May 24, 2024 14:49 GMT

Fund Flows

CREDIT MACRO

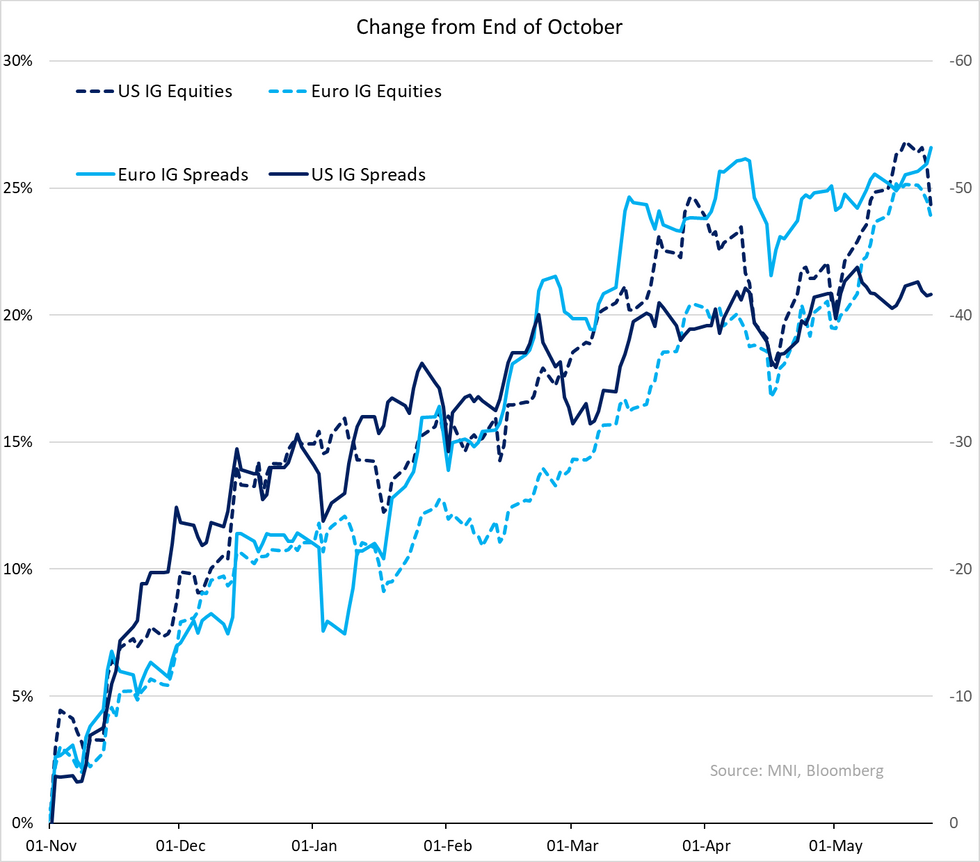

- Broad based inflows hitting everyone; €/$/£ IG & HY with particular strength in $. US led equity inflows & govvie inflows across both regions continued.

- Credit macro is dwindling in its relevance to spreads for now. UK April (real) retail sales miss this morning doing little to take rates off US PMI beats - the miss continues weak retail data for April. Some weakness in $ETF's on -$886m outflow from LQD - hard to be concerned with no signs of it being broad-based yet but also heading into a seasonal summer lull that tends to particularly acute in July/August and in €s. Add on any opportunistic pre-funding estimates (particularly in HY) that we may be in for an even larger dip with perhaps some offset in IG on a continued M&A pickup.

- Supply expectations (bbg) for next week in €/£ IG/HY incl. covered are at ~€16.5b down from ~€25b for this week (actual €28b). $IG at $15-$20b down from $20-25b this week (actual $26b). Public holidays on Monday in UK & US.

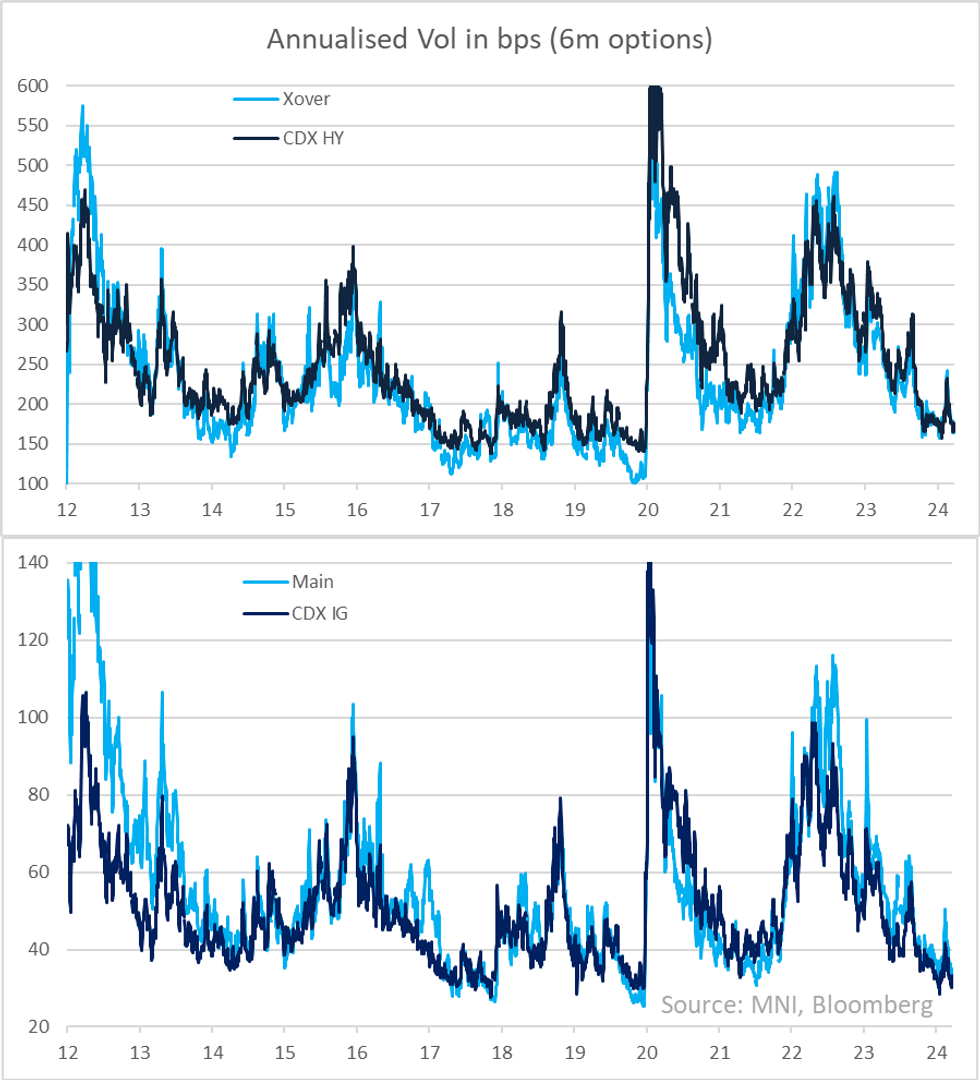

- In absence of anything interesting in macro we will leave you with below - vol in spreads are dead (well known) but so are option implied forward vols - 6m annualised in bps on CDX & iTraxx indices below.

229 words