-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessFactory Orders Decline as Non-EU Orders Dip

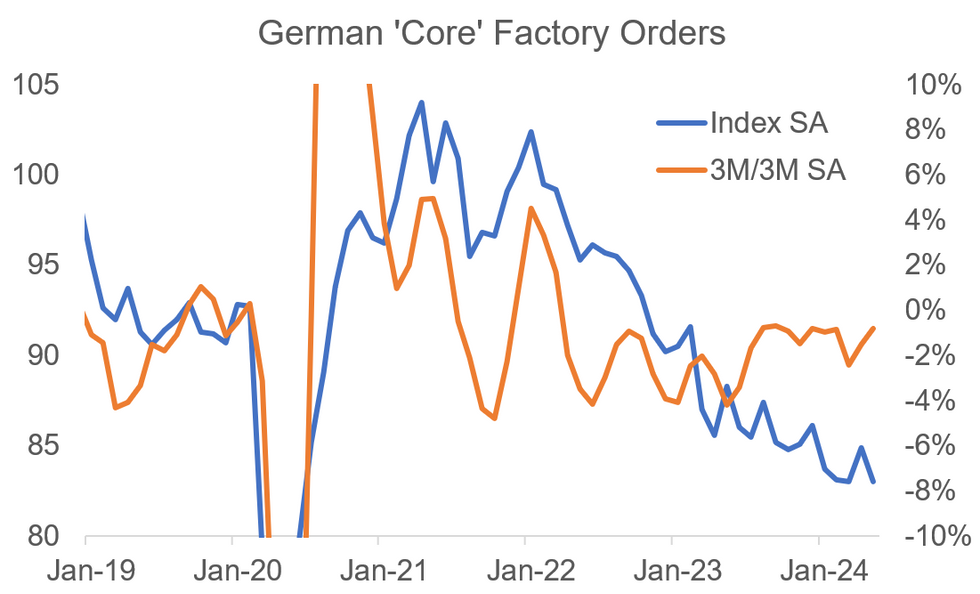

German factory orders declined 1.6% M/M in May, a notable miss compared to the +0.5% expected, particularly given April data was also downwardly revised by 0.4pp to -0.6% M/M. The underlying 'core' measure also points towards a decline - with the weakness solely driven by a drop off in non-EU orders.

- On a yearly basis, most of the decline to -8.6% was explained through a base effect - last May saw a strong +6.0% M/M, which fell out of the comparison this time. Nevertheless, the print surprised more than 2pp to the downside here.

- 'Core' (ex-large ticket items) orders, a better measure of underlying activity declined by 2.2% M/M (although this was largely just reversing April's +2.3%). The less volatile 3M/3M measure printed stronger than before, at -0.8% (vs -1.5% prior), driven by a base effect. The 3M/3M measure has now printed in negative territory for the 25th consecutive month, and the overall core index stands around levels last seen in Summer 2010. Orders in the 3-months to May were 18.4% lower than the peak seen in the 3-months to June 2021.

- Non-Eurozone orders drove the core decline, with orders falling -6.1%M/M. Domestic and Eurozone core orders both came in flat on a sequential comparison (vs +0.6% / +5.9% prior, respectively).

- The category breakdown showed lower investment goods / non-durable goods orders, which came in at -5.3% M/M (vs +4.0% prior; lowest rate since March 2023) and -2.3%, respectively (vs +2.9% prior). Durable goods meanwhile have seen a strong jump (+24.9%; the category can be volatile) but have not had much impact on the headline.

- Real manufacturing turnover meanwhile also decreased, by 0.7% M/M in May (-1.0% prior, revised from -0.9%).

- Overall, the data adds to the view that the gradual recovery of the German economy stalled recently, and shows that the external sector, which provided a decent boost in Q1, remains volatile.

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.