-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN OPEN: Familiar Risks Persist

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* REMDESIVIR HAS LITTLE EFFECT ON COVID-19 MORTALITY, WHO STUDY SAYS (FT)

* CHINA SET TO PASS ITS OWN LAW PROTECTING VITAL TECH FROM U.S. (BBG)

* U.S. OFFERS TARIFF TRUCE IF AIRBUS REPAYS BILLIONS IN AID (RTRS SOURCES)

* EU LEADERS CALL FOR UK TRADE TALKS TO CONTINUE (BBC)

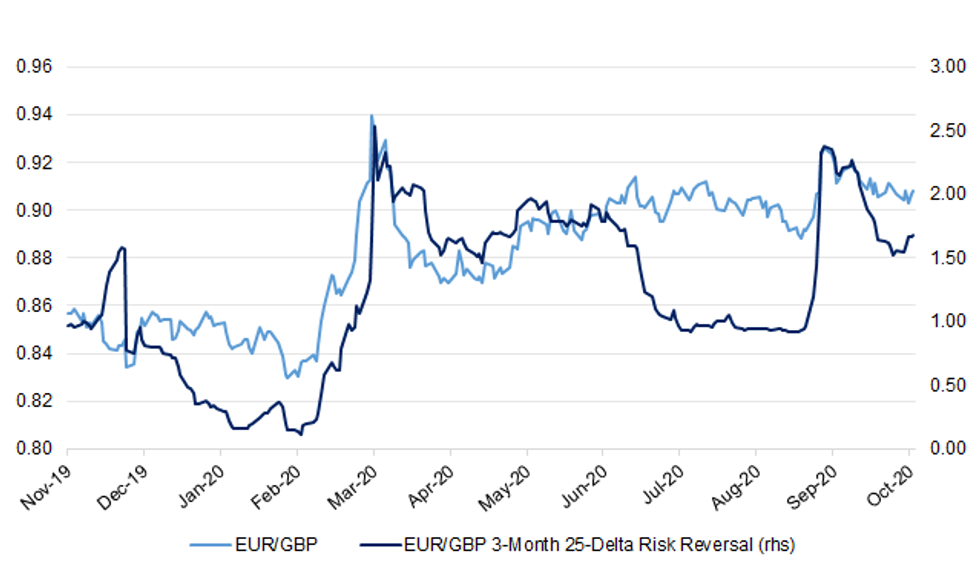

Fig. 1: EUR/GBP vs. EUR/GBP 3-Month 25-Delta Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson was on Thursday night embroiled in a standoff with Labour mayors and his own health advisers over his plans for local lockdowns. (Telegraph)

CORONAVIRUS: Lancashire is likely to be announced as the latest area to move into Tier 3 of England's lockdown restrictions, Sky News understands. Discussions between Westminster and local leaders around the financial package are still ongoing but the decision is expected to be announced within hours. Liverpool City Region is already under the highest category of the government's new three-tier system for localised restrictions. (Sky)

CORONAVIRUS: A limited circuit-breaker lockdown for Wales is due to be announced in the next few days, the BBC has been told. Restaurateurs, food businesses and unions have called for urgent clarity on the government's plans to stop the spread of Covid-19. Hospitality firms and council leaders were briefed this week. (BBC)

CORONAVIRUS: Italy is being removed from the UK's travel corridor in a fresh blow to holidaymakers who will have to quarantine for a fortnight on their return from the country. (Guardian)

BREXIT: EU leaders have called for post-Brexit trade talks to continue beyond the end of the week - the deadline suggested by UK Prime Minister Boris Johnson. At a two-day summit in Brussels beginning on Thursday, they called on the UK to "make the necessary moves" towards a deal. EU chief negotiator Michel Barnier said fresh "intensive" talks should aim to reach a deal around the end of October. But his UK counterpart said he was "disappointed" by the EU's approach. Lord David Frost tweeted the EU was expecting "all future moves" for a deal to come from the UK, which he called an "unusual approach to conducting a negotiation". He added the prime minister would react to the EU's position as the summit wraps up on Friday. (BBC)

BREXIT: The European Union is standing by its guns on fair competition and the governance of a future post-Brexit trade deal, negotiator Michel Barnier said Thursday, but is ready to move somewhat on a dispute over fishing. "We know that we will have to make an effort. This effort must be reasonable: it must protect the EU's fishing activity. That comes through a stable and reciprocal access to waters," he said. (AFP)

