-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

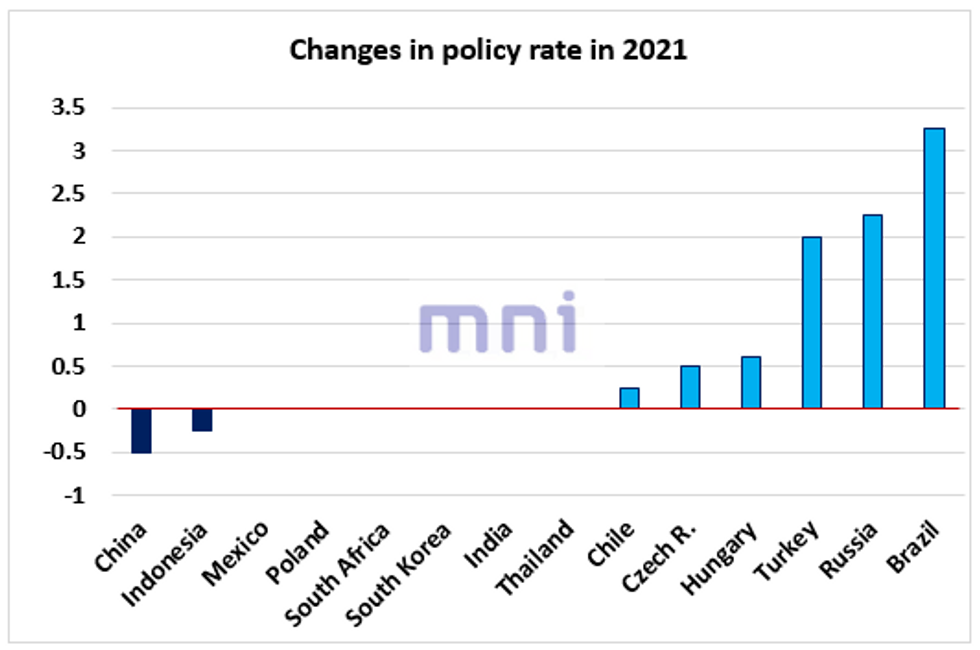

Free AccessEM Central Banks: Who's Hiking, Who's Not?

- Today, CNB raised its policy rate by 25bps as expected to 0.75%, gradually continuing its tightening cycle to curb the inflationary pressures.

- This week was also marked by the sharp 100bps hike in the Selic rate by the BCB (as expected, but largest increase since 2003), and policymakers confirmed that they stand ready to raise the policy rate beyond the 'neutral' rate to ensure inflation is converging back toward the central bank's target in 2022. With a 325bps hike since the start of the year, the BCB has been the most 'hawkish' central bank among the EM world.

- The CBR has also raised its policy rate significantly this year by 225bps to 6.5%; the central bank also opted for an aggressive 100bps on July 23 to rein in inflation, which came in at 6.5% in June far above the CBR 4% target.

- Last week, its was the NBH that raised its benchmark rate by 30bps (slightly higher than market expectations of 20bps) for a second time following the positive surprise in inflation (July CPI came in at 5.3% in Hungary, far above the NBH 4% upper tolerance band).

- The CBRT has remained on hold since March, keeping its benchmark rate steady at 19%, but the recent positive surprise in inflation could once again 'push' the central bank to increase interest rates, especially if the TRY keeps depreciating.

- In Asia and SE Asia, officials have adopted a more 'dovish' tone as uncertainty over the Delta variant has increased significantly in recent weeks:

- In China, officials agreed to cut the RRR (for big banks) by 50bps to 12% in order to ease financial conditions following the sharp consolidating in risky assets since February and stimulate the economic activity which has been decelerating in recent months.

- In Thailand, we saw that the board decision to maintain interest rate on hold was split (4 against 2), with 2 policymakers aiming to cut rates as growth expectations have been revised to the downside due to rising Covid cases.

- It will be interesting to see if the divergence in monetary policy between 'East and West' will be reflected in the FX crosses in the near to medium term (THB is down nearly 7% against USD since June, and could continue to depreciate against major crosses if BoT considers cutting rates to stimulate economic activity in following meetings).

Source: Bloomberg/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.