-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Italy Aims At NGEU Wriggle Room Over 2026 Deadline

MNI UK Inflation Preview: December 2024

MNI POLITICAL RISK - First Trump Nominee Faces Senate Scrutiny

MNI US MARKETS ANALYSIS - Recovery for Equities Weighs on USD

Final Reading Confirms Broad-Based Disinflation in April

German final April HICP was unrevised from the flash readings at +2.4% Y/Y (+2.3% Mar) and +0.6% M/M (+0.6% Mar). The final reading of CPI was also unrevised at +2.2% Y/Y (+2.2% Mar) and +0.5% M/M (+0.6% Mar). Core CPI printed at +3.0% Y/Y (+3.3% Mar), the lowest since March 2022.

- The final major CPI components confirmed the flash estimates: goods prices printed +1.2% Y/Y (+1.0% Mar), services at +3.4% (+3.7% Mar). Overall, the data seems rather supportive of a broad disinflation narrative - note, however, that services inflation was expected to decelerate more going into the release.

- The core rate saw disinflation in a wide range of subcategories, particularly for serivces: Healthcare printed at +2.9% Y/Y (vs +3.1% Mar), transport at +0.9% (vs +2.0%), and recreation and culture at +1.8% (vs +2.0%). Insurance was an outlier, extending its all-time high to 13.1% Y/Y (vs +11.0% Mar).

- Looking at the categories associated with a potential Easter effect, airfares reversed their March jump, coming in at -11.0% Y/Y (vs +10.0%), while both package holidays (+2.5% vs +4.3%) and hotels (+4.5% in both March and April) showed no strong changes. While the airfares category will have pulled overall services somewhat lower, its contribution was muted as per its low 0.5% weighting in CPI.

- On the headline front, energy continued printing in deflationary territory but ticked up significantly vs March as expected at -1.2% Y/Y (-2.5% Mar). Looking at the subcategories that weren't available in the flash reading: household energy prices came in at -3.2% Y/Y (-4.6% Mar), driven by a gas VAT increase, and petrol at +2.0% (+0.3%).

- Food prices, which were one of the main inflation upside drivers in 2023 but cooled towards the end of the year, ended their brief deflationary trend and came in at +0.5% Y/Y (-0.7% Mar).

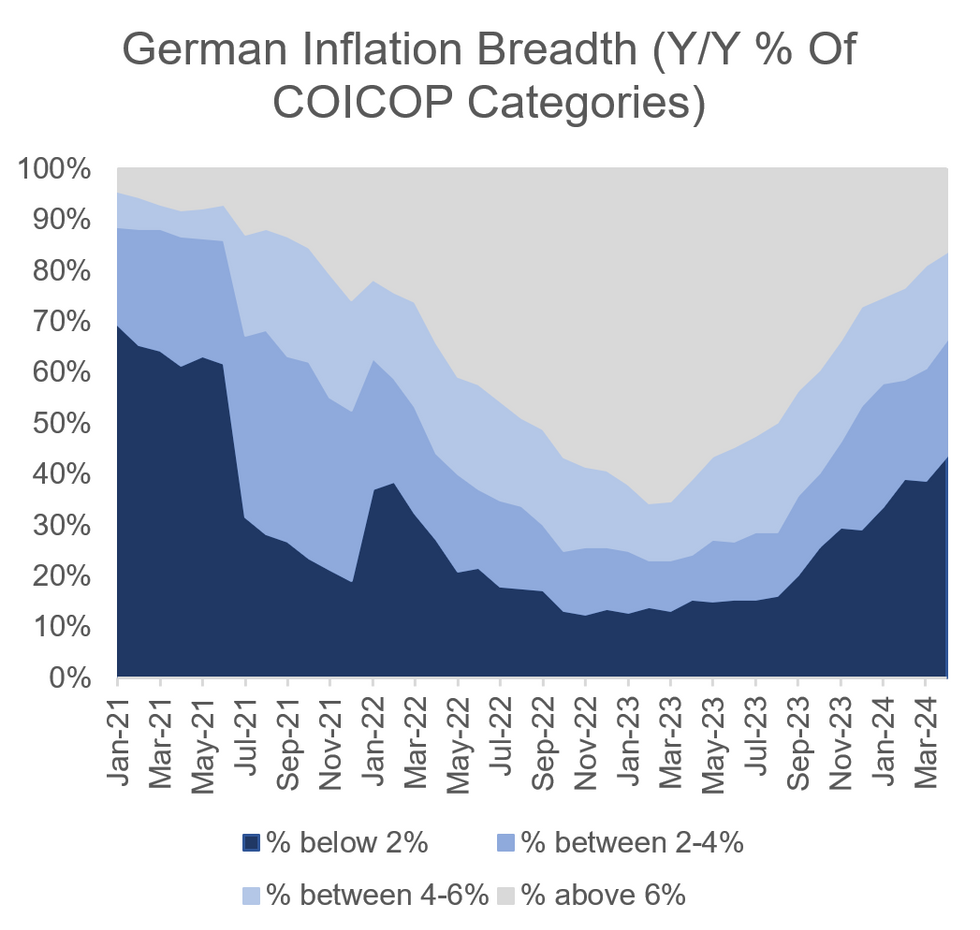

- MNI's HICP inflation breadth tracker (see chart below) shows disinflation broadly progressing in April, with the percentage of categories printing at or above 6% falling to 16.2% from 18.8% in March, and the percentage of categories printing below 2% Y/Y climbing to 43.5% vs 38.7% in March.

- Looking ahead, ECB officials are eying geopolitical risks to Eurozone inflation developments, MNI reported ('MNI SOURCES: Fed, Geopolitics, Feed ECB Caution Over Cuts', May 10). Combined with US interest rates likely remaining at their current level for longer than previously expected, the ECB rate path remains uncertain past the expected June cut.

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.