-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Comeback

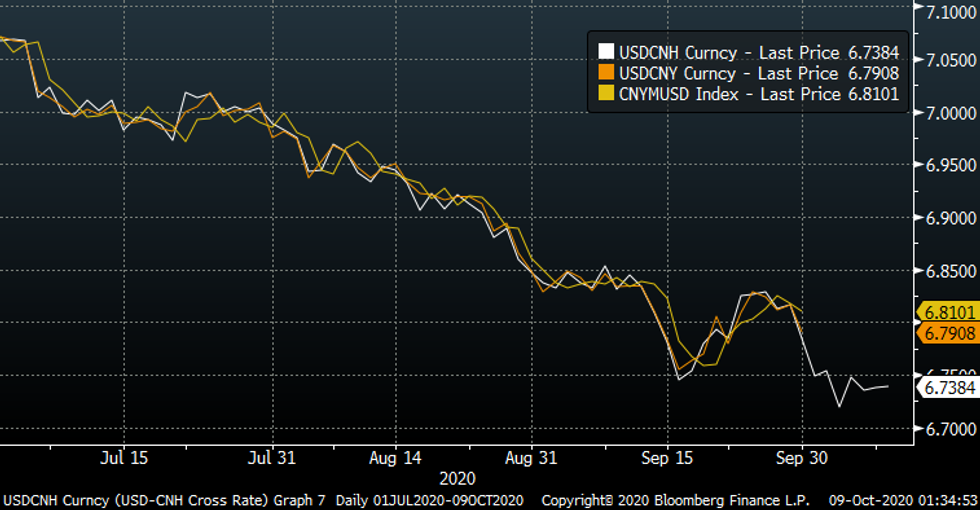

Spot USD/CNH holds a tight range ahead of the re-opening of onshore yuan trade after China's eight-day holidays. The rate sits at CNH6.7383 at typing, little changed on the day, after shedding ~450 pips since the last pre-holiday close (Sep 30).

- Onshore yuan will have to do some catch-up today and the PBoC fix will also be under the microscope. Offshore yuan's appreciation seen when mainland China was off to celebrate the Golden Week should provide a tailwind to onshore redback, but it remains to be seen if the central bank will seek to counter it. USD/CNY closed at CNY6.7908 and the PBoC fixed its USD/CNY mid-point at CNY6.8101 on the last trading day of Sep.

- The Global Times cited Dong Shaopeng, an adviser to the China Securities Regulatory Commission, as noting that the yuan may continue strengthening for another year, while Zhou Yu of the Shanghai Academy of Social Sciences told the newspaper that USD/CNY could reach CNY6.5, albeit a breach of that figure would cause perceivable pressure to exporters.

- The economic impact of the Golden Week holidays will be eyed going forward, with Chinese state media pointing to a surge in domestic travel.

- White House adviser Navarro appeared on Fox News today, noting that China is the most important issue in U.S. presidential election.

- Bears need a move through Oct 5 cycle low of CNH6.7136 to revive downside momentum and open up the CNH6.68-67 area, which cushioned losses in 2019. Bulls look to take out Oct 2 high of CNH6.7781 before targeting Sep 24 high of CNH6.8462, a key near-term resistance.

- On the data front, Caixin Services & Composite PMIs will provide interest today.

- Next week, Chinese trade balance comes out on Tuesday, with inflation figures coming up on Thursday.

USD/CNH vs. USD/CNY vs. PBoC Daily USD/CNY Fixing Rate

USD/CNH vs. USD/CNY vs. PBoC Daily USD/CNY Fixing Rate

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.