BREXIT: European Union leaders, led by France, dismayed Downing Street last night by calling Boris Johnson's bluff on his threat to walk out of negotiations and giving him an ultimatum to back down. President Macron told the prime minister that he should prepare for a no-deal Brexit unless he was willing to concede a "good settlement" preserving fishing access for French boats in British waters after the Brexit transition, which ends on December 31. (The Times)

BREXIT: Boris Johnson will be advised by his chief negotiator that a trade deal with the EU is still possible should the prime minister ditch his deadline and continue to negotiate with Brussels as tentative signs of a compromise on fisheries emerged. David Frost, who has been in talks with the EU team led by Michel Barnier this week, will inform the prime minister that a further two weeks, at least, of daily talks could result in the remaining gaps being bridged. (Guardian)

FISCAL: The government is demanding the extension of London's congestion charge zone and further fare hikes as part of a £1bn proposal to rescue the capital's transport authority for the second time this year. (Sky)

BOE: Britain's banks are not ready for negative interest rates, according to the chairman of NatWest. "We're not completely ready for it," Howard Davies said. "There would be technical issues and many contractual issues." The Bank of England said last week it had written to all banks and building societies to check whether they could pass on negative interest rates if the central bank cut the cost of borrowing below the current base rate of 0.1%. (Guardian)

BOE: Cash managers for Britain's largest companies with hundreds of billions of pounds on deposit have warned that negative interest rates would be a "very bad idea". The Association of Corporate Treasurers, which speaks for 90 per cent of the FTSE 100 and many more large corporates, said businesses may refuse to pay interest fees on their deposits and would face systems issues if the Bank of England cuts rates below zero. (The Times)

ECONOMY: A quarter of a million hospitality jobs are at risk from additional coronavirus restrictions imposed on London from this weekend, the mayor of London has been warned by an industry chief. Sky News has seen a letter to Sadiq Khan from Kate Nicholls, chief executive of UKHospitality, in which she said that his request for the capital to be moved to a higher risk status would be "incredibly damaging without additional financial support and urge you to work with us to secure that is in place before any changes to London's classification is made". (Sky)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Moody's on the United Kingdom (current rating: Aa2, Outlook Negative)

EUROPE

CORONAVIRUS: France reported a record 30,621 new infections on Thursday after the previous high last Saturday with 26,896 cases. Deaths increased by 88 to 33,125, according to the health agency. In Spain, 6,603 new cases were detected, the biggest daily increase since April. The region reporting the highest number of cases is Madrid, which reported 2,292 new infections, after the national government declared the state of emergency. Catalonia, the country's second most-populous region, is also set to implement a shutdown of bars and restaurants. Ireland reported a record 1,205 new cases. The number of hospitalizations is increasing faster than its modelling predicted, health authorities said, a sign of "a rapidly deteriorating disease trajectory nationally." (BBG)

CORONAVIRUS: Germany's Foreign Ministry on Thursday warned against non-essential travel to France, the Netherlands, Malta and Slovakia from Saturday due to high coronavirus infection rates. France said its number of confirmed cases was up by 30,621 over 24 hours versus 22,951 on Wednesday. (RTRS)

ITALY: Italy's southern Campania region, around Naples, on Thursday announced it would shut down schools until the end of October, the region said in a statement, in an effort to curb an increase in COVID-19 infections. On Thursday Italy recorded 8,804 new coronavirus cases in 24 hours, its highest daily tally since the start of the outbreak, of which some 1,127 were in Campania. (RTRS)

ITALY: Italian Prime Minister Giuseppe Conte is expected to sign in the next few days long-awaited measures paving the way for a crucial bad loan clean-up at Monte dei Paschi (MPS) and the sale of the bank, two government sources said. (RTRS)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- DBRS Morningstar on France (current rating: AAA, Negative Trend)

US

FED: MNI POLICY: More QE Would Be Bad Substitute For Fiscal: Kashkari

- Minneapolis Fed President Neel Kashkari on Thursday said more QE would be a far less valuable tool than more fiscal aid to prevent scarring in the economy, and there is almost no scenario where negative interest rates would be beneficial - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Monetary policy, including interest rates and the pace of asset purchases by the Federal Reserve are in a good place, but more fiscal stimulus may be needed to ensure that households and state and local governments are able to recover, San Francisco Fed President Mary Daly said Thursday. (RTRS)

FED: Spending by consumers and businesses could increase as people become more confident about the economy, but it could take longer for the labor market to recover because of mismatches in the labor force between the jobs lost and the jobs in higher demand, Richmond Federal Reserve Bank President Thomas Barkin said on Thursday. Some people who lost jobs at retailers or in restaurants may not see a clear path to figuring out their next role, Barkin said during a virtual discussion organized by the Economic Club of New York. (RTRS)

