell of from the 31's in secondary. BAT investor base failing to give the support that €JAPTOB got last week from its. We see limited room for further widening vs. peers & the new 32's still screen the cheapest among BBB Tobacco names, bar a firm view from investors on favourable US regulation - which we don't see in equity analyst forecasts. Tobacco names have had a strong run this year returning +3.3% in excess returns vs. €IG's +1.8% - BAT weakness even while broader spreads hold firm might be worth noting.

- Altria (MO) 31's were flat yesterday while BAT's moved another +11bps, now +20bps on the week - its left BAT curve trading in line with both Altria & Imperial.

- BAT is coming off a strong rally, but as we mentioned during pricing some of that is justified on management continuing to delever beyond expectations, some of it is broader compression.

- Both MO & BAT have come in a similar 50bps to PM YTD (around the 31s) & as we've flagged before, lower grade Tobacco names show signs of sharp underperformance on broader spread sell-offs/decompression.

- On expected supply; outside of the £500m line it let run-off earlier this year it has 2 $ lines totalling ~€2.7b and a single €850m line still to mature - the €900m deal this week was left broad on UoP, but we don't see risk of supply again in local markets.

- On ~£8b of FCF this year, buybacks net ITC sale proceeds (can be ignored) & dividends expected to be just north of £5b - it should leave ~€3.5b for debt paydowns. On FY24 EBTIDA we see ~€1.9b reduction needed in net debt to get to upper end of new leverage targets.

- Similar story in broader BBB supply; no remaining maturities for MO this year, IMBLN has a $1b dollar line due in July.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.