-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

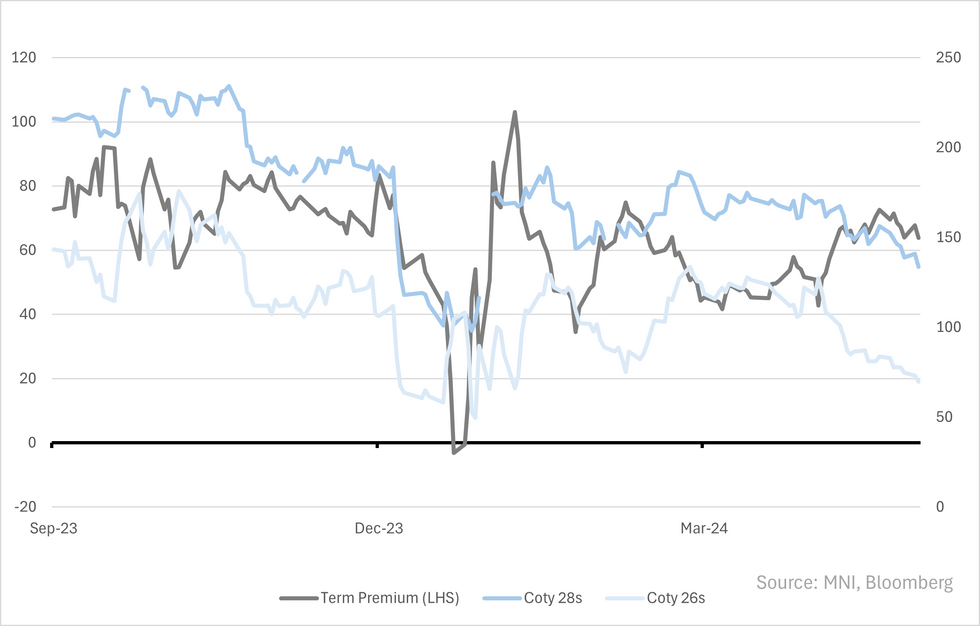

Free AccessCoty (Secured; Ba2 Pos, BB+ Pos, BBB- Stable)

Coty has a track record of delivering on leverage targets. Current guidance is to continue to ~2.5x by the end of this year. We see that tad about S&P's upgrade threshold, but if headline performance holds firm (as it did in Q3) we expect a pre-emptive upgrade. For now we expect S&P to wait for FY24 (ending June) results that come in August given FCF this year (includes Q1/2 of FY25) still key for deleveraging.

Re. the 28s; they were -4 this morning but have moved another -4 in on the US open. Flatteners over 28s in isolation screen the better option (see below) till we get firmer read through on CY24 guidance in FY24 results. Note 28s are pricing to a 1y par call in 2027 (trades at €104.2) but earlier call should not be ruled out here on the high cash price (callable from 2025 at €102.875).

- S&P criteria for upgrade on just leverage requires it to be sustained below 3x (eqv. to company reported ~2.3x). That is below the CY24 exit target of 2.5x and means we will be on wait till Wella stake sale in CY25.

- It does have alternative condition for upgrade as strong headline performance (including market share & EBITDA margin gains) alongside progressive deleveraging.

- Q3 results (3m ending March) last week lined up with above - it reported +10% LFL growth & 8% on reported basis, market share gains, gross margin gains of +190bps yoy & EBITDA margin gains of +30bps yoy. Leverage spiked to 3.4x though on seasonally weak cash flows (FCF -$234m vs. -$180 last yr) - latter tad disappointing but co pointed to some one-offs that it expects to reverse in 4Q.

- Strong results helped it firm FY guidance to "upper/high end" of previous ranges that were for LFL revenue at +9-11%, EBITDA margin expansion of 10-30bps. It says FX headwinds leaves EBITDA guidance unch at $1.08-$1.09b. FCF also left unch at ~$400m with "growth in FY25" (c$535m).

- Analyst & markets were tad disappointed on the implied weaker Q4 headline sales - company pointed to one-offs around restocking & kept early 1Q25 outlook firm.

- We'd note Coty has reasonable track record of deleveraging in line with guidance - it exited CY23 at 3.1x vs. guidance of ~3x that was given as early as Nov 2022. Targets have been unch through recent times at 2.5x exiting CY24 and 2x exiting CY25. The $1.1b Wella stake sale will do the heavy lifting in CY25 while current expectations for EBITDA in FY24 & 25 will cycle ~0.4x off leverage each year. Excess will be on FCF it generates - which we see particularly important for CY24 targets.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.