-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

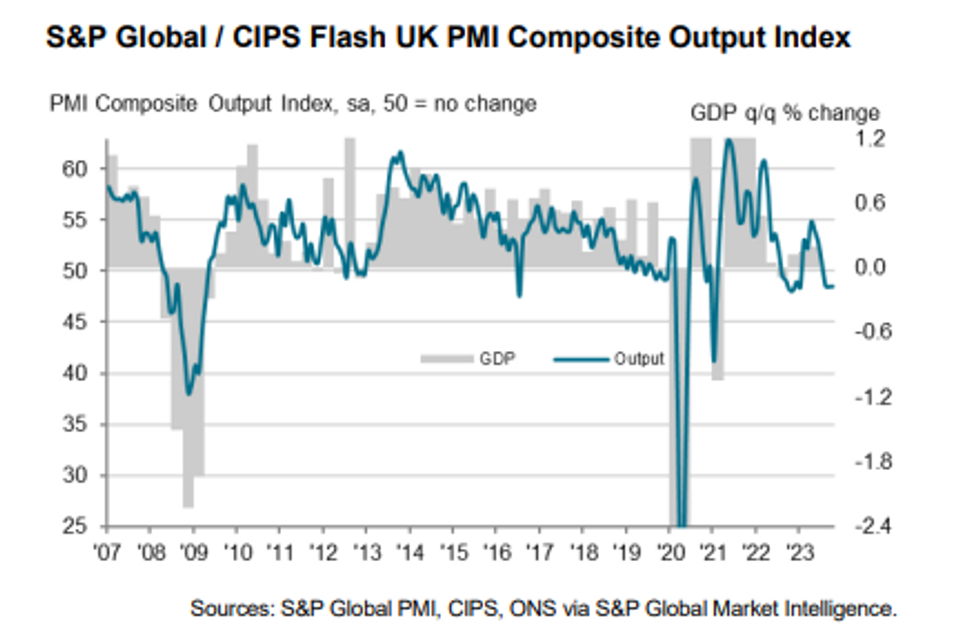

Free AccessContractionary Theme Continues In October PMI

UK flash October PMIs all printed in contractionary territory once again (services has been <50 for 3-consecutive months, while manufacturing has remained in contraction since August 2022). Services and composite readings were in line with expectations and broadly unchanged on the month , while the manufacturing print rose by almost 1 point to 45.2, just above expectations.

- "Lower output was seen in both the manufacturing and service sectors, with the former posting the sharper rate of decline".

- "Service providers indicated only a marginal fall in business activity during October" as a result of higher borrowing costs and weak consumer confidence/demand - these factors also contributed to declines in new work. The release notes "outperformance was mostly centred on the technology services sub-sector".

- There was reduced private sector employment as backlogs fell, likely a combination of non-replacement of leavers and staff redundancies.

- "Further softening of cost pressures across the service economy, alongside falling purchasing prices in the manufacturing sector" helped input price inflation fall, but higher salaries and fuel prices were key upside drivers nonetheless.

- However, there was a "sharp and accelerated increase in output charges across the service economy, with survey respondents often noting efforts to catch up on broader inflationary pressures and limit the squeeze on their operating margins".

- 10-year Gilts have sustained weakness following the release, with yields 3-4bps higher, while GBP has risen around 0.15% against the EUR and USD. SONIA-dated OIS sees a slight shift up in hikes across the curve, but only an additional 0.3bps for the November meeting (currently 4.0bps priced).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.