FED: MNI EXCLUSIVE: Fed May Extend Facilities as Fiscal Talks Stall

- The Federal Reserve will likely prolong emergency programs past their set end date of late December, current and former officials told MNI, citing concerns over coronavirus, the small cost of keeping facilities open, and a lack of more fiscal relief. Take-up of the so-called Section 13(3) facilities has totaled USD93 billion, a fraction of the USD2.6 trillion of lending the Fed said it would provide to companies and funds under "unusual and exigent circumstances" - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Balance Sheet Near Record High, +$77B to $7.15T

- The Fed's balance sheet climbed USD77 billion over the last week to USD7.15 trillion on MBS and Treasuries, data released Thursday showed. The Fed's increased holdings were driven by RMBS, up USD64 billion leading to a record USD2.05 trillion in total MBS holdings - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK: US Sep Retail Sales Seen Moderating Again

- U.S. retail sales likely rose modestly in September, figures due Friday should show, but a full recovery to pre-pandemic remains imperiled by increasing Covid-19 infection rates and disagreement among Congressional leaders over the price tag of a fiscal stimulus package, industry experts told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Mitch McConnell on Thursday rejected a coronavirus relief deal that costs more than $1.8 trillion, hours after President Trump indicated he was "absolutely" willing to raise his spending offer. Asked during an appearance in Henderson, Ky., whether there can be a compromise between the White House-backed $1.8 trillion proposal and a $2.2 trillion offer put forward by House Democrats earlier this month, McConnell pushed back. "I don't think so," he said. "That's where the administration's willing to go. My members think what we laid out, a half a trillion dollars, highly targeted, is the best way to go." (Fox)

FISCAL: U.S. House Republican Leader Kevin McCarthy said Thursday he does not expect agreement on a fresh coronavirus relief package before Election Day on Nov. 3 as long as House Speaker Nancy Pelosi is involved in negotiations, saying she is the "one stumbling block" to a deal getting done. (RTRS)

FISCAL: U.S. Treasury Secretary Steven Mnuchin told House Speaker Nancy Pelosi that President Donald Trump would "weigh in" with Senate Republican leader Mitch McConnell if a deal on a coronavirus stimulus package is reached, Pelosi's spokesman said in a series of posts on Twitter. Staff for Mnuchin and Pelosi "will be exchanging language on several areas," Drew Hammill, Pelosi's spokesman, added. (RTRS)

CORONAVIRUS: The US reported more than 63,000 coronavirus cases on Thursday, its biggest one-day jump since July, with half of the country's states reporting at least 1,000 new infections. A further 63,172 people tested positive, according to Covid Tracking Project data this evening, up from 56,797 on Wednesday and compared with 55,352 on Thursday last week. (FT)

CORONAVIRUS: Wisconsin Gov. Tony Evers said Thursday he'll challenge a Wednesday judicial decision that temporarily blocked the governor's order limiting capacity in bars, restaurants and other public places. (BBG)

CORONAVIRUS/POLITICS: A passenger on Joe Biden's campaign plane tested positive for Covid-19, the Biden campaign announced Thursday. An administrator for the aviation charter company the campaign uses was on the plane this week for trips to Ohio and Florida but sat more than 50 feet from the Democratic nominee, used a different entrance and exit and both Biden and the person were wearing masks at all times, campaign manager Jen O'Malley Dillon said in a statement. She added that health advisers said there was no need for Biden to quarantine. (BBG)

POLITICS: Trump and his close ally Senator Lindsey Graham both have solid leads in South Carolina, a Republican stronghold that hasn't backed a Democratic presidential candidate since 1975. A New York Times/Siena College poll released Thursday found Trump leading Democratic presidential nominee Joe Biden by 8 percentage points, 49% to 41%. Trump won the state by 14 percentage points in 2016. (BBG)

POLITICS: Biden led Trump by 4 percentage points in a poll of North Carolina likely voters released Wednesday by the New York Times and Siena College. The poll showed Biden leading Trump, 46% to 42%. In 2016, Trump won the state by a margin of 4 percentage points over Hillary Clinton, 50% to 46%. (BBG)

POLITICS: President Donald Trump fielded an intense line of questioning at a town hall on Thursday night that touched on the coronavirus, conspiracy theories and his reelection campaign. "Oh, you always do this. You always do this," Trump said at one point when the moderator, NBC's Savannah Guthrie, asked him to clearly denounce White supremacy, a sticking point following his answer in last month's presidential debate that left even some of his supporters unsatisfied. (CNBC)

