-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessCentral Bank Comms Help Boost Rate-Cut Bets Despite Questions On Disinflation Trajectory

Polish interest rates remain under pressure on the back of a combination of a dovish pivot in NBP rhetoric starting with Governor Adam Glapinski's most recent press conference (July 7) and the global market reaction to the recent batch of US macroeconomic data.

- Most NBP speakers echoed the gist of Governor Glapinski's messaging, with members of the dovish majority in the Monetary Policy Council reaffirming familiar conditions for cuts. Some added caveats, as Henryk Wnorowski noted that inflation that is "symbolically" below +10% Y/Y would not be a sufficient reason for a cut, while Cezary Kochalski said that "a certain kind of caution" is needed before lowering rates.

- However, Wnorowski flagged the potential for rate cuts by the year-end, while Kochalski and Iwona Duda said such discussions may be possible after the summer holidays. Gabriela Maslowska suggested that rates could be lowered in September/October. Separately, hawkish dissenters Joanna Tyrowicz and Ludwik Kotecki strongly hinted at a (in their view excessive) dovish bias of this MPC.

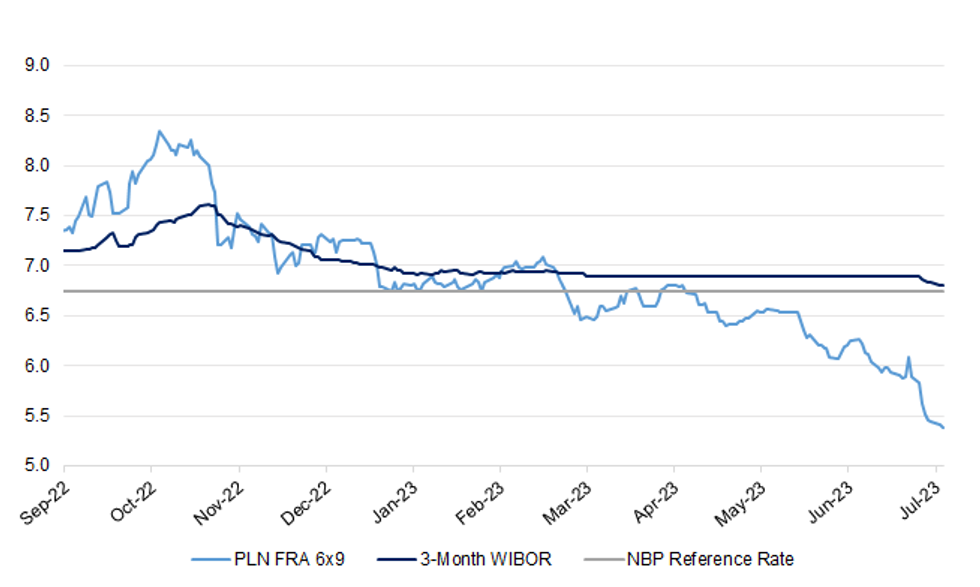

- Polish FRA curve has shifted notably lower over the past two weeks, with 6x9 contracts (last at 5.38%) refreshing cyclical lows today. The spread with the 3-Month WIBOR (6.81%) and the NBP's reference rate (6.75%) has been widening as participants added dovish NBP bets, even as local sell-side desks are warning that disinflation may slow towards the year-end and beyond.

- Citi Handlowy wrote that "the FRA curve currently assumes 125bp worth of rate cuts through the year-end." According to their estimates based on the NBP models, this would mean that inflation would be above +5% Y/Y in 4Q2024 and around +4% Y/Y in 4Q2025. The discontinuation of VAT exemption for food items would boost 2024 inflation by a further 1pp and these calculations do not account for a further 150bp worth of rate cuts priced for 2024. As a result, they believe that the scenario priced by the Polish FRA curve "looks ambitious."

- The market has been discounting the growing perception that the NBP operates with a dovish bias and intends to cut interest rates as soon as possible, even at the cost of delaying the return to the inflation target. Where the market positions itself with regards to the tension between the perceived policymaker's perspective and the predominant view on macroeconomic trends will be an important factor in NBP pricing in the coming months.

Fig. 1: PLN FRA 6x9 vs. 3-Month WIBOR vs. NBP Reference Rate

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.