-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGov't Faces Damaging By-Elections As Technical Recession Declared

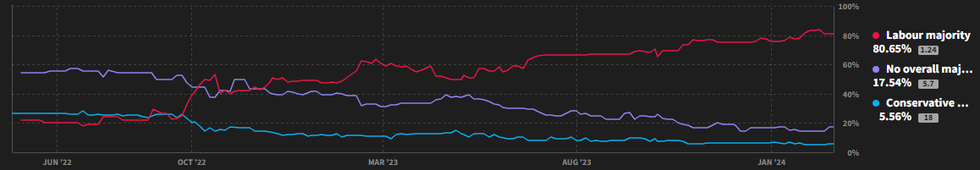

Two parliamentary by-elections take place today. While these sort of elections would not usually garner market focus, the fact that it is an election year and the votes come on the day that ONS figures show the UK has entered a technical recession gives the by-elections some added interest.

- The constituencies of Kingswood and Wellingborough were both held by Conservative members of parliament, with Kingswood MP Chris Skidmore resigning in opposition to legislation to offer new oil and gas drilling licences in the North Sea, while Wellingborough MP Peter Bone was removed by a recall petition having been suspended from the House of Commons due to inappropriate conduct.

- Kingswood in southwest England has been Conservative since 2010 and was held with a 11k majority in 2019, while Wellingborough in the Midlands has been Conservative since 2005 and was held with a 18.5k majority in 2019. Despite these sizeable majorities, both seats are expected to be won by the main opposition centre-left Labour Party. Results in Wellingborough ~0400GMT, and in Kingswood from 0200-0500GMT on Friday.

- Compounding the issue for the Conservatives are the figures from the ONS showing the economy shrinking 0.3% in Q423, confirming a technical recession after another decline in Q323. PM Rishi Sunak has put significant political capital into his 'five pledges', one of which was 'growing the economy'. With today's figures this pledge becomes more difficult to achieve, dealing the Conservatives a blow ahead of the election expected in Q424.

Source: Smarkets

Source: Smarkets

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.