-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

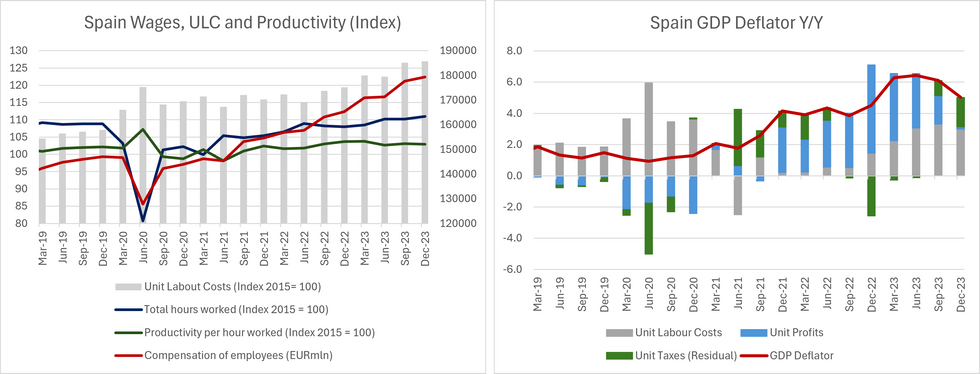

Free AccessIncrease In Q4 '23 Unit Labour Costs Absorbed By Lower Unit Profits

The preliminary Q4 '23 national accounts data from Spain showed unit labour costs rising 6.3% Y/Y (down from 6.9% in Q3). However, unit labour costs (ULCs) still rose +0.4% Q/Q (index 2015 = 100, calculated using SWDA data from Eurostat). The sequential acceleration came as total compensation (+1.0% Q/Q) rose at a faster rate than hours worked (+0.7% Q/Q) and productivity per hour worked (-0.1% Q/Q).

- The extent to which ULC increases across the Eurozone are passed onto end-consumers in the form of higher prices is a key concern for the ECB. This pass-on can be proxied by the development of unit profits. If unit profits grow at least as fast as unit labour costs, it may be indicative of wage pressures having an inflationary impact. This is particularly relevant for services, where wage costs form a higher proportion of total costs.

- Evidence from Spain however, is encouraging: MNI's calculations indicate that the GDP deflator rose by 5.0% Y/Y in Q4 '23 (from 6.1% in Q3). Of this, ULC contributed 3pp and unit profits (calculated as gross operating surplus and mixed income divided by GDP in 2015 volume terms) contributed just 0.2pp. The remainder is treated as a residual, comprising of unit taxes net of subsidies and any remaining difference with the deflator.

- Summing up, the Q4 accounts data suggests that Spanish services inflation can continue to disinflate in the coming months. However, we still think current ULC levels are incompatible with the 2% inflation target and there remains a risk that unit profits may stall at current levels. Further evidence will still be required in the Q1 '24 accounts.

- We will be watchful of Eurozone-wide trends when the full national accounts data is released to gauge the wider implications for the ECB.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.