-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGlobal Morning Briefing: Ifo Index Seen Higher, BOE On Hold

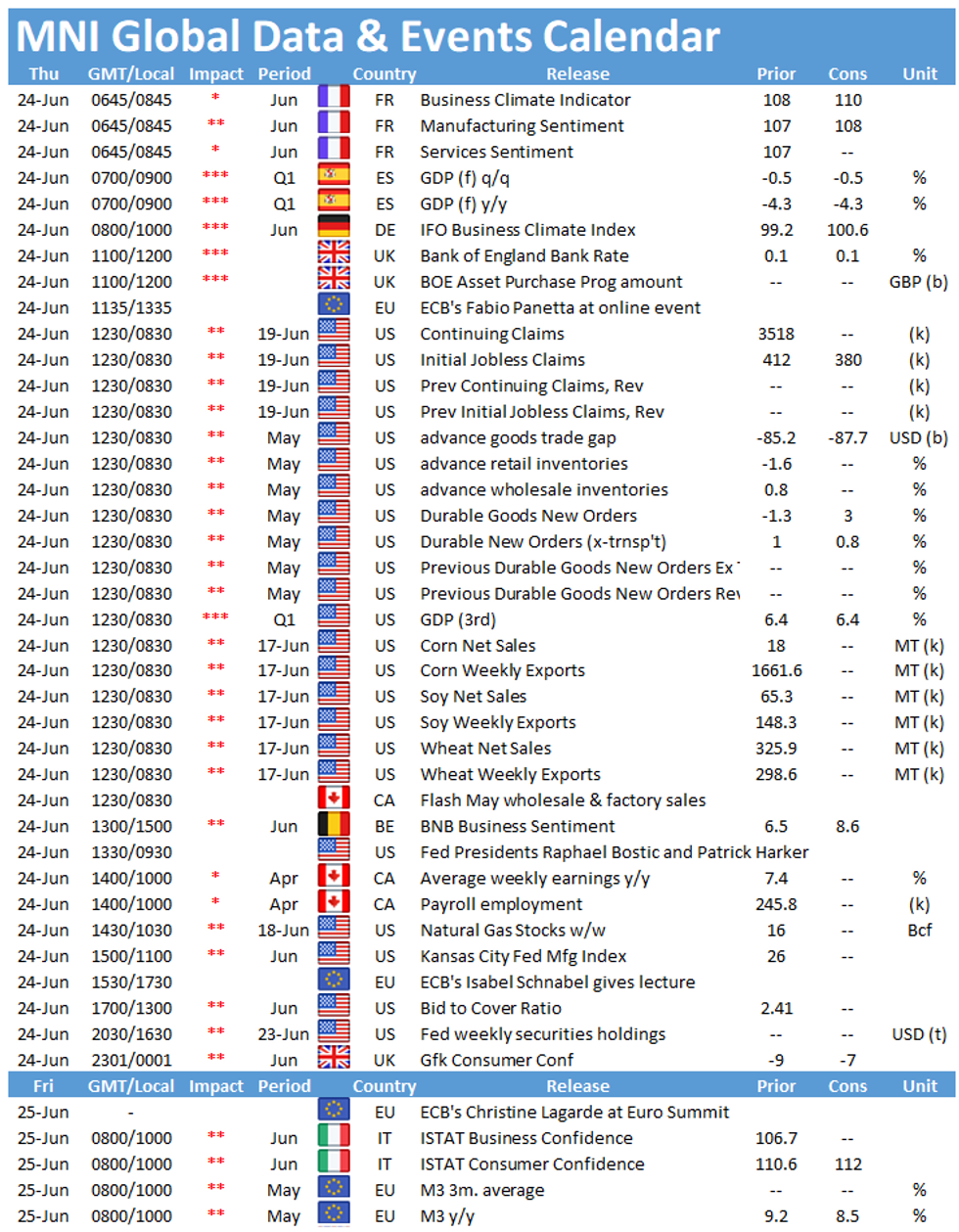

Thursday sees several data events of note, including the release of the German Ifo business climate indicator at 0900BST. At 1200BST the announcement of the BOE's interest rate decision will be closely watched by the markets. The highlight of the day in the US is the publication of durable goods orders at 1330BST.

