-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

GLOBAL MORNING BRIEFING: PMIs Eyed

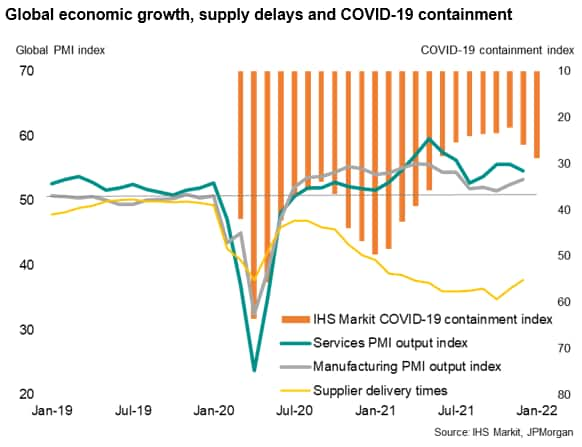

The week kicks off with service and manufacturing flash PMIs. These preliminary estimates will be key indicators in identifying the extent of disruptions caused by the omicron covid wave.

Business confidence remains strong across the regions, with all readings looking for continued expansion with the exemption of German services. Common themes of supply chain disruptions and rising covid cases hampering production persist.

France (0815 GMT)

French PMI readings are seen weakening compared to December as cost inflation remained high and demand weakened on the back of a dip in foreign demand. Services are expected to step down to 55.5 in January from 57.0 last month and manufacturing is predicted to moderate to 55.0 for January from 55.6 with input goods and raw material shortages dampening output.

Germany (0830 GMT)

German manufacturing is projected to moderate slightly in January to 57.2 from 57.4 in December, dipping to a 12-month low. Although above the breakeven point of 50, this reading represents a substantial slide from booming spring/summer of 2021 largely due to continued supply bottlenecks, with automotives particularly hampered by raw inputs and semiconductor shortages. Full order books in the December reading were a driving force of firms’ outlooks which remain optimistic.

The German services PMI is set to slide to 48.0 from 48.7 in the flash reading for January, implying a contraction of service activity due to tight restrictions for unvaccinated and a drop in demand due to surging covid cases. Input and output prices hit historic highs in the month prior, as the German economy grapples with a 30-year high inflation.

Eurozone (0900 GMT)

Manufacturing for the Eurozone aggregate is predicted to weaken slightly in January to 57.8, down from the 10-month low of 58.0 in December as consumer goods production weakened, albeit input and output cost inflation easing.

The services PMI is seen dampening to 52.2 in January from 53.1 in December due to the jump in covid cases.

UK (0930 GMT)

UK services represent the only improvement in PMIs in today’s data, seen strengthening to 54.3 for January from 53.6 in December, where surging omicron cases led to a drop in customer-facing service demand and staff absentees.

UK manufacturing is projected to weaken to 57.5 from 57.9 on the back of continued Brexit issues, rising covid cases which led to uncertainties surrounding restrictions and continued supply chain issues. Input and output costs hit a record high last month.

US (1445 GMT)

The flash reading for US services is projected to drop 1.1 points to 56.8 for January likely due to surging wages and input prices.

Manufacturing is expected to moderate to 56.8 in January from 57.7 in December. Output expectations remain strong in the US reaching a 2021 high in December as firms as high inflation rates began to soften, however labour shortages due to the duality of a tight labour market and surging covid cases are likely to have played a substantial role in today’s estimate.

There are no are no key policymaker appearances on the schedule for Monday

The latest data forecasts can be found here.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.