-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

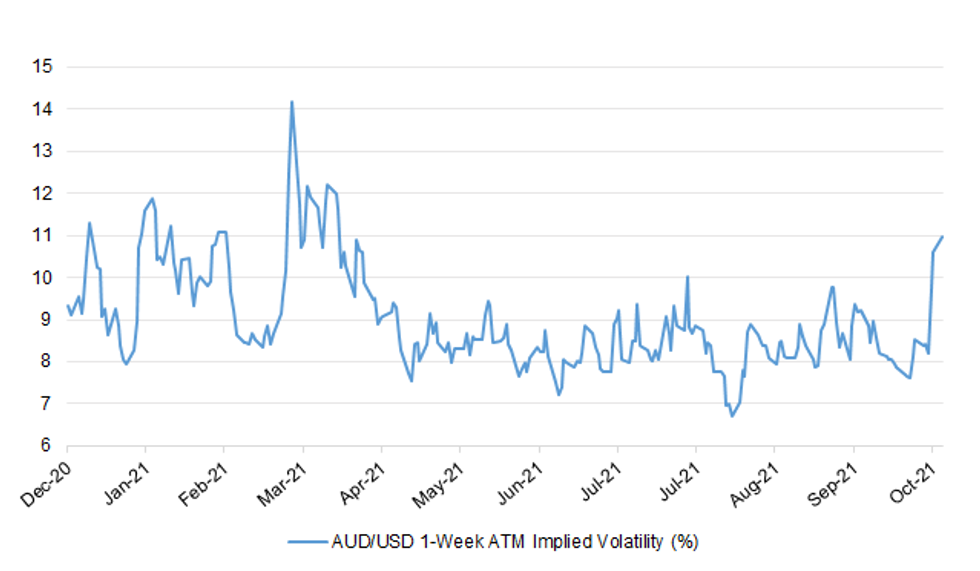

Implied Vols Elevated Ahead Of RBA Decision

AUD/USD has meandered in early Sydney trade with participants in the waiting mode ahead of the imminent RBA meeting. China's softer than expected official PMI data published left the AUD unfazed, as did local releases, but AUD/USD has edged lower over the last half an hour or so.

- The RBA will deliver their monetary policy decision on Tuesday. Reminder that consensus now looks for the Bank to drop its YCT mechanism at tomorrow's decision, after they have consistently refrained from defending their yield target via ACGB Apr '24 purchases in recent days.

- Worth taking a look at the options space, as AUD/USD implied volatilities keep rising across the curve. The overnight tenor has surged to 15.43% this morning, its highest point since Sep 22, as participants await the RBA's decision. Implied 1-week vol has extended gains to 10.99%, its best level since Mar 26.

- On the data front, ANZ job ads grew 6.2% M/M last month after a 2.8% decline in Sep, as Sydney, Melbourne and Canberra emerged from their respective lockdowns. The final reading of Markit M'fing PMI was revised higher to 58.2 from 57.3.

- Notable local releases due later this week include building permits (Wednesday), trade balance (Thursday) and RBA SoMP (Friday). The Reserve Bank's Dep Gov Debelle will participate in a panel discussion tomorrow.

- Spot AUD/USD last trades -10 pips at $0.7508 and bears would be pleased by a continued sell-off past Oct 22 low of $0.7454 towards Oct 8 low of $0.7288. Bulls need a breach of the 50% retracement of the Feb-Aug slide, which coincides with the 200-DMA at $0.7557. Above there opens Jul 6 high of $0.7599.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.