-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Global COVID-19 Tracker – September 25

by Tom Lake

COVID-19 Trends and Developments

- The Spanish government has recommended that the capital city, Madrid, is placed into a full COVID-19 lockdown due to a spike in cases in the city. Spain recorded its fourth consecutive day of 10,000+ new cases registered on September 24, taking the country's overall caseload since the start of the pandemic to over 700,000. The tighter lockdown restrictions already in place in 37 zones of the city have been expanded to 45 zones as of today.

- There remains no sign of a sustained decline in new cases recorded in the United States, with the seven-day average new case load remaining above 40,000 new cases per day for the past week. The number of fatalities due to the virus also continues to plateau rather than fall, with the seven-day average around 700-800 fatalities per day over the course of September.

- For the second day in a row the United Kingdom registered its highest single-day total of new cases on September 24, with 6,634 new cases added to the total. The record figure came on the day the country entered a period of stricter restrictions, with hospitality venues forced to close at 10pm and fines for breaking lockdown restrictions increased.

- Having so far avoided the mass-scale outbreaks recorded in many of its neighbouring countries, the Netherlands registered its highest number of new cases on September 24, with 2,544 added to the total. The country's total number of cases stands at 103k on September 24, compared to 281k in Germany, 108k in Belgium, and 511k in France.

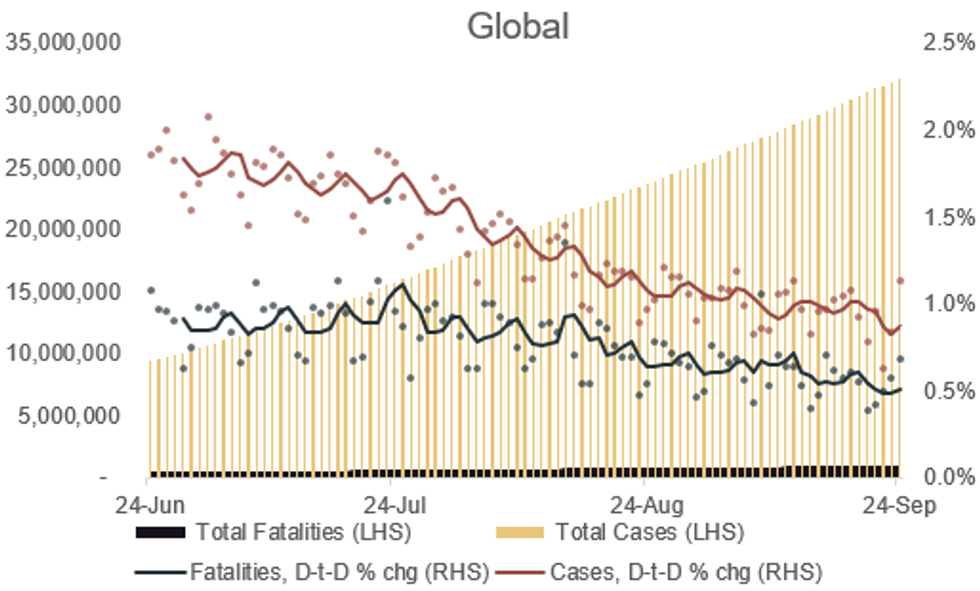

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0600BST September 25. N.b. Each dot represents a single day's figures, data for past three months

Source: JHU, MNI. As of 0600BST September 25. N.b. Each dot represents a single day's figures, data for past three months

Full article PDF attached below:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.