March 15, 2024 11:24 GMT

Deceleration In French and Italian Services HICP

EUROZONE DATA

The French and Italian final February HICP releases saw minor revisions to the flash estimates. Details of the prints indicate that annual services HICP inflation decelerated in February, in contrast to the acceleration in German and Spanish counterparts earlier this week.

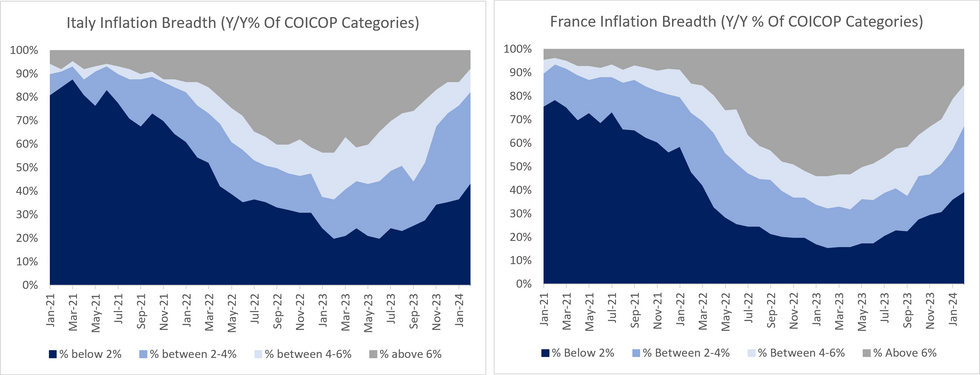

- Additionally, MNI's metrics showed narrowing inflation breadth in both France and Italy.

- However, while decelerating, FR/IT services inflation remains above 3% - and services inflation continues to look sticky for the Eurozone as a whole - potentially complicating the apparent ECB consensus on a June rate cut.

- In France, services HICP (which is not reported in the flash), decelerated to 3.3% Y/Y (vs 3.5% prior). Italian services HICP inflation confirmed flash estimates at 3.1% Y/Y (vs 3.2% prior).

- HICP excluding energy and unprocessed foods was 2.7% Y/Y in France (vs 3.0% prior) and 2.6% Y/Y in Italy (vs 3.0% prior).

- MNI's inflation breadth indicator saw a modest improvement in France, with 61% of components printing annual inflation rates above 2% (vs 64% in January)

- Italian inflation breadth saw a larger 6pp improvement in February, with 57% of components printing annual inflation rates above 2% (vs 63% in January). This was the lowest reading since March 2022.

206 words