-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

EUROPEAN MARKETS ANALYSIS: A Promise Was Made

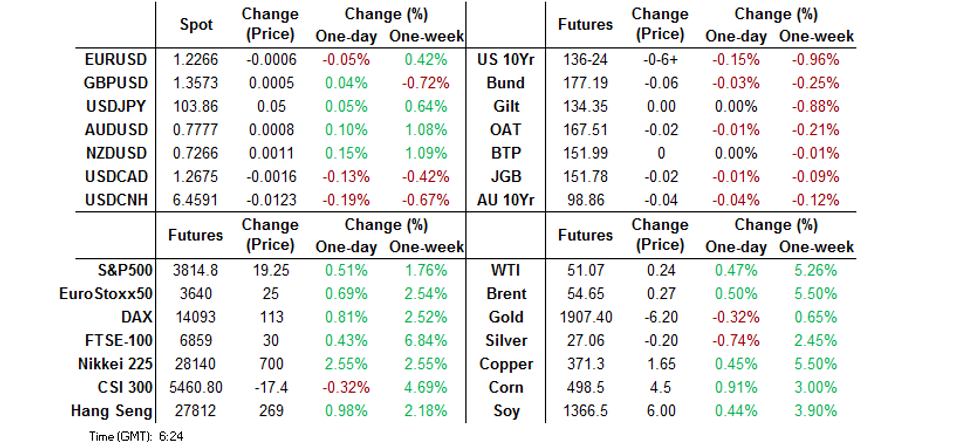

- Trump's pledge to work towards a smooth transition later this month and pushback against Wednesday's scenes in DC supported e-minis and weighed on Tsys overnight.

- Broader headline flow was light ahead of NFPs.

- Oil continues to operate just shy of recent cycle highs.

BOND SUMMARY: Further Modest Pressure For Core FI In Asia

U.S. Tsys were subjected to some light pressure overnight, with U.S. President Trump pledging to work towards a smooth transition for the incoming Biden administration and cautiously optimistic news flow surrounding existing COVID-19 vaccines being effective against the recently discovered variants of the virus at the fore. T-Notes now sit below their Thursday low, with the contract last -0-06+ at 136-24, just off lows, while the cash curve has been subjected to some bear steepening, with 30s sitting ~2.5bp cheaper on the day at typing. There was also some focus re: talk of a Biden infrastructure plan (albeit linked to higher taxes for high earners), which came via an Axios sources piece. Most of the Fedspeak seen over the last 24 hours has touched on the potential for tapering of the central bank's asset purchase schemes, in one way or another, with various views given. While some stressed that it is too soon to ponder such moves the NY-Asia crossover saw Bostic note that the Fed may taper earlier than expected N.B. this comes after a recent RTRS interview saw Bostic note that he is "hopeful that in fairly short order we can start to recalibrate" Tsy and MBS purchases. December's NFP report headlines locally on Friday, with an address from Fed Vice Chair Clarida also due.

- There was nothing in the way of a notable reaction in JGB futures to the soft round of 30-Year supply, with the contract sticking to a tight range, closing -2. 30s were also little moved in the wake of supply (unwinding a brief, limited nudge higher in yields), while JGBs are marginally mixed across the curve with some light outperformance seen in super-long paper late in the day. In terms of 30-Year auction specifics, potential domestic buyers may have been deterred by more attractive 10-Year FX hedged yields on offer across several G10 nations coupled with the current fiscal dynamic in the U.S. This meant that the cover ratio hit the lowest level seen at a 30-Year auction since June of last year, while the tail width doubled vs. the previous 30-Year auction. The low price matched broader dealer expectations, as proxied by the BBG dealer poll, which may have been a saving grace. Elsewhere, several prefectures are seemingly pushing for COVID-19 related states of emergency after Thursday's declaration covering Tokyo and some surrounding prefectures. A reminder that Tokyo will observe a market holiday on Monday.

- Aussie bonds have mostly taken direction from U.S. Tsys, with YM -0.5 and XM -4.0 at the bell, although Sydney ranges have been tight. News of a short-term COVID lockdown for the greater Brisbane area, positive COVID-19 vaccine procurement developments for Australia and tighter restrictions re: entry to Australia from abroad did little for the space. Swaps were tighter vs. ACGBs in the main.

FOREX: Calm Asia Session, USD Strength Continues To Pummel EMFX

Another quiet session for G10 FX with markets welcoming U.S. Pres Trump pledge to work on a "smooth, orderly and seamless transition of power." The greenback drew some support for a continued softening of U.S. Tsys, with 10-Year yield hitting its best levels in almost 10 months. Price action across the G10 FX space was sedate, with the limited data docket providing no notable catalysts.

- NZD firmed up a tad as a BBG trader source cited purchases against AUD after Queensland imposed a three-day lockdown in Brisbane. AUD/NZD is on course for its first weekly loss in five weeks, which occurs after the rejection of resistance from the 61.8% recovery of the 2018 - 2020 sell-off on Monday.