POLITICS: Joe Biden said at an ABC town hall on Thursday night that he will come out with a clear position on court-packing by Election Day, but that his answer on the issue will depend on how the confirmation of Amy Coney Barrett to the Supreme Court is "handled." (Axios)

EQUITIES:Federal Communications Commission Chairman Ajit Pai said Thursday he plans to move forward with rulemaking to "clarify" the scope of Section 230, an important legal shield for tech companies such as Facebook, Google and Twitter. Section 230 protects tech platforms from being held liable for their users' posts. It also allows them to moderate content in good faith without repercussions. The law was passed in the early days of the internet in the 1990s as part of the Communications Decency Act, but lawmakers across the political spectrum have since called for it to be revised as the tech companies have grown to massive scale and influence. (CNBC)

OTHER

GLOBAL TRADE: In the month since the U.S. cut off Huawei Technologies' access to components made with American technology, Japanese makers of electronic parts have enjoyed a fresh wave of orders from other smartphone manufacturers seeking to claim market share now up for grabs. (Nikkei)

GLOBAL TRADE: The United States has offered to settle a long-running aircraft subsidy dispute with the European Union and remove tariffs on wine, whisky and other products if Airbus repays billions of dollars in aid to European governments, several sources close to the matter told Reuters. The offer was made by U.S. Trade Representative (USTR) Robert Lighthizer days before the World Trade Organization's (WTO) release on Tuesday of a report authorising Brussels to slap counter-tariffs on U.S goods over subsidies to planemaker Boeing. (RTRS)

GLOBAL TRADE: U.S. President Donald Trump on Thursday threatened to "strike back" against the European Union if it put tariffs on U.S. goods after it won the right to do so earlier this week in retaliation against subsidies for planemaker Boeing. "If they strike back, then we'll strike back harder than they'll strike. They don't want to do it," Trump told reporters at the White House. (RTRS)

GLOBAL TRADE: China will collect anti-dumping deposits on polyphenylene sulfide from Japan, U.S., South Korea and Malaysia from Oct. 17, Ministry of Commerce says in statement. Deposits for American companies range 214.1%-220.9%; 25.2%-69.1% for Japanese firms. (BBG)

U.S./CHINA: China is set to pass a new law that would restrict sensitive exports vital to national security, expanding its toolkit of policy options as competition grows with the U.S. over access to technologies that will drive the modern economy. China's top legislative body, the National People's Congress Standing Committee, is expected to adopt the measure in a session that concludes on Saturday. (BBG)

U.S./CHINA: A judge said she's unlikely to allow the U.S. to implement prohibitions on WeChat while the government appeals her earlier ruling blocking them. U.S. Magistrate Judge Laurel Beeler said at a hearing Thursday that she wasn't inclined to grant the government's request for a stay pending appeal. (BBG)

GEOPOLITICS: The Japanese government has told the U.S. that it won't join the "Clean Network" initiative in which the Trump administration called on nations to participate, Yomiuri reports, citing multiple unidentified government officials. (BBG)

CORONAVIRUS: The Covid-19 treatment remdesivir has no substantial effect on a patient's chances of survival, a clinical trial by the World Health Organization has found, delivering a significant blow to hopes of identifying existing medicines to treat the disease. Results from the WHO's highly anticipated Solidarity trial, which studied the effects of remdesivir and three other potential drug regimens in 11,266 hospitalised patients, found that none of the treatments "substantially affected mortality" or reduced the need to ventilate patients, according to a copy of the study seen by the Financial Times. (FT)

CORONAVIRUS: Vaccine maker Moderna could possibly finish enrolling their 30,000-person study next week and could have its first data analysis next month, according to company spokesperson Ray Jordan. The projections are yet another indication that a vaccine will not be on the market by Election Day. (CNN)

CORONAVIRUS: Some Chinese cities are seeking applications from the public to receive experimental Covid-19 vaccines, as China expands a controversial emergency use programme that has already administered hundreds of thousands of doses. (FT)

CORONAVIRUS: The shot under development by China National Biotec Group Co., a subsidiary of state-owned Sinopharm Group Co., was tested in phase 1/ studies in more than 600 volunteers, according to results published Thursday in The Lancet medical journal. (BBG)

CORONAVIRUS: The National Health Service (NHS) is in talks with the British Medical Association (BMA) and others around mobilising the rollout of a potential COVID-19 vaccine from December, Pulse website for health professionals reported on Thursday. There is optimism around the first cohorts being given a vaccine in December but there is a 50/50 chance of the vaccine being available by that time, Pulse bit.ly/3lQhtJt reported, citing a person close to the discussions. (RTRS)

