June 06, 2024 11:59 GMT

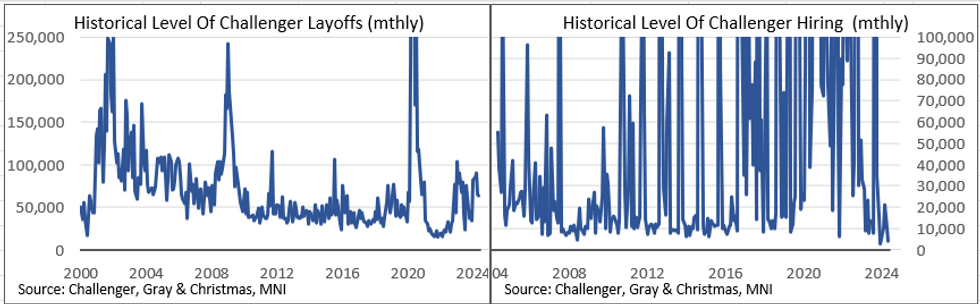

Challenger Data Adds To Evidence Of A Less Dynamic Labor Market

US DATA

Challenger job cut announcements came in at 63.8k in May, vs 64.8k prior - a drop of 20.3% Y/Y, the biggest fall on that basis since November 2023 (on an unrounded basis).

- Of note, hiring announcements were down 46% to 4.2k, the 2nd lowest tally in series history (only January of this year has seen fewer going back to 2004 for data available).

- In recent months, tech layoffs have pulled back vs high layoffs in the same period of 2023 (though still-elevated), with 7.7k in May for -66% Y/Y, after 5.0k in April and 10+k earlier in the year. Ex-Tech sector layoffs fell 2% Y/Y.

- While layoffs are falling, and should fall further in the summer in line with the usual seasonal pattern, the lack of hiring adds another piece of evidence of a lack of dynamism in the US labor market that will eventually resolve in looser conditions and moderating wage growth.

- Even so, it shouldn't have too much of a read into Friday's nonfarm payrolls data.

175 words