-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGlobal Morning Briefing: Eyes on BOE

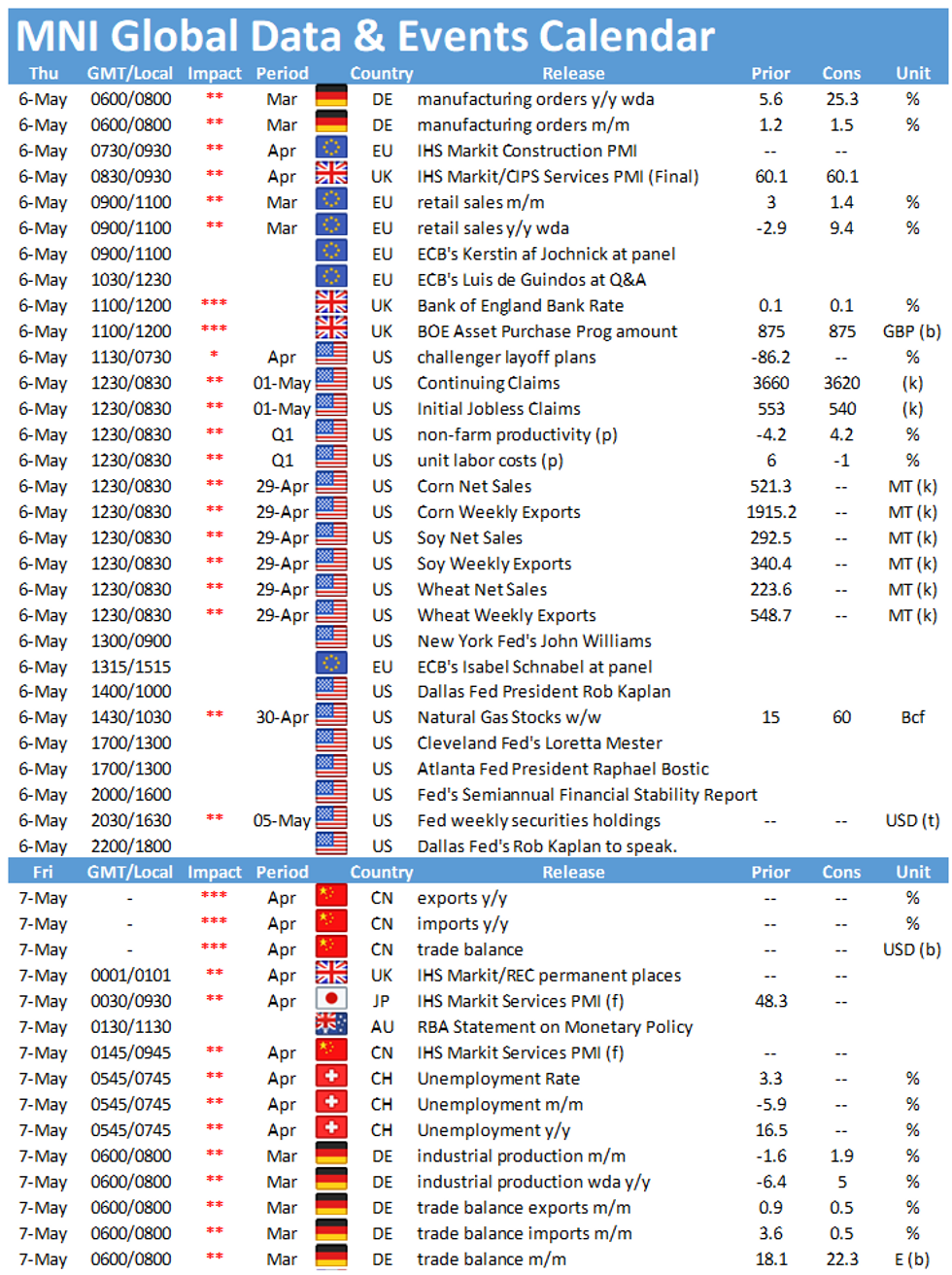

The main events in Europe on Thursday include the publication of the final services PMI for the UK at 0930BST, followed by EZ retail sales at 1000BST. At 1200BST the BOE's interest rate decision will be closely watched before the attention turns to the release of the US initial jobless claims at 1330BST.