CORONAVIRUS: Fujifilm Holdings Corp said on Friday it was seeking to have its flu drug Avigan approved in Japan as a treatment for COVID-19 - a move that comes after a late-stage study showed reduced recovery times for patients with non-severe symptoms. (RTRS)

JAPAN: Japan's cabinet decided on Friday to tap emergency budget reserves worth 549 billion yen ($5.2 billion) to support supply chains and farmers and provide job subsidies to cushion the impact of the COVID-19 pandemic, the Ministry of Finance said. That leaves 7.28 trillion yen in reserves out of a total 11.5 trillion yen originally earmarked to combat the health crisis. (RTRS)

AUSTRALIA: The Australian state of Victoria reported its lowest number of coronavirus cases in four months on Friday, with just two new infections discovered. Victoria's health department reported two cases down from six a day earlier and the lowest since early June. It also recorded no new deaths linked to Covid-19. (FT)

AUSTRALIA/CHINA: Australia's cotton industry is bracing for what could be a devastating blow as it becomes the latest casualty in the escalating trade tensions with China. Mills in China are being told to stop buying Australian cotton as speculation grows that a hefty tariff is about to be slapped on the trade. Government sources have told the ABC the cotton industry could face tariffs as high as 40 per cent, a sanction that could make the trade with China unviable. (ABC)

BOK: The Bank of Korea (BOK) will maintain a soft monetary policy to bolster the recovery of the South Korean economy hit by the coronavirus pandemic, the top central banker said Friday. "The BOK will keep its monetary policy accommodative to help the domestic economy bounce back," BOK Gov. Lee Ju-yeol said at the start of an annual parliamentary audit of the central bank. (Yonhap)

CANADA/CHINA: China's ambassador to Canada is urging Ottawa to stop granting asylum to democracy activists from Hong Kong, whom he described as violent criminals, and warned that accepting these people could jeopardize the "health and safety" of 300,000 Canadians who live in the former British colony. Asked if he was issuing a threat, envoy Cong Peiwu replied: "That is your interpretation." He also rejected the accusation from Prime Minister Justin Trudeau this week that his country practises "coercive diplomacy." Foreign Affairs Minister François-Philippe Champagne called the envoy's statements inappropriate. (Globe & Mail)

BOC: MNI BRIEF: BOC to Discontinue BA and Mortgage Bond Facilities

- The Bank of Canada said Thursday it will discontinue programs to purchase bankers' acceptances and mortgage bonds in the week of Oct. 26, citing improving market conditions - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: Central bank governor Jonathan Heath says in tweet that Mexico's economy could grow above 12% in 3Q. Heath's comments are based on IGAE indicator growth observed in July and the average of three "nowcasting" models for August and September, which incorporate the latest industrial production figure for August. (BBG)

BRAZIL: President Jair Bolsonaro's deputy senate leader resigned from his position after Brazil's federal police caught him with Covid assistance money stuffed in his underpants, according to the local press. The government confirmed Thursday afternoon that Senator Chico Rodrigues was the target of an investigation into the embezzlement of 20 million reais ($3.5 million) in public funds intended to combat the pandemic. Supreme Court Justice Luis Roberto Barroso suspended Rodrigues from his term as lawmaker for 90 days while the investigation is ongoing. (BBG)

RUSSIA: U.S. intelligence agencies warned the White House last year that President Trump's personal lawyer Rudolph W. Giuliani was the target of an influence operation by Russian intelligence, according to four former officials familiar with the matter. The warnings were based on multiple sources, including intercepted communications, that showed Giuliani was interacting with people tied to Russian intelligence during a December 2019 trip to Ukraine, where he was gathering information that he thought would expose corrupt acts by former vice president Joe Biden and his son Hunter. (Washington Post)

ARGENTINA: Argentina's Central Bank aims to more efficiently influence short-term rate of the economy and to reduce the cost of sterilization, according to message sent by a spokesman. The cenbank raised its 1-day repo rate to 30%, from 27% and its 7- day repo rate to 33%. It also lowered the benchmark Leliq rate to 36%, from 37%. The BCRA raised the rate on certificate deposits to 32% and to 34% for retail accounts (of under 1 million pesos). (BBG)

MARKETS: Working from home hasn't slowed down Wall Street's trading desks. The five biggest U.S. investment banks are on pace for their first $100 billion year for trading revenue in more than a decade. In just three quarters, they've already generated almost $84 billion, more than any full year since 2010. (BBG)

