-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI NBP Preview - April 2024: Staying Cautious

Executive Summary:

- The NBP is widely expected to keep interest rates unchanged again.

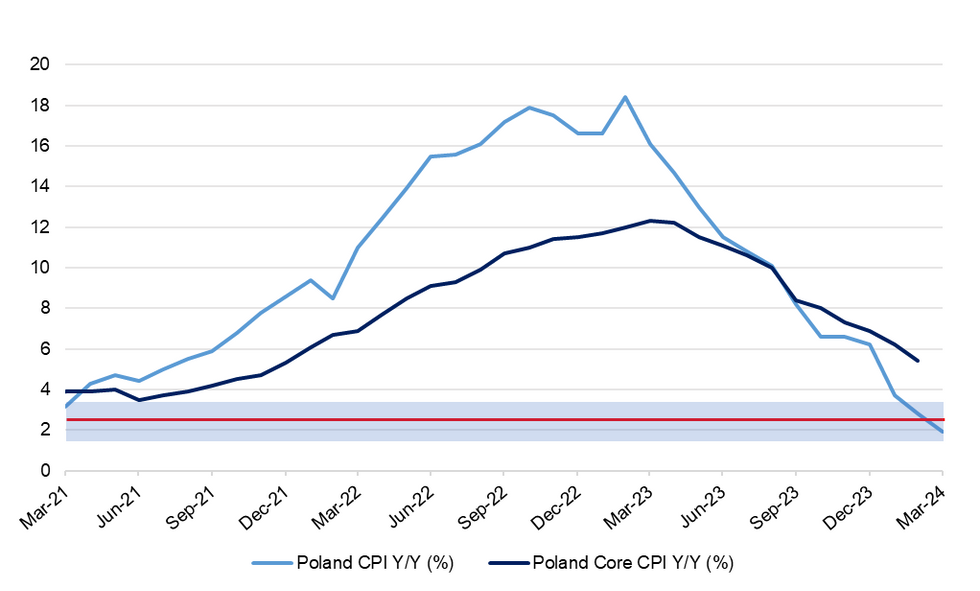

- Headline inflation dipped below the +2.5% Y/Y target but upside risks remain.

- Recent communications signalled the cautious approach of most MPC members.

Full preview including a summary of sell-side views here:

MNI NBP Preview - April 2024.pdf

The National Bank of Poland (NBP) will most likely keep interest rates stable this week, striking familiar cautious notes in the statement and during the subsequent press conference with Governor Adam Glapiński. Although headline inflation dipped below the NBP’s point-target of +2.5% Y/Y in March, the central bank has been warning for several months that CPI will accelerate going forward. Official rhetoric has also emphasised that the uncertainty around the government’s decisions concerning anti-inflation shields warrant keeping interest rates on hold and maintaining a vigilant approach. Recent communications from several Monetary Policy Committee (MPC) members suggest that the prevalent view within the panel remains that interest rates will most likely stay on hold in the coming months, possibly through the rest of this year.

Figure 1. Poland CPI and core CPI inflation. The red line represents the NBP’s official +2.5% Y/Y target, while the shaded region represents the +/- 1pp tolerance band around the point-target.

Figure 1. Poland CPI and core CPI inflation. The red line represents the NBP’s official +2.5% Y/Y target, while the shaded region represents the +/- 1pp tolerance band around the point-target.

Governor Glapiński’s press conference on Friday will be closely watched for any updates to the inflation outlook included in the macroeconomic projection released last month. If NBP staff fed the latest inflation print and some of the government’s administrative decisions into their model, the Governor could theoretically offer some more detailed discussion of the expected inflation path. In any case, we expect him to deploy cautious rhetoric, placing much emphasis on upside risks to inflation and extant underlying price pressures. He may also touch upon the motion to put him on trial before the Tribunal of State, which has been formally tabled in parliament and awaits clearance from the Speaker. If it gets a green light, the first step will be a series of hearings before a special parliamentary committee, which will decide whether to refer the case to the Tribunal.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.