UK Services PMI signals expansion

The final UK services PMI is expected to register in line with the flash result showing an increase to an 80-month high of 60.1 in April. The gradual easing of restrictions including the reopening of non-essential businesses and the hospitality sector bodes well with services sector activity. Even employment saw a monthly gain in April, following months of muted hiring intentions. The report also noted that firms are confident that the recovery is sustainable and firms expect output levels to rise further.

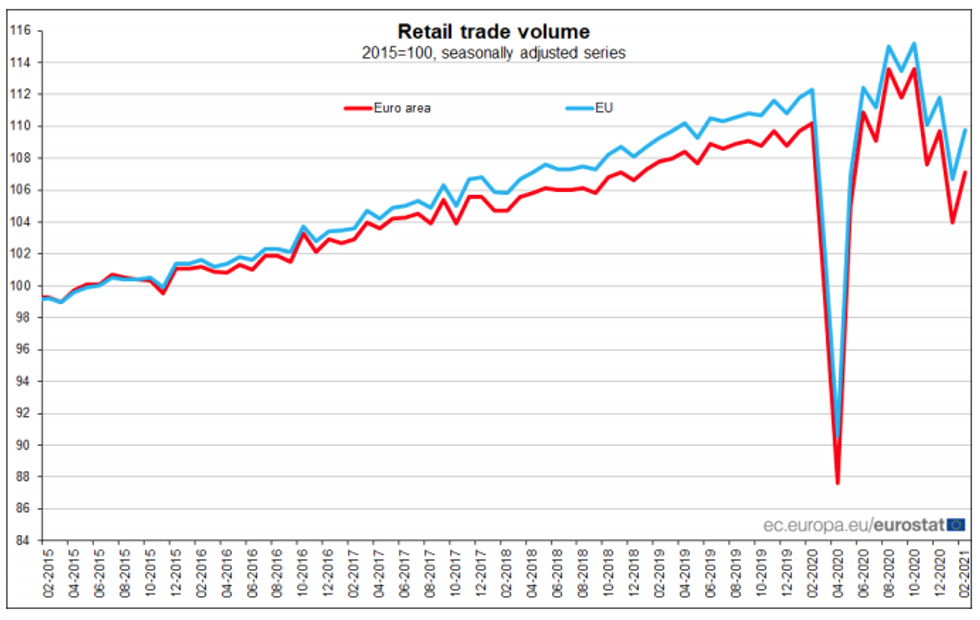

EZ retail sale seen slowing

Retail sales in the eurozone are expected to decelerate to 1.5% on a monthly basis in March, after rising by 3.0% February. February's increase was driven by a sharp rise in non-food sales and a rebound of fuel sales. This pattern is likely to persist as more non-essential businesses were able to reopen in many European countries. Annual sales are projected to rise sharply by 9.4% in March, following February's drop of 2.9%.

Already available state level data suggests an upside risk. German retail sales surprised on Monday when they rose by 7.7% in contrast to markets looking for a 3.0% uptick. Spanish sales also gained 3.5% in March.

Source: Eurostat

Bank of England seen on hold

No change is expected in rates or QE levels, staying at 0.1% and GBP895 billion. There is an outside change the BOE may outline a framework for a potential move into negative rates, which it has been tasked to have in place by August. The main thrust of the meet and the following press conference will likely be growth and inflation forecasts.

US jobless claims seen falling

U.S. jobless claims filed through May 1 are set to have fallen to 540,000 from 553,000 through April 24, according to the Bloomberg consensus. Continuing claims filed through April 24 are expected to fall to 3.64 million from 3.66 million through April 17.

March's nonfarm payroll report showed an improvement of the labour market and April's report, due Friday, is expected to show another increase in employment and a decline of unemployment. The ADP private payrolls indictor registered an increase of employment by 742k, after 517k workers had been hired in the previous month.

Thursday's events calendar throws up a busy schedule including speeches by ECB's Kerstin af Jochnick, Luis de Guindos and Isabel Schnabel as well as New York Fed's John Williams, Dallas Fed's Rob Kaplan, Atlanta Fed's Raphael Bostic and Cleveland Fed's Loretta Mester.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.