COMMODITIES: The Commodity Futures Trading Commission is imposing long-delayed federal limits on the size of speculative bets that hedge funds and other financial firms can make in futures contracts tied to key commodities such as oil and metals. The measure passed by the CFTC in a 3-2 vote on Thursday comes after the main U.S. derivatives regulator failed several times in the past decade to impose more restrictive rules. Key industry groups backed the position limits plan after fighting versions developed during President Barack Obama's administration. (BBG)

METALS: Rio Tinto's third quarter iron ore production improved to be just one per cent below the same period last year as staff returned to pre-COVID work rosters. The miner produced 86.4 million tonnes of iron ore from the Western Australia's Pilbara region, and has produced two per cent more after three quarters than the same time last year. Rio said staff were still working under COVID-19 restrictions. Iron ore shipments for the quarter of 82.1 million tonnes were down five per cent. This was due to maintenance work at the Pilbara port, which had been postponed from the first half of the financial year. (AAP)

COPPER: Chilean state-run copper miner Codelco is producing at full capacity and aims to meet its 2020 output targets, its chief executive said on Thursday, noting that the coronavirus pandemic was now under control with a low infection rate. (RTRS)

OIL: OPEC+ made little progress in September in compensating for overproduction in previous months, figures given to Reuters by OPEC sources showed on Thursday. The volume of compensatory cuts stood at 2.33 million barrels per day in September, the sources said. The figure was 2.38 million bpd in August, sources previously said. (RTRS)

OIL: With the oil market's recovery from the coronavirus pandemic slower than hoped, some OPEC+ members are acknowledging that the alliance's production cuts may need to be extended, rather than eased as planned, at the end of the year. (Platts)

OIL: Libya's daily oil production has risen to around 500,000 barrels, according to people familiar with the situation, as the war-battered nation restarts its energy industry after a truce. (BBG)

OIL: Less than a quarter of U.S. Gulf offshore crude oil production remains shut after last week's Hurricane Delta, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) said on Th

CHINA

PBOC: Loose monetary policy in China' may have reached its highest point in September and policymakers are likely to further "control the rhythm" to prevent excessive stimulation as exports remain vibrant, consumption recovers and state-led investments take effect, the 21st Century Business Herald said in a commentary. The rise in macro-leverage ratios in the first half was phasic and is likely to decline as the economy expands, the newspaper said. The bond and equity markets are taking a greater share of the real economy's need for capital, it said. (MNI)

PBOC: The PBOC is likely to maintain the current MLF operating rate to the end of the year to allow controlled liquidity and also account for potential growth in Q4 and Q1 2021, the China Securities Journal reported citing Yan Se, an economist from Founder Securities. China is likely to expand its fiscal expenditure in the next two months to improve liquidity, and the probability of rate or RRR reductions are small given the current level of inflation, the Journal reporting citing Wen Bin, a researcher from China Minsheng Bank. The MLF renewals will likely carry a stable long-term interest rate to reduce financing costs and support the real economy, said Wen. (MNI)

ECONOMY: China's domestic demand is steadily recovering with the core CPI rising for two consecutive months, the Shanghai Securities News reported citing analysts. Core CPI, which excludes food and energy prices, rose for the second month by 0.2% m/m in September, the fastest since the outbreak of the epidemic, confirming the continued improvement of terminal demand, the newspaper said citing Zhu Jianfang, chief economist of CITIC Securities. China's overall CPI slowed to 1.7% y/y from 2.4% in August, though the indicator is heavily weighted with food items including pork. (MNI)

EQUITIES: China will push forward reforms to expand registration-based system to all IPOs "at an appropriate time," Yi Huiman, head of China Securities Regulatory Commission, said in a report to the nation's top legislative body Thursday. No timetable is given. (BBG)

OVERNIGHT DATA

NEW ZEALAND SEP BUSINESSNZ M'FING PMI 54.0; AUG 51.0

BusinessNZ's executive director for manufacturing Catherine Beard said that given what happened post the nationwide COVID lockdown, a boost in activity post the Auckland lockdown was not a surprise. "September saw Auckland at level 2.5 or lower, which meant back to business for most manufacturers. This saw the unadjusted regional activity level for the Northern region recovering from 41.2 in August to 50.6 in September". "All but one of the key sub-indices improved in September, including Employment (51.6), which showed expansion for the first time since February". BNZ Senior Economist, Doug Steel said that "although the September PMI pushed above its long term average of 53.0, it should not be confused with above average activity levels. Rather, it indicates growth off the low base set earlier in the year. Growth has not yet been enough to recoup previous loses, but some progress is being made". (Business NZ)

