-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

Diokno Reiterates Commitment To Flexible FX Policy, Expects CPI To Rise +4.3 Y/Y This Month

Spot USD/PHP last changes hands at PHP50.321, virtually unchanged on the day, with domestic focus falling on the latest comments from BSP Gov Diokno. Bears look for a retreat under Jul 23 low of PHP50.085 towards Jul 13 low of PHP49.940, while bulls need a clearance of Jul 19 high of PHP50.496 before targeting May 28/22, 2020 highs of PHP50.770/50.795.

- USD/PHP 1-month NDF last seen +0.120 at PHP50.430, with bulls looking for a jump above Jul 27 high of PHP50.730, before taking aim at Jul 19 high of PHP51.390. Bears keep an eye on Jul 22/13 lows of PHP50.140/50.100.

- BSP Gov Diokno reiterated that Bangko Sentral is committed to a flexible FX policy, as a market-driven exchange rate can serve as a buffer against external shocks. Diokno said that the peso's depreciation is in line with regional dynamics, while the currency will draw support from foreign remittances and outsourcing revenue.

- Fitch said that household spending in the Philippines is expected to grow 5.1% in 2022, after rising 4.0% this year. They noted that "a full recovery of Philippines' consumer and retail sector will only take place in 2022, with conventional growth returning in 2023."

- Philippine bank lending data may hit the wires over the coming days, but there is no fixed time of the release. Next week's highlights include unemployment (Tuesday), CPI (Thursday) & trade balance (Friday).

- Ahead of the release of inflation data next week, BSP's Diokno said that the central bank expects headline CPI to settle within the +3.9%-4.7% Y/Y range this month, while the point inflation forecast is +4.3% Y/Y. Bangko Sentral see higher prices of petroleum products and key food items as key sources of upward price pressure.

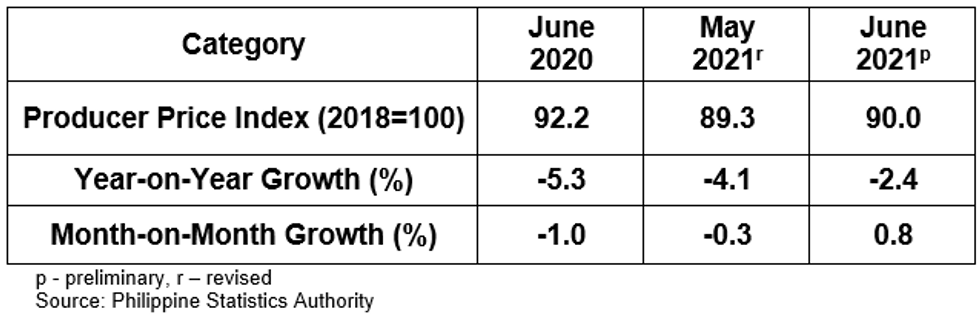

- Meanwhile, Philippine PPI fell 2.5% Y/Y in June, according to the latest update from the Philippine Statistics Authority, after a revised 4.1% decline recorded in May.

Fig. 1. Philippine PPI For Total Manufacturing

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.