July 12, 2024 11:14 GMT

Eurozone Macro Signal – July 2024: Limited Progress On All Fronts

Eurozone economic activity has been mixed recently across sectors and countries, underscoring that the emerging recovery will be characterized by a still-sluggish pace of expansion held back by restrained fixed investment and declining fiscal stimulus.

MNI Point of View: Limited Progress On All Fronts

Eurozone economic activity has been mixed recently across sectors and countries, underscoring that the emerging recovery will be characterized by a still-sluggish pace of expansion held back by restrained fixed investment and declining fiscal stimulus.

- Latest Developments: Final GDP growth figures confirmed the stronger-than-expected preliminary +0.3% Q/Q Q1 print, and suggest that external demand was a key contributor to momentum at the beginning of 2024.

- The emerging economic recovery appears to have been set back recently, driven by weak developments in Germany and France.

- Unexpected political developments in France have tightened financial conditions and increased policy uncertainty, potentially weighing on growth. Retail sales have been broadly flat, while manufacturing industry momentum continues to be mixed, and overall sentiment has deteriorated.

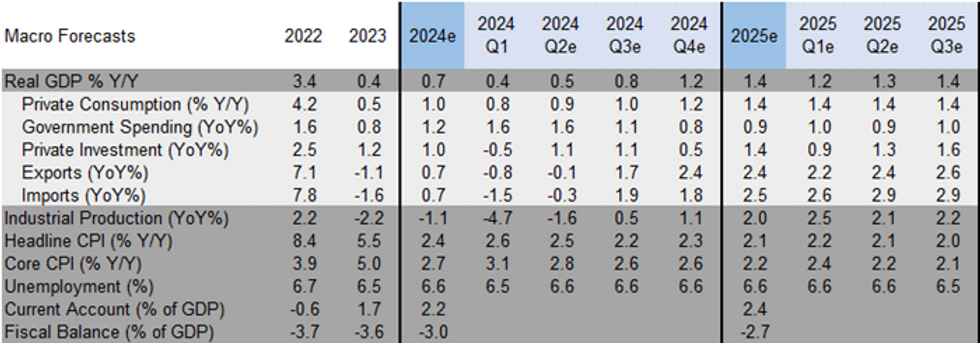

- Medium-Term Outlook: Growth in the Eurozone is set to pick up in the coming quarters in a continuation of Q1's uptick in momentum. But the pace of recovery will be subdued, as indicated by the most recent sentiment and manufacturing data. Limitations remain both structural (e.g. German industrial weakness / transition to higher energy costs) and cyclical (e.g. employment gains maxed out).

- Real GDP is expected to expand by 0.5% Y/Y in Q2 (after 0.4% in Q1) and accelerate during the remainder of 2024.

- Consumer spending is recovering and is seen driving growth in H2 2024 as a tight (if loosening) labour market and softer inflation should allow real wage gains to trickle through. Fiscal stimulus will likely taper off amid Eurozone excessive debt procedures taking shape. Snap elections in France mean increased uncertainty here, however.

PDF here:

Keep reading...Show less

290 words

MNI, Bloomberg

MNI, Bloomberg