-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY47.9 Bln via OMO Tuesday

MNI: PBOC Sets Yuan Parity Lower At 7.1878 Tues; -2.35% Y/Y

MNI ASIA OPEN: Tsy Inside Range Ahead Key Inflation Data

MNI BRIEF: EU Calls Feb 3 Summit To Brainstorm Defence

Carnival (CCL Snr Unsec; B2 Pos (now)/ BB) Moody's Upgrade

Co is having a year of upgrades with Moody's moving one-notch higher last night. It's unsecured rating still lags S&P by 3-notches and it's driven by the +3/-1 secured/unsecured notching vs. baseline. S&P notches 2/flat vs. baseline. We flagged that may change at Moody's on secured debt being targeted for gross paydowns (40% reduction already, part of strategy) - but nothing from Moody's yesterday. Reminder Carnival targets IG ratings, sees net 4.5x by end of this year (on guided $5.8b in EBITDA) or "2/3 the way to IG".

- Moody's flags Carnival operates 9 brands, is 40% of industry's annual revenue and 37.5% of total capacity - impressive metrics.

- It's projecting leverage (gross) to approach 5x by end of FY24 and 4.5x by end of FY25.

- It sees no issues on liquidity or ICRs. Sees FCF of ~$1b and $1.2b in FY24/25.

- Rating upgrade will depend on what it does with FCF (Moody's expects less used in debt paydowns next year) - upgrade threshold is below 4.5x.

The small amount of secured debt left (now IG at S&P) is in $s with our markets having the unsecured 29 and (new) 30s. Positive on FCF uncertainty above is last month's earnings call where mgmt was asked about a dividend restart (has been on pause since Covid);

"Right now, our priority is generate all that free cash flow, pay down debt and re-strengthen the balance sheet, and in that process, returning value from the debt side to the equity holders. I can't wait to have those conversations, but I'd say that's premature."

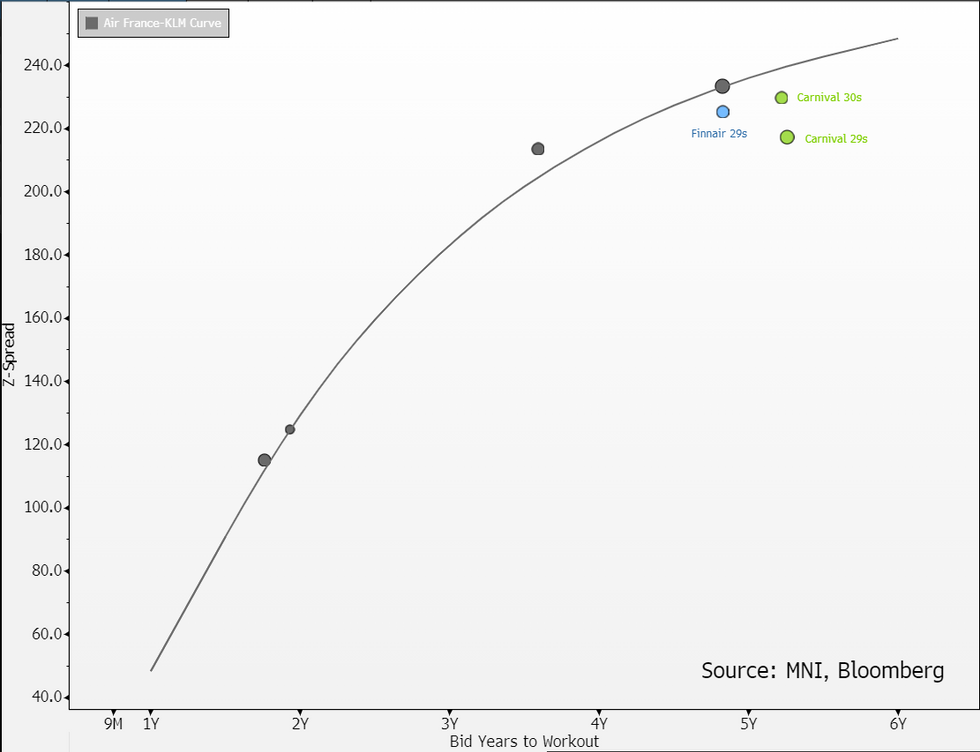

On RV 1) The new 30s look better value on both working out to 5.25y (3m par calls/IG docs) 2) Neither look extreme value on current ratings - Finnair29s trade flat to the 30s and AFFP 29s wide of it. The caveats to the RV are this is a potential rising star (Finnair is not, AFFP we don't think will anytime soon), neither airline commands the market share Carnival does and neither comes close to running the low double digit EBIT margins Carnival does. Negatives are the more discretionary travel exposure, asset heavy BS ($40b in owned ships (little leases) - though depreciation & amortisation costs at ~10% of revenue are similar to Finnair and not far off AFFP at 8.5%) and no government ownership/support.

We see small amount of value on XCCY for the €30s as well. Some exposure here to the 30s alongside airlines may be warranted; a view less focused on carry (vs. the case with FOY29s) and more on near term positive catalyst/spread returns. Cash lines unch this morning.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.