NEW ZEALAND SEP NON-RESIDENT BOND HOLDINGS 49.4%; AUG 49.5%

SOUTH KOREA SEP UNEMPLOYMENT 3.9%; MEDIAN 3.7%; AUG 3.2%

SOUTH KOREA SEP EXPORT PRICE INDEX -6.2% Y/Y; AUG -6.7%

SOUTH KOREA SEP EXPORT PRICE INDEX -0.3% M/M; AUG -0.1%

SOUTH KOREA SEP IMPORT PRICE INDEX -11.5% Y/Y; AUG -10.5%

SOUTH KOREA SEP IMPORT PRICE INDEX -1.3% M/M; AUG -1.1%

CHINA MARKETS

PBOC NET DRAINS CNY150BN VIA OMOS

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged on Friday. This resulted in a net drain of CNY150 billion given the maturity of CNY200 billion of medium-term lending facilities, according to Wind Information.

- The operation aims to keep the liquidity in the banking system ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2015% at 09:35 am local time from the close of 2.1823% on Thursday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday, flat from the close of Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7332 on Friday, compared with 6.7473 set on Thursday.

MARKETS

SNAPSHOT: Familiar Risks Persist

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 55.49 points at 23451.41

- ASX 200 down 26.8 points at 6183.5

- Shanghai Comp. down 9.329 points at 3322.854

- JGB 10-Yr future up 4 ticks at 152.12, yield up 0.2bp at 0.025%

- Aussie 10-Yr future up 1.5 ticks at 99.250, yield down 2.2bp at 0.744%

- U.S. 10-Yr future +0-00+ at 139-04+, yield down 0.49bp at 0.727%

- WTI crude down $0.37 at $40.59, Gold down $3.31 at $1905.4

- USD/JPY down 18 pips at Y105.27

- REMDESIVIR HAS LITTLE EFFECT ON COVID-19 MORTALITY, WHO STUDY SAYS (FT)

- CHINA SET TO PASS ITS OWN LAW PROTECTING VITAL TECH FROM U.S. (BBG)

- U.S. OFFERS TARIFF TRUCE IF AIRBUS REPAYS BILLIONS IN AID (RTRS SOURCES)

- EU LEADERS CALL FOR UK TRADE TALKS TO CONTINUE (BBC)

BOND SUMMARY: A Mixed Bag

A light downtick in e-minis resulted in some modest support for core FI markets as we moved through the final Asia-Pac session of the week, although there was little in the way of notable headline flow, with the moves only marginal, at best.

- T-Notes clung to a tight range, last +0-01 at 139-05, with yields sitting 0.3-0.8bp richer across the cash Tsy curve. Flows were eyed, with some focus on the downside, with some light screen interest in 1x2 TYZ0 137.00/135.00. Eurodollar futures sit unchanged to 0.5 tick higher through the reds. Here, a combination of block and screen sales in EDM1 and on screen steepener flow in EDU2/U4 received attention, especially given the lack of headline flow that was evident overnight.

- JGB futures sagged during the morning, after the pullback from overnight highs continued, before the defensive feel in the Nikkei 225 and e-minis crept in, allowing JGB futures to bottom, at least for now. Contract last +4, with the super-long end outperforming in cash, while 10s represent the weak point on the curve.

- Spill over from yesterday's RBA commentary, in addition to a stellar ACGB auction and Westpac expressing greater conviction re: imminent RBA easing, supported the Aussie bond space. YM +0.5, XM +1.5.

JGBS AUCTION: Japanese MOF sells Y6.1563tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1563tn 3-Month Bills:

- Average Yield -0.0834% (prev. -0.0945%)

- Average Price 100.0224 (prev. 100.0254)

- High Yield: -0.0781% (prev. -0.0875%)

- Low Price: 100.0210 (prev. 100.0235)

- % Allotted At High Yield: 26.7333% (prev. 79.9574%)

- Bid/Cover: 3.229x (prev. 2.631x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:- Average Yield: 0.1895% (prev. 0.3070%)

- High Yield: 0.1900% (prev. 0.3075%)

- Bid/Cover: 7.0100x (prev. 6.5405x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 93.8% (prev. 99.0%)

- bidders 42 (prev. 60), successful 9 (prev. 10), allocated in full 3 (prev. 5)

AUSSIE BONDS: Vanilla AOFM Issuance Schedule For Next Week

The AOFM has released its weekly issuance schedule:

- On Wednesday 21 October it plans to sell A$2.0bn of the 1.00% 21 December 2030 Bond.

