-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

Ceconomy (CECGR; NR/BB-/BB) Price Talk

€500m 5NC2 SLB 6.25%a (+/-12.5) (eqv. MS+342) vs. IPT low-mid 6%s

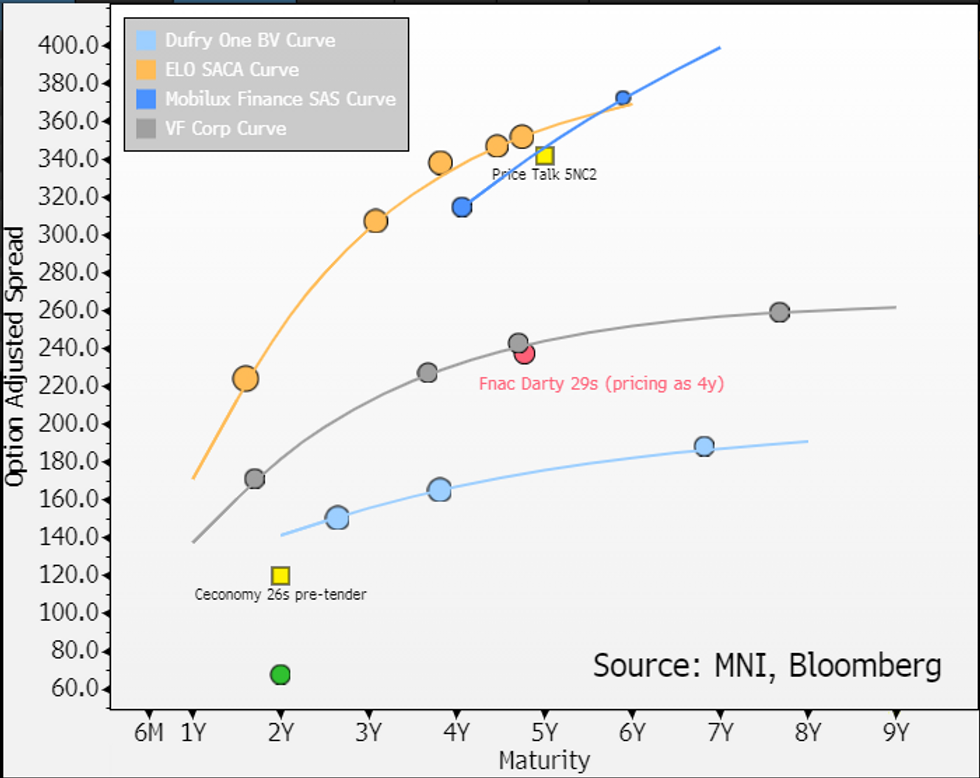

No FV from us, see chart below. We don't see it as cheap BUT those with a firm view on margins improving (even if headline holds flat) should be interested in this deal. We don't have a firm view on that hence the reluctance - it is pricing flat to our cheap view on new Elo 28s (Z+330, NR/BB+) which runs razor thin margins but is a supermarket retailer and has support from its Real Estate portfolio (contributes 26% of EBITDA, source of cash). Ceconomy does benefit from a well levered BS but we would caveat that with 1) it has headroom on current leverage (net 1.8x vs. target <2.5x) and Moody's was on B1 early last year before withdrawing soon after (on a bearish view of margins then). The other cautionary point to note is the 23.4% stake in Fnac Darty (NR/BB+/BB+) does cause sizeable swings to EBIT and leaves investors with secondary exposure to another name.

FY is 12m to Sept.

- It says it is Europe's largest consumer electronics retailer with leading position sin 9 of 11 markets. Main stores are MediaMarkt and Saturn alongside its 23.4% stake in Fnac Darty.

- 54% of sales in DACH (Germany, Austria & Switzerland), 32% in Western/Southern Europe and 12% Eastern Europe.

- The negatives are not on the headline (looks well diversified, €22.2b in sales is large) but further down; EBIT margin is 1.1% which is very low vs. peers and puts it in the realm of Elo/Auchan (a supermarket operator).

- Adding to that FCF is extremely seasonal quarter to quarter and consensus does see for capex increasing from here. 1H24 FCF is €229m down from €472m last year mainly from poor operating cash flows.

- On ratings worth noting Moody's downgraded it to B1 (snr unsec) in early 2023 before withdrawing in May that year. Moody's saw "several years" for EBIT margin to improve to at least 2%...and saw cost efficiency programs dragging on cash flows in short term (then).

- Re the stake in Fnac Darty {FNAC FP Equity} it was downgraded in March of this year to Ba3 (Stable) with snr unsec dropped to B1 - it followed a -25% fall in operating income last year. Moody's has since withdrawn ratings on that too after the redemption of the 26s. Fnac's remaining snr unsecured 29s (NR/BB+ neg/BB+) trade at OAS+237/Z+238/5.36% pricing to early 2028 par call.

- Still Fnac is contributing a (somewhat concerning) amount of Ceconomy's swings in EBIT; in 1H it was €46m of EBIT vs. group €33b (Ceconomy EBIT was only €5b). For FY23 it dragged -€50m on profit share and -€82m on a impairment charge from €243 of Ceconomy's EBIT.

- Ceconomy's guidance in FY24 (12m ending Sept.) is for EBIT of €290-€310m (would be up +23% yoy) which analyst are sitting at. It also sees "a slight increase in total sales adjusted for currency effects". Consensus is at net +0.4% in headline implying a 1.3% margin - an improvement year on year but still leaves it at bottom of comps by some distance (most run 3-4% margins).

- On BS: it had €2.6b in debt which is mostly in leases. Ex. that debt is €800m and net of €900m cash debt is €1.7b. This is leverage neutral transaction (Gross at 2.7x and net at 1.8x, both include lease liabilities) with tender out on the 26s. It has headroom on net target of <2.5x.

- This is a SLB line with +0.375% per annum step ups if targets have not been achieved as of 30th September 2027 (3+ yrs from now - line is a 5NC2, no impact to pricing).

- Books close 2:30pm London.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.