-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

History Suggests CNH May Struggle To Benefit From Wide PMI Gap With The US

USD/CNH hasn't seen much follow on the downside today post the US ISM miss from Monday's session, which weighed on the dollar and US yields during NY trade. US yields have firmed modestly during the first part of Tuesday trade in Asia Pac, which has aided dollar sentiment.

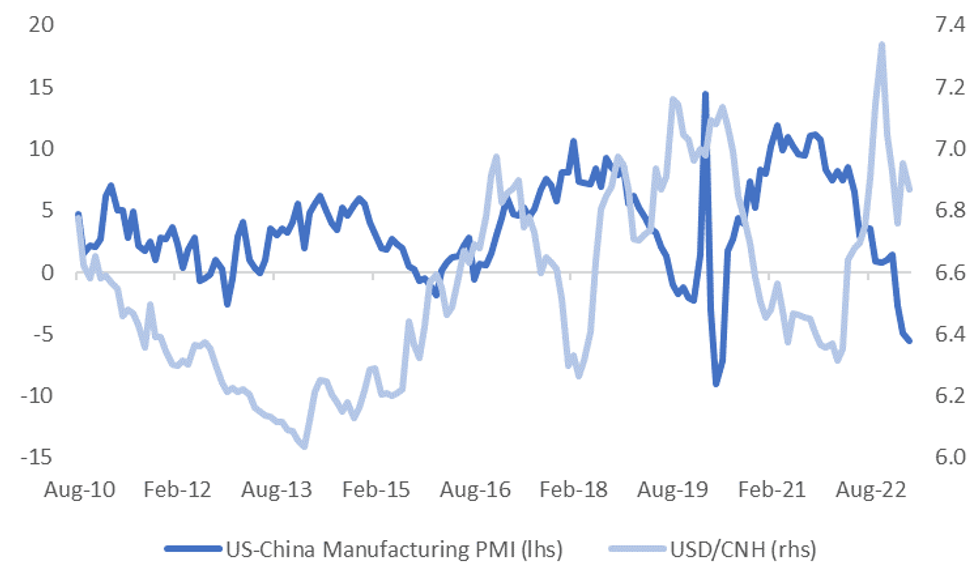

- More broadly though USD/CNH tends to have an inverse relationship with the US-China PMI differential. The chart below plots USD/CNH against this differential (for manufacturing PMIs, the official one for China versus ISM for the US).

- That is, periods where the US ISM is sharply lower than the China manufacturing PMI don't often coincide with weaker USD/CNH levels. Indeed, the correlation between the two series is -70% for the past 5 years. This comes down a bit when we look at service PMI differentials, but only to -40%.

- One factor may be what happens to China export growth when the US ISM falls sharply. Such episodes may leave the China authorities reluctant see local FX appreciation.

Fig 1: USD/CNH Versus US ISM - China Manufacturing PMI

Source: MNI - Market News/Bloomberg

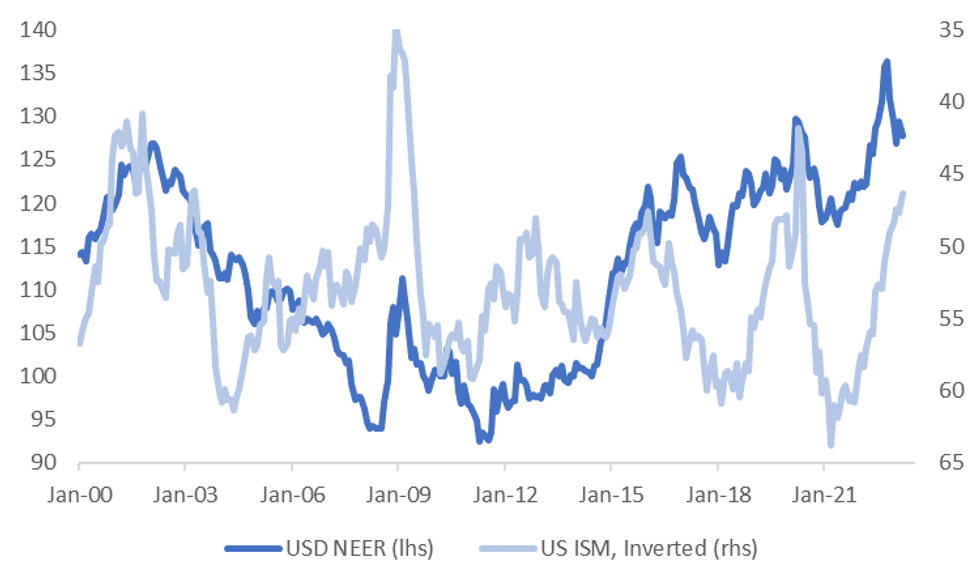

- The USD may also benefit from flight to safety flows during ISM slumps, which often coincide with US recessions. The second chart below plots the USD NEER (J.P. Morgan Index) against the US ISM level, which is inverted on the chart.

- Other factors in the context of the current cycle are lingering fears of higher inflation still driving Fed support for the USD in the near term.

- The China authorities have also been highlighting the weaker external backdrop in recent months, so again may be reluctant to encourage FX strength. Indeed, the CNY NEER has slipped to the bottom end of its recent range for 2023 over the past few weeks.

- The final point would be around scope for a further easing in monetary policy settings in China, which could be to aid the recovery, but all else equal, may act as a FX headwind.

Fig 2: USD NEER And US ISM (Inverted)

Source: J.P. Morgan/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.