- Dollar strength continued to jolt EMFX, with IDR and KRW becoming the main victims. USD/IDR rallied past the IDR14,000 mark last breached when it gapped lower on Monday. USD/KRW topped out just shy of the KRW1,100 mark but stopped short of attacking the level.

- The redback outperformed its peers from the Asia EM basket and the USD, even as the PBOC fixed USD/CNY at 6.4708, around 100 pips higher than yesterday (roughly in line with expectations). The bank injected CNY 5bn of liquidity, equating to a net drain of CNY 505bn this week - the biggest since October.

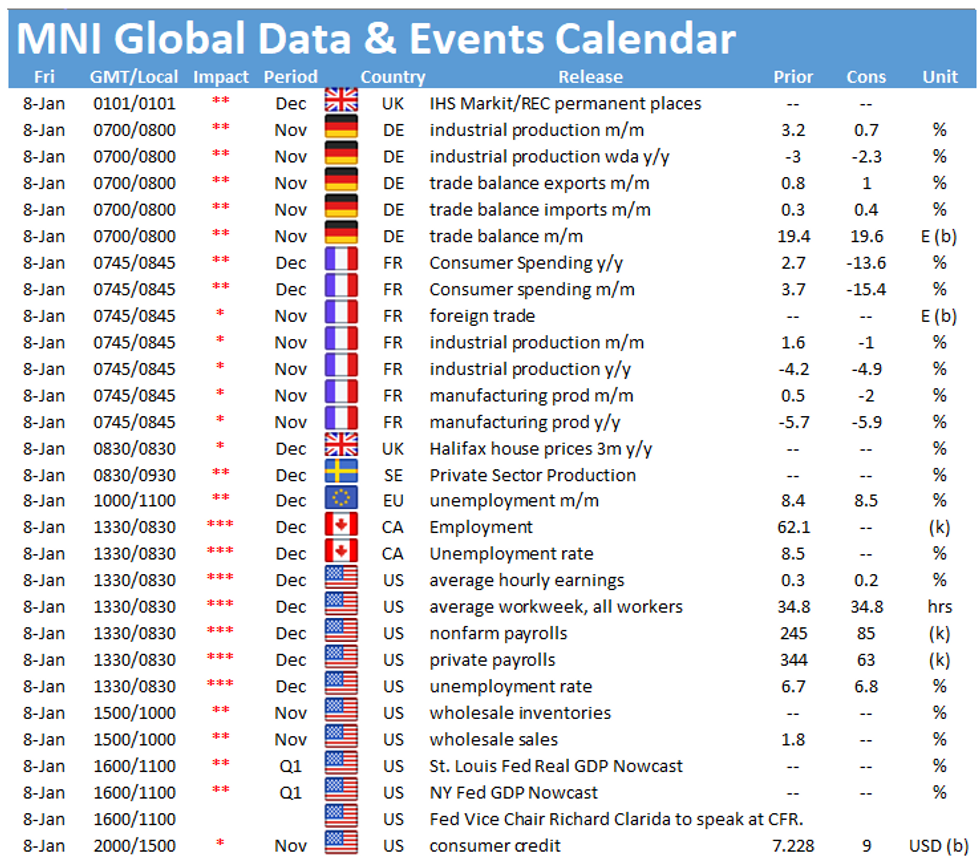

- Focus moves to U.S. NFP report, German, French & Norwegian industrial output figures, German & French trade data, Canadian & EZ jobs reports as well as comments from Fed Vice Chair Clarida.

FOREX OPTIONS: Expiries for Jan08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E793mln), $1.2175-80(E897mln), $1.2240-60(E870mln), $1.2300(E743mln)

- USD/JPY: Y103.90($790mln)

EQUITIES: Chinese Equities Red Against A Broader Sea Of Green

A more passive tone from Trump, as he pledged to work towards a smooth Presidential transition later this month, alongside talk of a Biden infrastructure plan (albeit linked to higher taxes for high earners) and potential positive news on the vaccine front re: COVID-19 mutations supported the majority of the major equity indices during Asia-Pac trade, with the S&P 500 e-mini tapping new highs in the process.

- The CSI 300 was the exception to the rule, with this week's seasonal liquidity withdrawal, MSCI index deletion for the three major Chinese telco names targeted by the Trump executive order and continued policymaker scrutiny of Alibaba hampering A shares.

- Nikkei 225 +2.3%, Hang Seng +1.1%, CSI 300 -1.1%, ASX 200 +0.7%.

- S&P 500 futures +20, DJIA futures +198, NASDAQ 100 futures +42.

GOLD: Insulated

Gold has held to a tight range over the last 24 hours, with the uptick in the DXY providing little in the way of meaningful pressure for bullion. Elsewhere, U.S. real yields have been fairly stagnant over the same timeframe, while ETF holdings of gold have flatlined over the last couple of days. Spot last deals little changed, just above $1,910/oz, with no change to the broader technical backdrop.

OIL: Just Off Cycle Highs

WTI & Brent sit ~$0.25 above their respective settlement levels after backing off from the fresh cycle highs lodged in the last 24 hours or so, holding to tight ranges over that timeframe, with a lack of crude-specific news flow evident but still leaning on the uptick in broader equity indices.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.