-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Heavy Short End Sales Weighs on Rate Cut Odds

MNI ASIA MARKETS ANALYSIS: Curves Flatter Ahead Inauguration

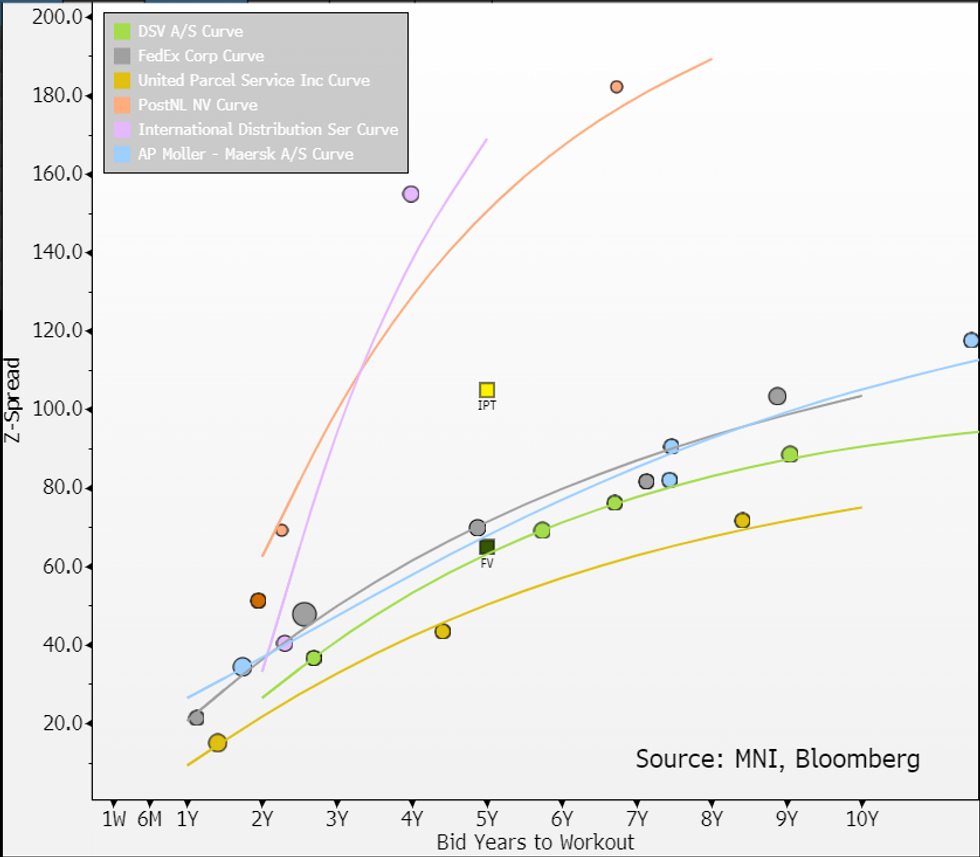

DSV (DSVDC; A3/A-; S) FV

€500m 5Y IPT MS+105a vs. FV +65 (-40)

DKK 10b = €1.34b, FY is 12m ending December

- DSV is a DKK150b/€20b transport & logistics company that runs high single to low double digit EBIT margins. Between Air&Sea, Road & Solutions its revenue is split 60/24/15% and EBIT 75/11/13% (in FY23). In 1Q results it left FY24 EBIT guidance was unch for DKK15-17b (consensus is at midpoint) which would be a circa 8% fall yoy.

- It targets "gearing ratio" (net debt to EBITDA) of <2x. FY23 it ended with DKK41b/1.8x gross leverage and net of the 6.5b in cash left it 1.5x levered. FCF was 11.5b (down from 22.8b) with it paying out 15.4b to equity holders (reflecting headroom on leverage).

- Note it caveats net 2x ceiling by adding "the ratio may exceed this level following significant acquisitions". On that note it is a finalist bidder for Deutsche Bahn's (Aa1/AA-) logistics unit DB Schenker with valuation around the ~€14b mark in latest reports; {NSN SDVYVFDWRGG0 <GO>}. We'd note in the last 5years it has always kept net leverage in 1-2x range and in-line with that its last rating change was a upgrade from S&P (to A-) in 2018.

- It's coming in-line here, secondary is +1-2, image below captures that. No firm view but at high-level does look cheap vs. Maersk (Baa1/BBB+) who has more pure exposure to shipping and lower margin (though larger in scale at €50b rev's).

- Note we have cheap views in postal Co's IDSLN28s and new PNLNA31s included below. Also note that private co Otto Group (unrated) has a mandate out for 4.3Y - it has logistics divisions as well though more to do with warehousing and parcel delivery on ground.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.