-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Fortunes Still Tied To US Yields, PHP A Stronger Underperformer In May

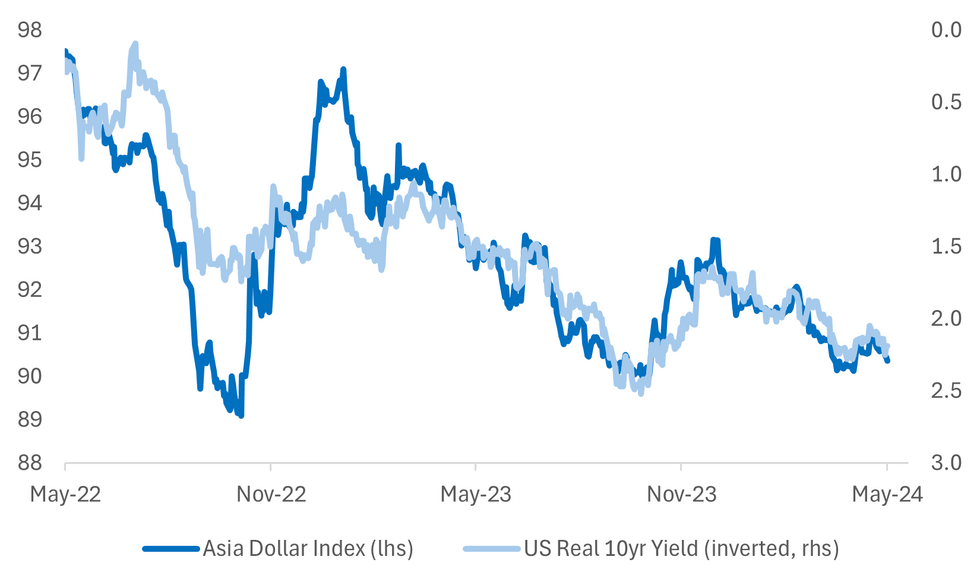

As May draws to a close, the Bloomberg Asia Dollar index looks set to finish marginally above end April levels. The first chart below plots this index against the US real 10yr yield, which is inverted on the chart. The two series, for the most part, continue to exhibit a strong inverse correlation. Highs for Asia FX this month generally coincided with the trough in US real yields.

Fig 1: Bloomberg Asia Dollar Index Versus US Real 10yr Yield (Inverted)

Source: MNI - Market News/Bloomberg

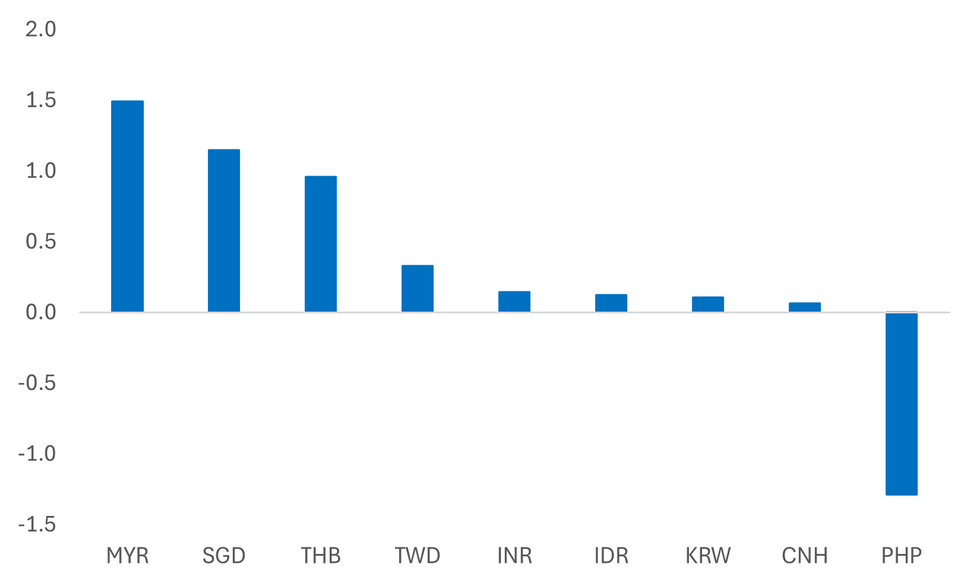

- Outside of broader US yield shifts/monetary policy expectations, we did see reasonable divergence within the region in terms of FX performance in May.

- The second chart below plots currency returns against the USD for the month. South East Asia FX outperformed, albeit with PHP FX a clear outlier on the downside. A shift towards potentially easier BSP settings in the second half has weighed. At the same time the authorities haven't set a line in the sand from a FX standpoint. USD/PHP has rallied to fresh highs above 58.50 (levels last seen in 2022).

- SGD and THB have likely benefited from G10 gains against the USD, while USD/MYR topside is likely capped to a degree, given the authorities reluctance to let the pair push through 4.8000.

- IDR has struggled amidst portfolio outflows particularly on the equity side. Offshore investors have been sellers and the local JCI index has broken lower.

- In North East Asia, CNH and KRW are close to flat. Concern remains around China capital outflows and the domestic economic backdrop, underscored by today's PMIs misses. Efforts to boost housing appear to be gaining some traction, albeit from quite depressed levels from an activity standpoint. The authorities continue to state the yuan will remain broadly stable.

- USD/KRW is back close to earlier highs from May above 1380. Weaker global equities, coupled with outflow pressures in recent weeks have been won headwinds. This has offset signs of further improvement in export growth.

Fig 1: EM Asia FX May Spot Returns By Currency

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.