-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessHong Kong Equities Higher With Tech Outperforming

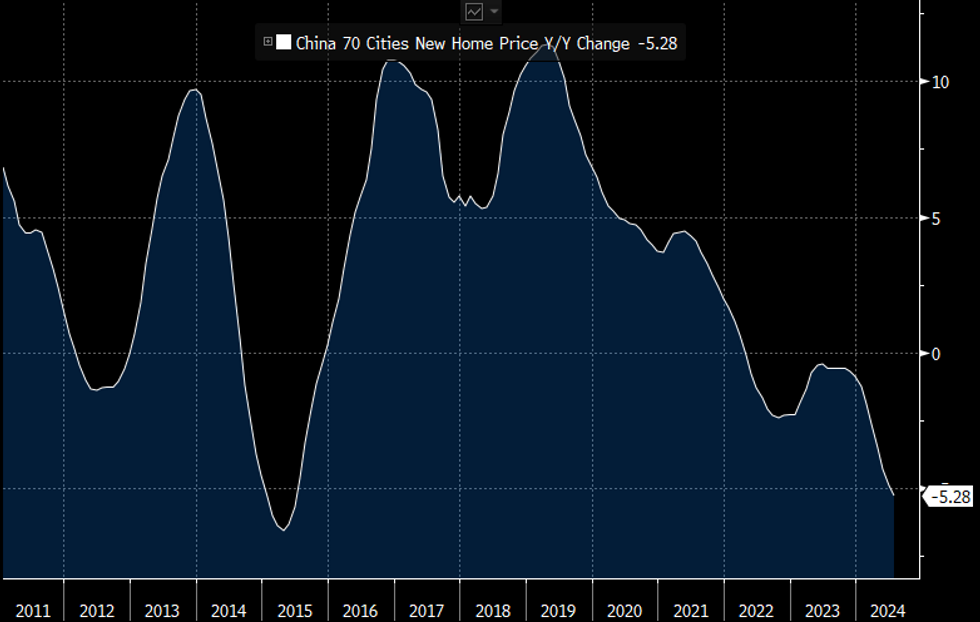

Chinese and Hong Kong markets saw mixed reactions as investors digested weak housing data out of China's after home prices in July plunged the most since 2015, with residential property sale values dropping significantly below their four-year average. Despite these downturns, the PBoC indicated no immediate rush for large-scale economic stimulus, emphasizing a strategy of "policy patience and stability." Hong Kong's HSI started strong on Friday, buoyed by gains in tech stocks like Alibaba, which surged despite reporting a nearly 30% dip in quarterly profits.

- Hong Kong markets are outperforming today with the HSI up 1.70% with tech stocks leading the way (HSTech up 2.15%), property indices have underperformed with (Mainland unch, HS Property -0.37%). China onshore equities are little changed with CSI 300 up 0.04%, small-caps are mixed with the CSI 1000 down 0.30%, while the CSI 2000 is up 0.22%.

- China's central bank chief, Pan Gongsheng, pledged further measures to support the country's economic recovery but emphasized avoiding drastic policy changes. He highlighted the importance of maintaining price stability amid deflationary risks and indicated a gradual shift towards using interest rates over quantitative targets as key monetary tools. Pan also reaffirmed the PBOC's commitment to a supportive monetary policy while acknowledging the relative stability of China's financial system, as per BBG

- China's new home prices in July saw their largest y/y decline since 2015, deepening the bear market for homebuilder stocks.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.