-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

How To Communicate That A Hold Isn't A Final Hike (2/2)

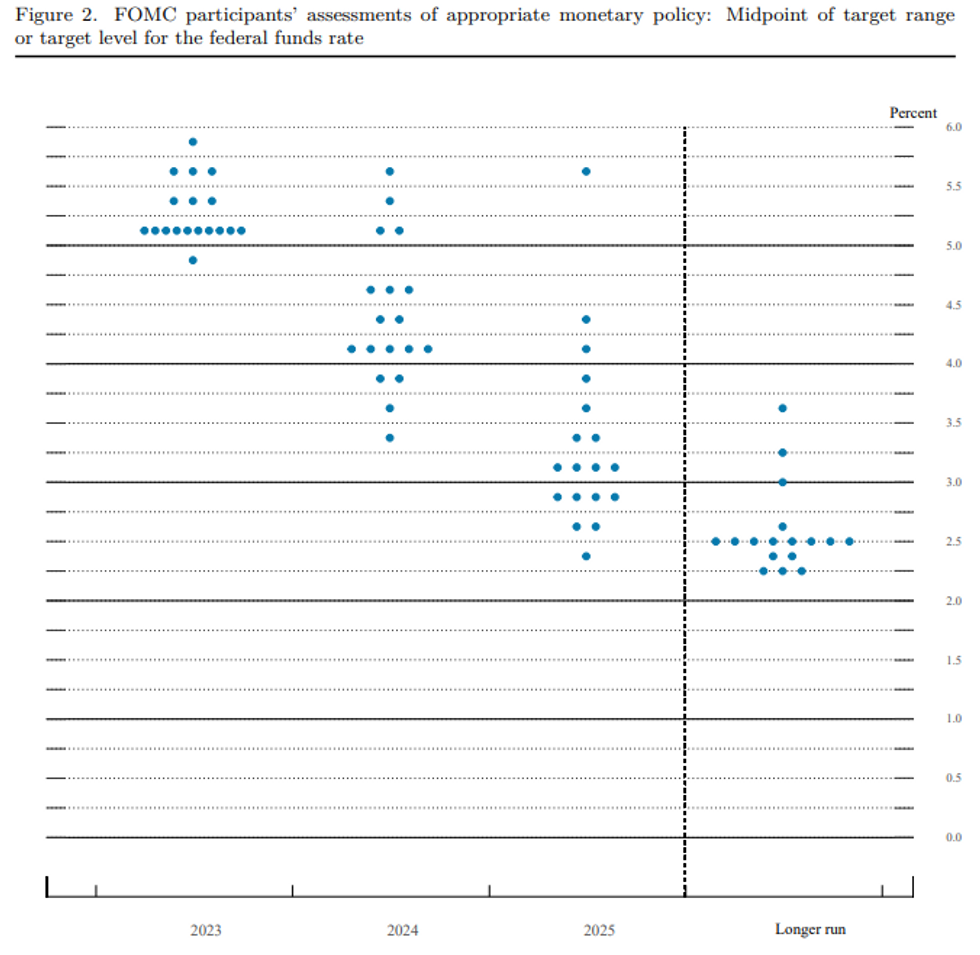

With a sizeable divide on a hike vs hold likely, the June FOMC meeting will be about keeping rates steady but communicating that the Fed isn't necessarily done hiking yet.

- The "skip" approach that appears to have gained ground this week is a compromise underlining that the burden of evidence has - since the May meeting - shifted to those who see further tightening as necessary. Those on the FOMC who see the job as done will expect to see further evidence to that effect over the subsequent six weeks. But they can be persuaded. Likewise, the doves expect their approach to be vindicated by further disinflation progress.

- Indeed, the two main choices at June's meeting is whether to 1) hold rates while retaining a hiking bias into July or 2) hike 25bp with less of a hiking bias.

- The main reason to galvanize communications around a bias of future hiking is not just to placate the hawks, but to ensure that expectations of a cut don't increase with any hint that the next move is implicitly seen by the FOMC to be downward. The Statement will reflect this caution, probably by maintaining the current language intact ("In determining the extent to which additional policy firming may be appropriate...") And Powell will keep the door clearly open to a July hike pending the data.

- It's less clear whether we end up with a higher median 2023 end-year rate Dot in the June SEP which would even more clearly signal a hiking bias. A 25bp hike in June would mechanically force a 25bp shift higher to 5.4% from 5.1% (where it has been for the last 2 updates), but apart from that, the numbers on the Committee make it tricky to see a shift higher.

- The last SEP in March showed 7 dots above the 5.1% that was eventually reached in May. A solid 10 of 18 were right at 5.1% (1 at 4.75-5.00% suggested someone thought March's would be the last hike). Recall that these projections were made in the midst of the banking crisis, and when a hold was considered. Even with this backdrop, there was some analyst expectation that the median would rise to 5.4%.

- June's SEP could well see a final rise to 5.4%: the most hawkish 7 of the 18 will remain above 5.1%, and they need to be joined by 2 others to move the dot higher (by 1/8 percentage point to 5.25%, splitting 5.125 and 5.375). 8 of them could be Mester, Bullard, Kashkari, Logan, Bowman, Waller, Barkin, and the KC Fed stand-in.

- Getting to 9 let alone 10 will probably be dependent on inflationary data the next couple of weeks including today's payrolls and the June 13 CPI reading.

- In this way we could see the data influencing a hawkish message delivered through the Dots signaling a lean toward a July hike, but not necessarily a hike itself.

Source: Federal Reserve March Summary of Economic Projections

Source: Federal Reserve March Summary of Economic Projections

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.