May 24, 2024 08:40 GMT

Coty (Secured; Ba2 Pos, BB+ Pos, BBB- Stable) New 3NC2

CONSUMER CYCLICALS

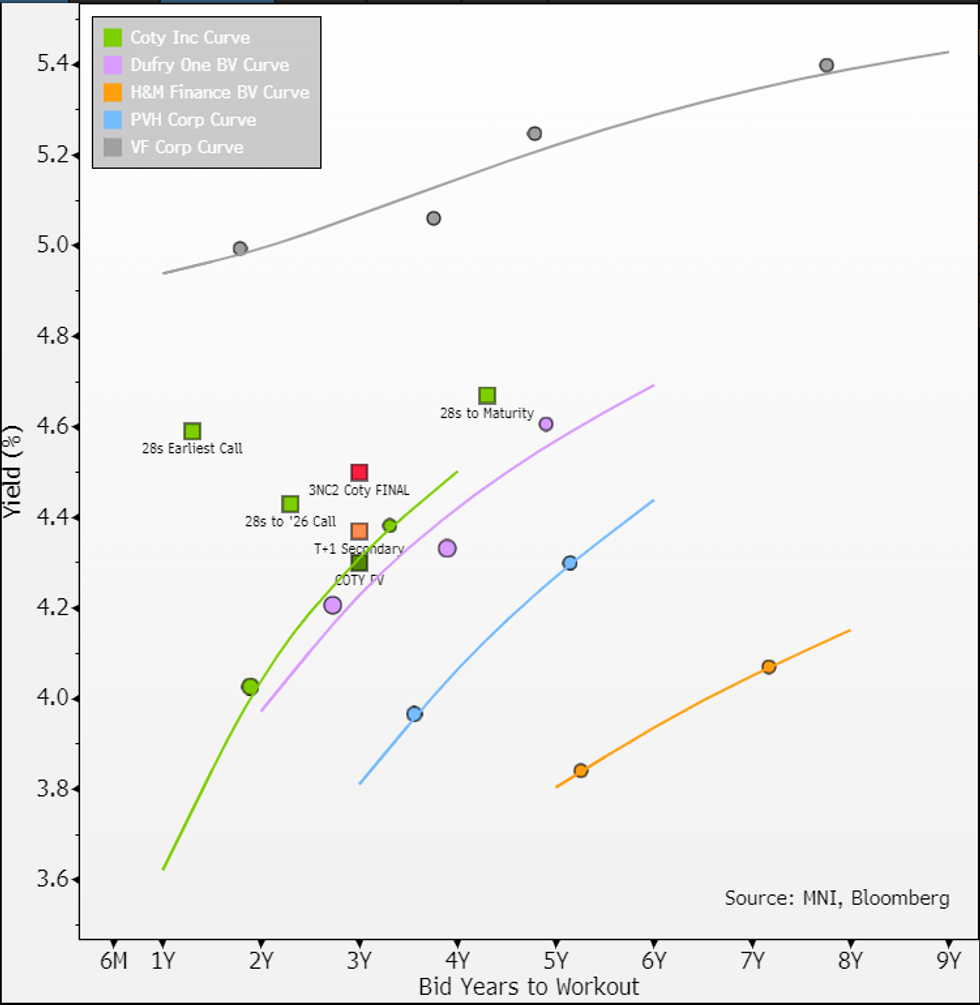

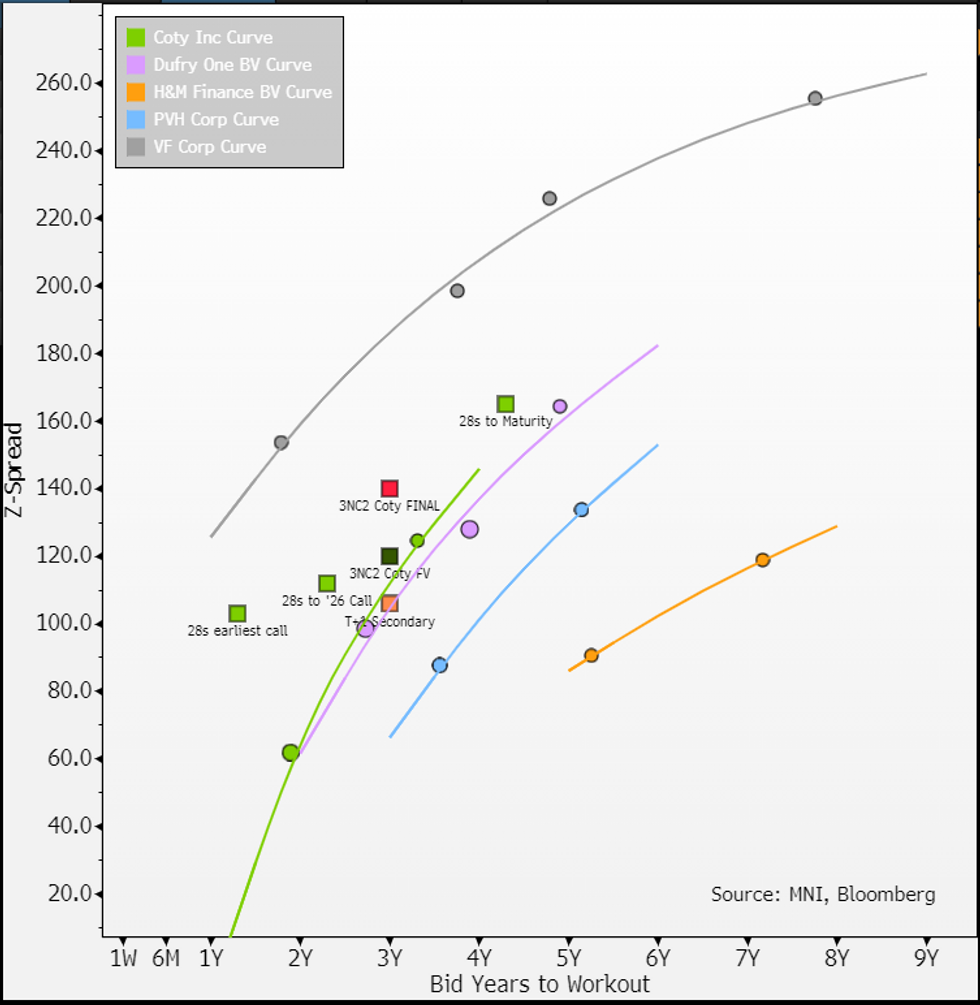

- We were excited to see Coty bring a new issue onto a secondary we already thought was cheap (the 28s). New 3NC2 has not disappointed, brushing past a 7bp sell-off in 3y bunds to move in 13bps (BVAL bid side), trading half the NIC away on yields & moving through our FV on spread (we don't attach any value/see a early call on this line).

- Screen cheap still stands on 28s, callable starting on Sept '25 but we see gross deleveraging targeting the $1.6b in '26 maturities first. Eventual call on excess deleveraging or cheaper refi (5.75% coupon) we see as likely.

- FY24 Earnings (12m to June) come late August, guidance was left unch but at top-end of range - seen as conservative after a Q3 beat.

146 words