- On Thursday 22 October it plans to sell A$1.5bn of the 26 February 2021 Note & A$1.0bn of the 21 May 2021 Note.

- On Friday 23 October it plans to sell A$1.5bn of the 0.50% 21 September 2026 Bond.

EQUITIES: No Firm Direction

E-minis edged higher in Asia-Pac trade, building on Thursday's late bounce, while the major Asia-Pac indices struggled for any uniform direction.

- The Hang Seng was the outperformer within the region, after underperforming yesterday, while the remainder of the major regional indices traded either side of unchanged.

- As we have noted, familiar sources of risk have dominated headline flow of the last 24 hours, most notably, the fiscal impasse in DC, COVID-19 worry (largely focused on Europe) and the ongoing Brexit saga.

- Nikkei 225 +0.1%, Hang Seng +0.9%, CSI 300 +0.2%, ASX 200 -0.3%.

- S&P 500 futures +6, DJIA futures +37, NASDAQ 100 futures +15.

OIL: Oil Nudges Lower, Aided By Downtick In E-Minis

WTI & Brent sit $0.45-0.50 lower vs. settlement at typing, with e-minis pulling back in recent trade, although there has been little in the way of meaningful headline flow to drive the move.

- Thursday saw OPEC Secretary General Barkindo look to reinforce faith in the OPEC+ production pact, even with RTRS source reports noting that "OPEC+ made little progress in September in compensating for overproduction in previous months. The volume of compensatory cuts stood at 2.33 million barrels per day in September, the sources said. The figure was 2.38 million bpd in August, sources previously said." Platts sources went as far as noting that "with the oil market's recovery from the coronavirus pandemic slower than hoped, some OPEC+ members are acknowledging that the alliance's production cuts may need to be extended."

- Elsewhere, Libyan production continues to come back online, with U.S. Gulf facilities also re-opening.

GOLD: Familiar Themes, Familiar Levels

Little to drive a meaningful move for bullion over the last 24 hours, with spot edging higher over that time, last sitting unchanged on the day around $1,907/oz. Familiar fundamental drivers and technical parameters remain in play.

FOREX: Defensive Feel Supports JPY, Sino-Aussie Trade Tensions Weigh On AUD

A sense of caution continued to linger in Asia, as the timezone digested a mix of familiar risks. The rapid resurgence of coronavirus across Europe, Brexit uncertainty and U.S. fiscal stalemate buoyed JPY, the best G10 performer, with a round of purchases seen into the Tokyo fix.

- AUD faltered amid reports noting that Chinese mills have been instructed to stop buying Australian cotton, as Beijing may slap 40% tariffs on the commodity, making shipments unviable.

- A downtick in oil prices applied pressure to NOK & CAD, while preventing any recovery attempts in AUD.

- GBP edged lower as participants awaited UK PM Johnson's decision, whether the UK will abandon Brexit talks with the EU. The announcement is expected today, after the European Council called upon the UK to make concessions, drawing the ire of London's chief negotiator.

- USD/KRW crept higher as South Korean unemployment rose more than expected, which offset potential impact of an optimistic signal sent by local health data. Daily coronavirus case count dipped below 50 for the first time in nearly three weeks.

- Focus turns to EZ trade balance & final CPI, U.S. retail sales, industrial output & flash U. of Mich. Survey as well as comments from Fed's Bullard & Williams and from Riksbank's Ingves.

FOREX OPTIONS: Expiries for Oct16 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1525(E651mln), $1.1650(E888mln), $1.1700(E680mln), $1.1715-25(E687mln), $1.1745-50(E643mln), $1.1800(E2.51bln-E2.32bln of EUR calls), $1.1845-50(E1.1bln), $1.1900(E832mln-EUR calls)

- USD/JPY: Y104.50($1.6bln), Y105.00-04($3.0bln-$2.9bln of USD puts), Y105.35-40($1.2bln), Y105.50-60($626mln)

- GBP/USD: $1.2945-50(Gbp483mln)

- EUR/NOK: Nok10.30(E840mln), Nok10.55(E800mln), Nok10.65(E571mln)

- AUD/USD: $0.6700(A$753mln), $0.7050-60(A$566mln), $0.7175(A$794mln)

- AUD/JPY: Y74.30(A$555mln)

- USD/CAD: C$1.3000($745mln), C$1.3220($670mln)

- USD/CNY: Cny6.72($570mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.