-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

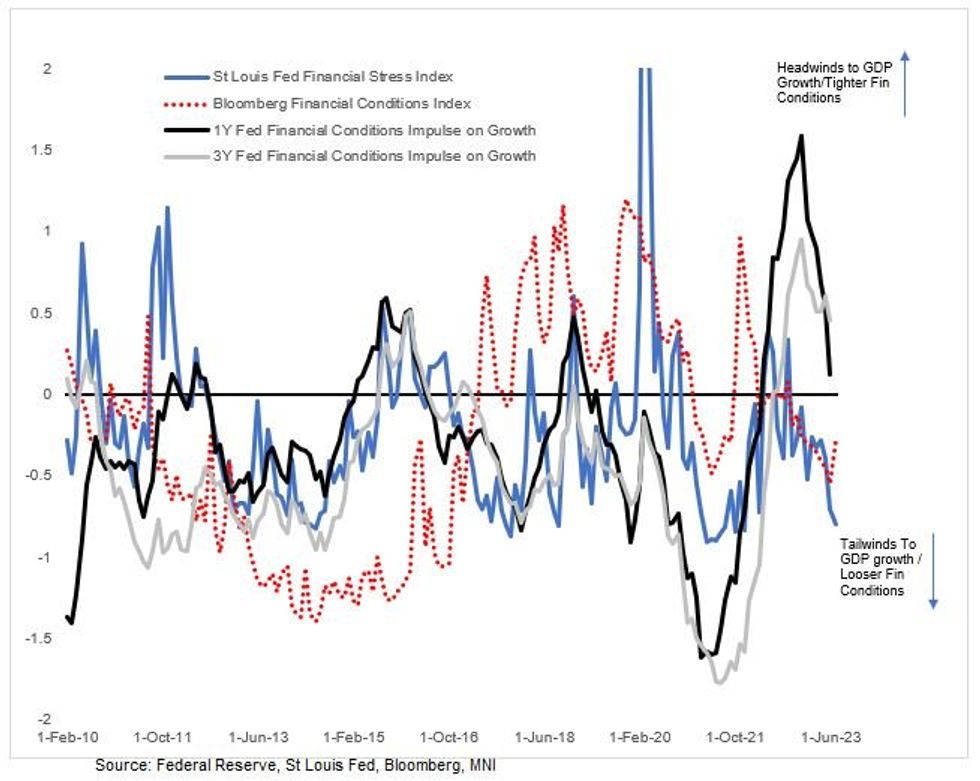

Free AccessFed's Financial Conditions Index Loosened In June

The Fed's Financial Conditions Impulse on Growth (FCI-G) Index - updated last week through the month of June - suggests that on a one-year lookback basis, financial conditions in June 2023 were their least tight since March 2022, while the 3Y index was at the least restrictive since August 2022.

- The Fed staff introduced the FCI-G in June "to gauge broad financial conditions and assess how these conditions are related to future economic growth". Versus traditional FCIs, which "typically measure whether financial conditions are tight or loose relative to their historical distributions, the new index assesses the extent to which financial conditions pose headwinds or tailwinds to economic activity."

- This index's pullback is closing the divergence with most market-based financial conditions / stress indices which continue to point to relatively loose conditions - which got even looser through July (including after the Fed hike) based in large part on rising equities and the softer USD.

- These higher-frequency indicators will have reversed in the past few days with rising Treasury yields, a stronger dollar and weaker stocks, but only partially. Overall they are at levels consistent with the loosest financial conditions of the past 7-10 years.

- In response to an MNI question at July's press conference, Chair Powell said "we will do what it takes to get inflation down and in principle, that could mean that if financial conditions get looser we have to do more. But what tends to happen though is financial conditions get in and out of alignment with what we're doing, and ultimately over time we get where we need to go".

- The Fed's measure suggests that the headwinds to GDP growth - while they haven't yet flipped to tailwinds - are dissipating.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.