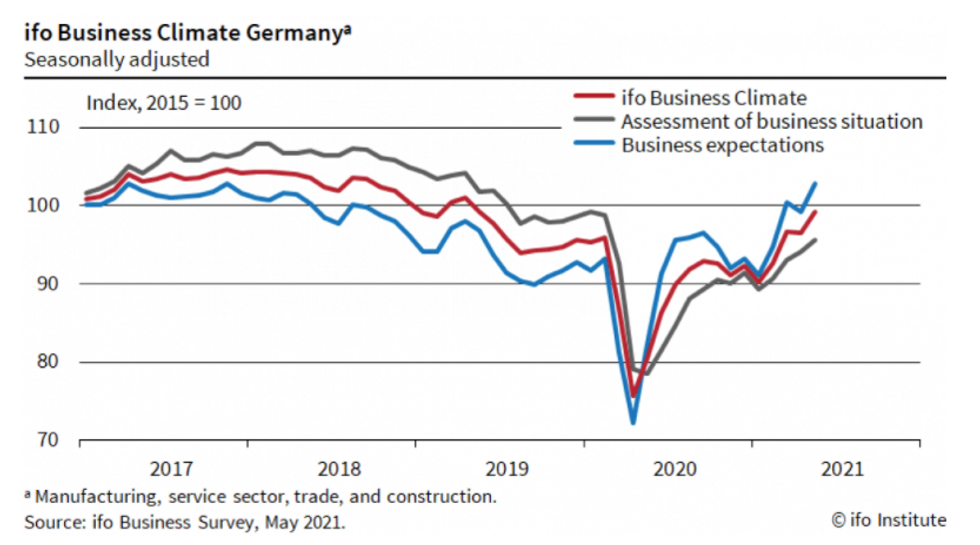

Ifo business climate seen rising further

The headline Ifo business climate indicator is forecast to rise further in June to 100.6, up from 99.2 seen in May. This would mark the fourth consecutive increase and the best reading since April 2019. Both the current assessment and expectations are expected to improve in June. In May, the current situations index improved to the highest level since the start of the pandemic and in June markets project another gain to 97.9. Expectations deteriorated in April amid a tightening of restrictions due to higher infection rates. However, as the situation has improved significantly in recent weeks, the index ticked up in May and markets expect it to rise to 103.8 in June, which would be the highest level since February 2011.

Similar survey evidence also points to an ongoing recovery of the German economy. The flash composite PMI recorded an increase as well in June, while the recently released ZEW expectations index eased slightly, although from a very high level. On the other hand, the ZEW current situations index jumped to the highest level since the start of the pandemic.

Source: Ifo Insitute

BOE interest rate and QE seen unchanged

Focus will be on how the MPC balances higher-than-expected inflation with a delay to the economic re-opening, with rates likely held at 0.1% and the total QE target maintained at GBP895 billion.

Andy Haldane, the BOE's Chief Economist, is again expected to vote for a reduction in the total QE the bank intends to complete by year-end. Haldane leaves his position shortly after the June meeting. A hawkish surprise could come if a second MPC member voted alongside Haldane, although there have been no public signals that any of the other eight members are peeling off from the collective view.

US durable goods orders expected to rise

New orders of durable goods likely recovered in May after dipping in April, according to Bloomberg, forecasting an increase of 3%. Excluding orders of transportation equipment, orders should increase 0.8% following a 1% gain in April.

Survey evidence is in line with market forecasts. May's IHS manufacturing PMI surged as new orders were rising at a record pace. The ISM manufacturing and services PMI both reported an increase in new business in May as well.

The events calendar throws up a busy schedule on Thursday. The main speakers to follow include ECB's Fabio Panetta and Isabel Schnabel as well as Richmond Fed's Tom Barkin, Fed's Raphael Bostic, New York Fed's John Williams and Dallas Fed's Rob Kaplan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.