-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

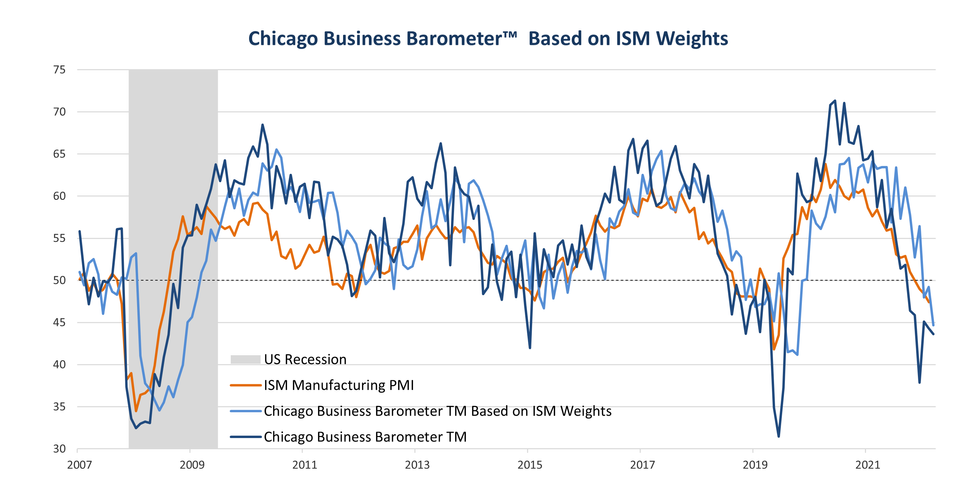

Free AccessChicago Business Barometer™ – Edges up to 43.8 in March

Key Points – March 2023 Report

The Chicago Business Barometer™, produced with MNI, inched up by 0.2 points to 43.8 in March. Despite increasing for the first time since December 2022, the headline index signaled a seventh consecutive month of contractionary business activity in March.

- New Orders and Supplier Deliveries declined in March, the latter recording the steepest fall since February 2022. All other sub-indexes increased in March. Barring Inventories and Prices Paid, all sub-indexes were in contractive territory.

- Production improved 2.6 points in March, after a marked 10.2-point fall in February. Firms continued to flag softening demand, also noting that semiconductor shortages continue to drag on auto and countless other applications.

- New Orders softened -1.0 points; a tenth consecutive month of declining orders. Responses were mixed, with some firms seeing a small pick-up whilst others noted a slowdown due to clients’ inflated orders over earlier months.

- Order Backlogs picked up again in March, rising 5.6 points but marking three months of falling backlogs.

- Employment increased by 5.4 points on the month, moving to similar levels seen in both December and January. Note that the February reading was the lowest since 2009, barring the pandemic. 21.4% of firms saw lower employment levels in March, compared to 34.4% in February.

- Supplier Deliveries fell -9.3 points, moving below 50 for the first time since June 2016, with some respondents finding substantial improvements in deliveries as supply chain pressures ease further.

- Inventories jumped 13.6 points in March, re-entering expansive territory and returning to November levels. This follows three months of contraction as firms actively reduced stock levels.

- Prices Paid edged up by 0.3 points after the substantial February deceleration. Just below half of respondents continued to see prices increase in March. Price reductions from commodity suppliers were supported by reduced container transit costs

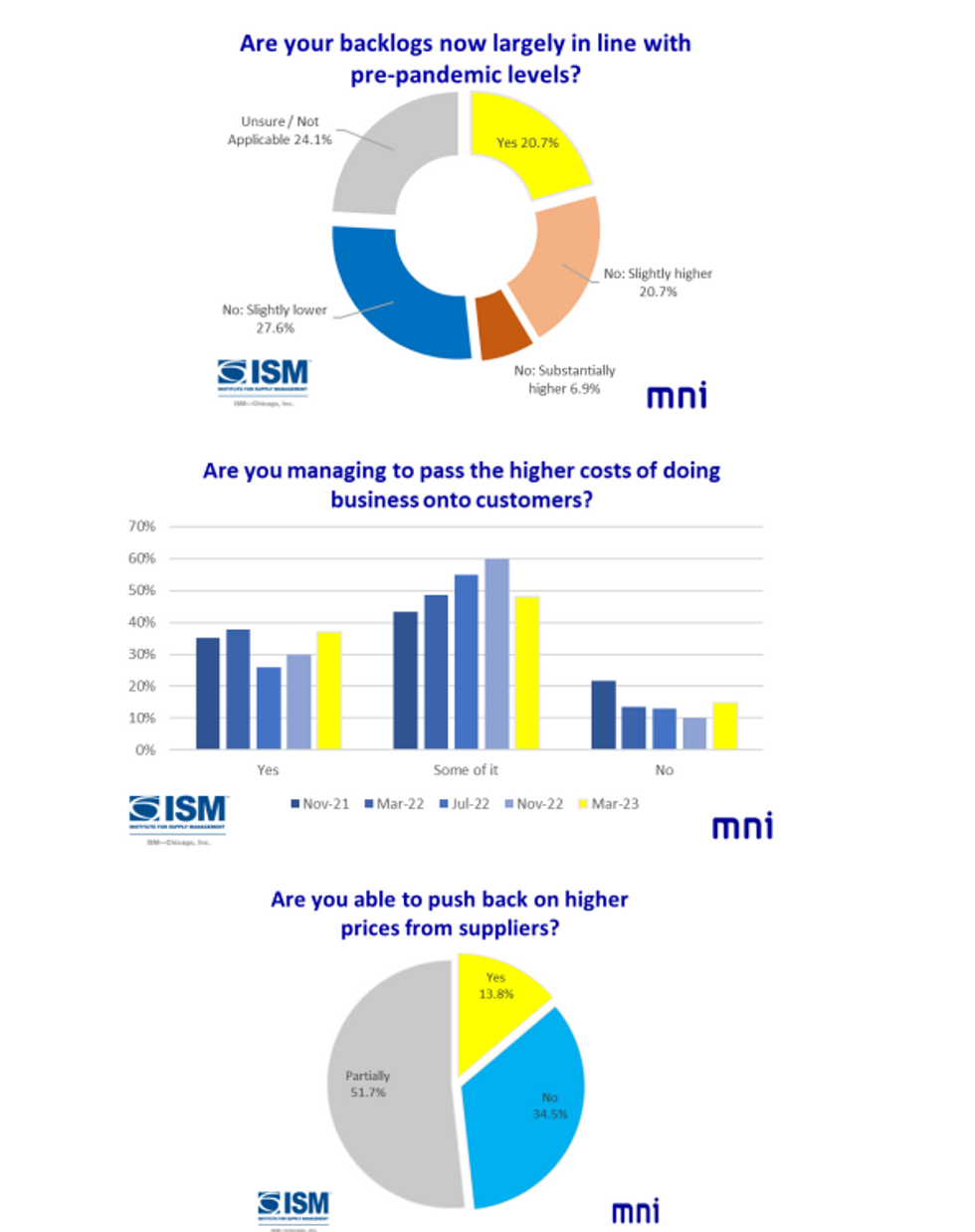

SPECIAL QUESTION

Click below for the full press release:

MNI_Chicago_Press_Release_2023-01.pdf

For full database history and full report on the Chicago Business Barometer™, please contact:sales@marketnews.com

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.