-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

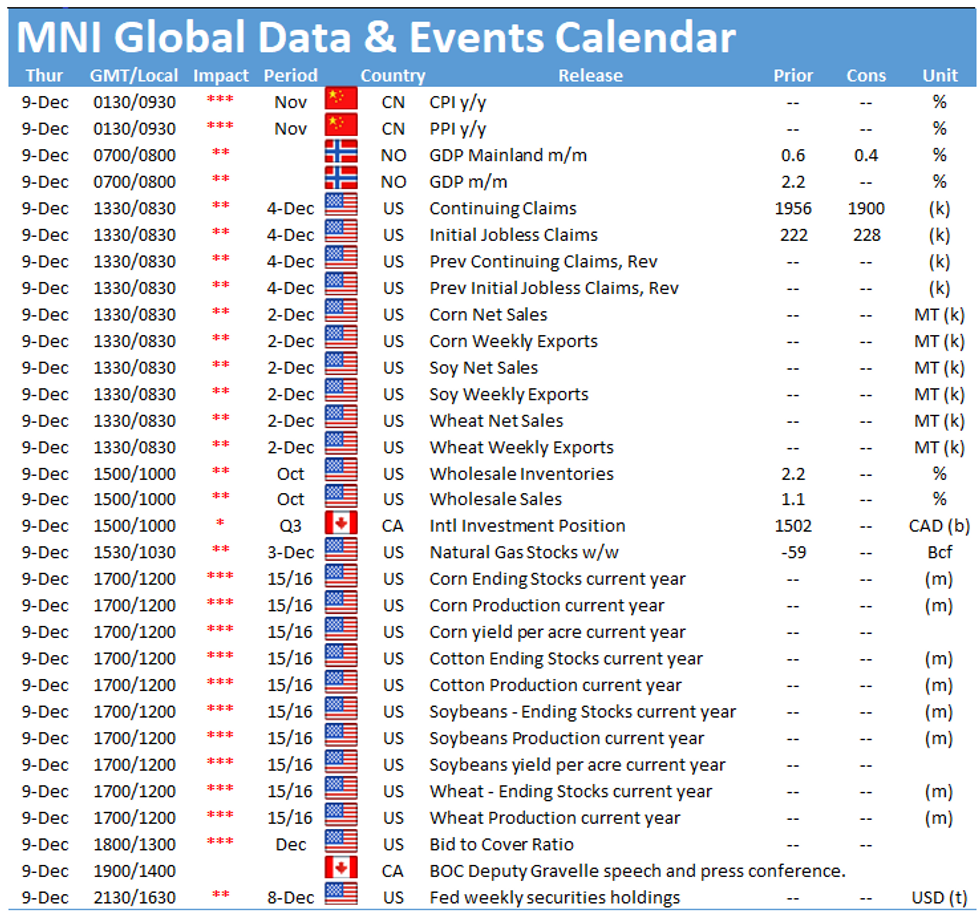

GLOBAL MORNING BRIEFING: December 9

Thursday’s data is relatively light, with key focus on Germany and the US.

Norway GDP (0700 GMT)

Norway’s mainland GDP is forecasted to slow to 0.4% m/m in October, maintaining a slight downward trend from 0.6% in September and 1.0% in August. However, the 2.6% Q3 expansion implies the economy remains strong due to high employment rates and strong service sector expansion.

Germany trade data looks a little more optimistic (0700 GMT)

Market’s will be focus early attention on German trade data Analysts predict exports to rise to 0.8% for October’s monthly reading, up from -0.7% m/m in September. This comes following slight easing of supply bottlenecks whereby the automotive and machinery industries made significant recoveries. Imports are predicted to rise too (albeit less substantially) to 0.4% m/m in October, compared to 0.1% m/m in September.

Germany’s trade balance is forecast to narrow further in October, dropping to E14.3bln surplus from E16.2bln in September. The current accounts balance is similarly projected to have fallen, with the October reading predicted to be E17.0bln for October, down from E19.6bln in September.

US labour market improving marginally (1330 GMT)

US employment continues to rebound amid nationwide labour shortages, incited by demographic shifts and higher demand for goods. Initial jobless claims for last week are set to reduce marginally to 220,000 down from 222,000 the week prior, which came following a five-year low of 194,000 in the week before. Similarly, continuing claims look likely to reduce to around 1,910,000 for the final week of November compared to the prior reading of 1,956,000.

US wholesale inventories increase (1500 GMT)

Wholesale trade sales and inventories are forecasted to come in at 1.0% and 2.2% m/m respectively for October, compared to 1.1% in and 1.4 % in September. The jump in inventories was highlighted by the Chicago Business Barometer resulting from stockpiling to buffer for supply chain disruptions.

Today we see only one policymaker speech from Bank of Canada’s Deputy Gravelle.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.