-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBNZ Cuts 50bps, OCR Forecast Slightly Higher

MNI China Daily Summary: Wednesday, November 27

MNI Global Morning Briefing: ECB PEPP Watch

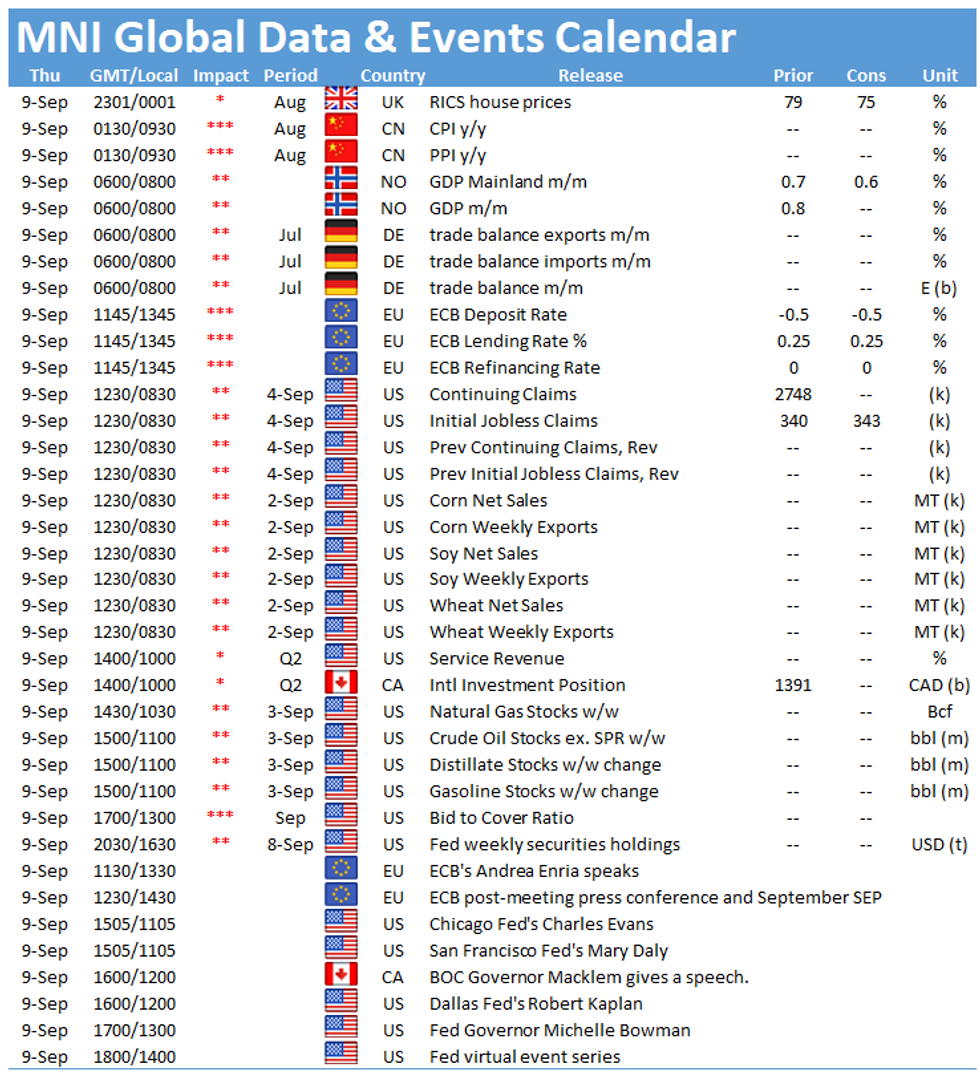

Thursday sees a light data calendar but the highlight will be the ECB policy decision.

Data includes the early release of the Norwegian monthly GDP data and the German import/export prices.

ECB Mull PEPP Purchases (BST 1245)

European Central Bank policymakers meet against a backdrop of consumer prices at multi-year highs and factory gate inflation at levels not seen since the 1980s. Despite that, the Governing Council looks set to keep policy unchanged, keeping the deposit rate at -0.5% and the envelope for PEPP purchases at EUR1.85 trillion.

Expectations are that while signals over the scale of bond buying will be unchanged from the previous 2 quarters, there is an outside chance they could tweak the wording to give themselves a little flexibility. New signals regarding post-PEPP bond-buying policy are unlikely to come this time around.

Staff macroeconomic projections for the current quarter, expected in the post decision press conference, will also be closely watched.

Initial claims may rise (1330BST)

In the U.S., the main data release will be the weekly unemployment claims data. Forecasts suggest a modest uptick in claims for the second time in three weeks, which could reflect a slowdown in hiring and employment requirements in parts of the service sector. Medians suggest a rise to 343,000 from 340,000 last week.

Thursday sees a full slate of speakers, including ECB President Lagarde and Supervisory Board chair Andrea Enria. Also on deck are Fed Charles Evans, Michelle Bowman, Robert Kaplan and Mary Daly. BOC Governor Tiff Macklem is also scheduled to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.