-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

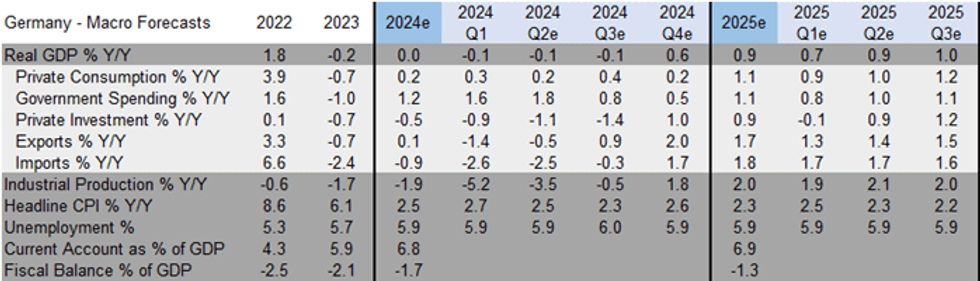

Free AccessGermany Macro Signal – August 2024: Recovery Stalls

Germany Macro Signal – August 2024: Recovery Stalls

Data released over the summer of 2024 suggest that the German economic growth momentum seen toward the beginning of the year has tapered off. A weaker external sector and structural issues have weighed on growth.

- One driver behind weaker Q2 activity was the external sector, with some of the downside risks we had previously flagged seemingly having materialized.

- Structural issues also weigh on the economy. The ruling government coalition plans to implement a set of measures intended to increase trend productivity growth, which seems to be a step in the right direction but is not expected to provide a major shift here. Fiscal headroom also remains limited amid continued realignments on budget planning.

- Employment continues to benefit from further (public) services-driven upticks. Other metrics generally point a picture of softer conditions, however. Wage gains have slowed recently, but a nascent round of centrally-bargained contract negotiations provides some upside risk.

- Headline CPI inflation came in slightly firmer than expected in July. Past disinflation in the goods categories has mostly faded. The question remains when, if at all, service price inflation stickiness starts to fade – slower wage growth provides some basis for optimism here.

- After the ECB’s largely anticipated July interest rate cut, focus turns on the pace of further policy easing. ECB governing council rhetoric points towards a quarterly pace of 25bps cuts, but market expectations have turned more dovish amid soft US labour market and inflation data.

- From a broader perspective, a rebound in German economic conditions is expected by the end of the year, but that outlook carries largely downside risks and any pickup in growth will be limited. Analyst forecasts for 2024 activity have been downgraded recently.

2024_08_German_Macro_Signal.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.