-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

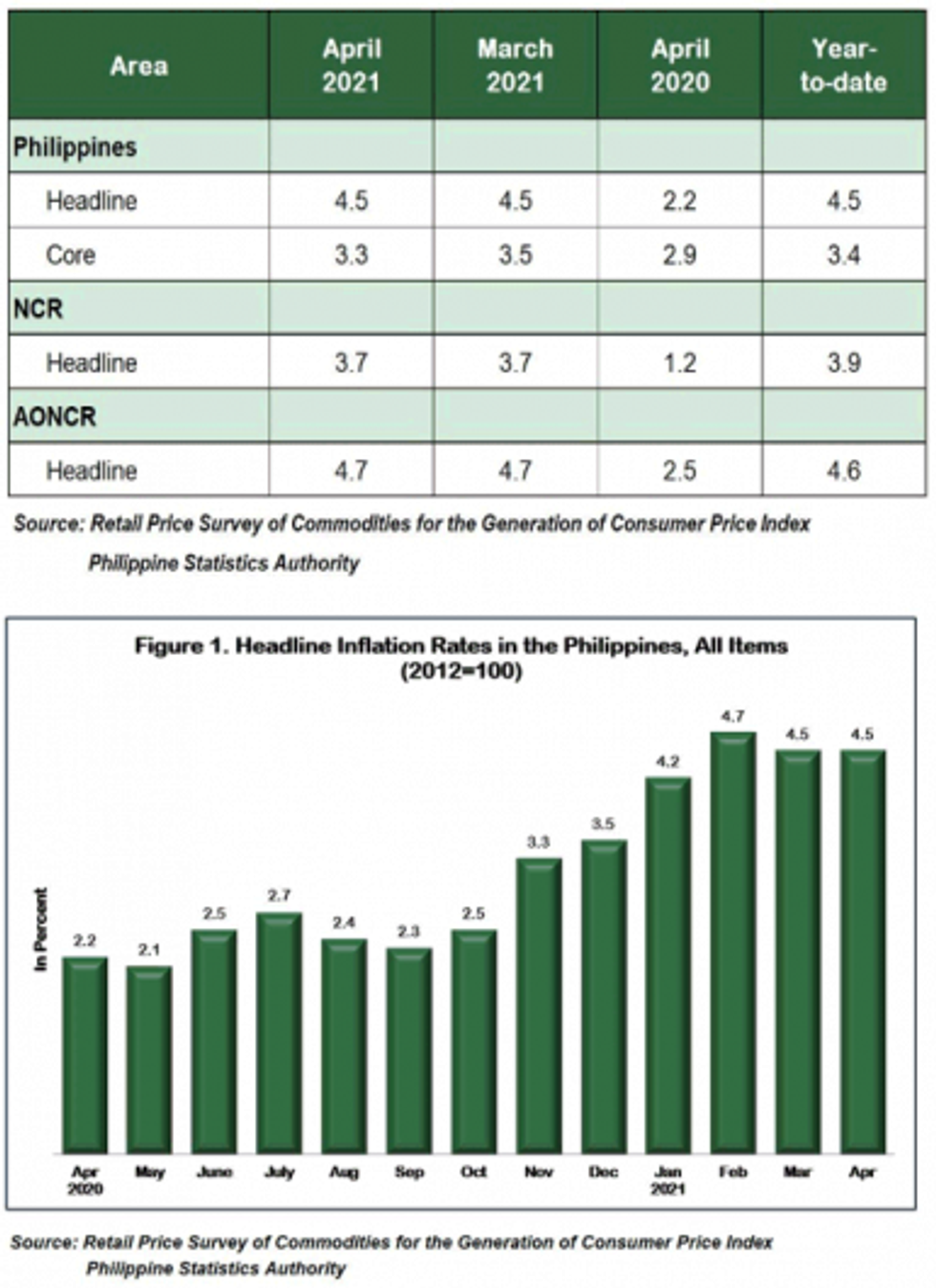

CPI Misses Forecasts, BSP Expect It To Remain Elevated Through 2021

Spot USD/PHP has faltered despite a miss in Philippine CPI as consumer prices unexpectedly rose at a steady pace in April. When this is being typed, USD/PHP changes hands -0.067 at PHP47.970, probing the wated below the PHP48.000 mark for the first time since Feb 16.

- Headline CPI registered at +4.5% Y/Y in April, mimicking the March reading and undershooting expectations of +4.7%. Core CPI eased to +2.9% Y/Y from +3.5% recorded in March, while inflation in the NCR region remained at +3.7%.

- BSP Gov Diokno commented that inflation is poised to remain elevated this year on the back of supply-side pressures, but will ease towards the target in 2022. He noted that inflation expectations are well anchored and expressed hope that pork import tariff cuts will help mitigate price pressures.

- Tensions between the Philippines & China continue to simmer, as Manila said a unilateral fishing ban imposed by China does not apply to waters within the Philippine jurisdiction. Manila also said that it will continue patrols and maritime exercises in the disputed waters.

- Philippine unemployment comes out Thursday, with trade balance coming up Friday. Latest money supply & bank lending data should hit the wires by the end of this week.

- Bears keep an eye on the 61.8% retracement of the YtD rally at PHP47.943 and a break here would open up the 76.4% Fibo level/Feb 16 low at PHP47.751/47.721. Conversely, a jump above yesterday's high of PHP48.071 would shift focus to the 100-DMA at PHP48.285.

Fig. 1: Philippines CPI Y/Y (%)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.