-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessInternational Distribution Services (IDSLN; NR/BBB Neg/NR) FY24 Results (ending March)

- After a 1-day delay FY24 results came on the close Friday. Revenue at £12.7b and adj. operating profit at loss of £28m (guidance was for breakeven, c-£14m). Its still reporting adj. EBITDA at £574m. In-trading cash flow at -£73 on Capex running at -£380m & WC of -£167m.

- Net debt rose to £1.7b from £1.5b last year; £1.4b of that in operating leases, another £1.4b in bonds & net of £1.1b in cash & eqv's. Total liquidity it says around £2.1b including a €925m undrawn bank facility. Its reiterated has already refi'd the July line coming due (€364.5m outstanding) on Sept. deal last year.

- Dividend of 2p/share (~£20m) & special cash dividend of £8p/share (£80m) on completion of transaction with EP group. That is up from no dividend last year but still down from £20p/share final (+20c/share special) 2 years ago (totalled £366m).

- BS policy unch at IG rating target. Credit metrics in downgrade territory already. EBITDA is flat since S&P's last look, gross & net debt levels higher pushing leverage lower and a (small) dividend restart all point to downgrade as likely. If so it would help HY rating chances post EP acquisition.

- Re. the revised EP offer at £370p/share; "The Board is minded to recommend the revised offer of 370 pence to IDS shareholders, should an offer be made at that level, subject to satisfactory resolution of the final terms and arrangements. However, there can be no certainty that any offer will be made."

- It goes on to note that the bonds (£1.45b) and bank syndicate loan facility (£925m) contain CoC provisions - the latter it sees potential for withdrawal and former (as we've noted) on the case of downgrade into HY gives a put option at par for holders.

- IDS pressor 2 weeks ago on the revised deal said "the Board is seeking assurances from EP Group to maintain an investment grade rating profile of IDS.". Wording today seems a tad more vague with it adding "the Directors have concluded that it is beyond their control to dictate or confirm the actions of the EP Group if they were to acquire the Group.

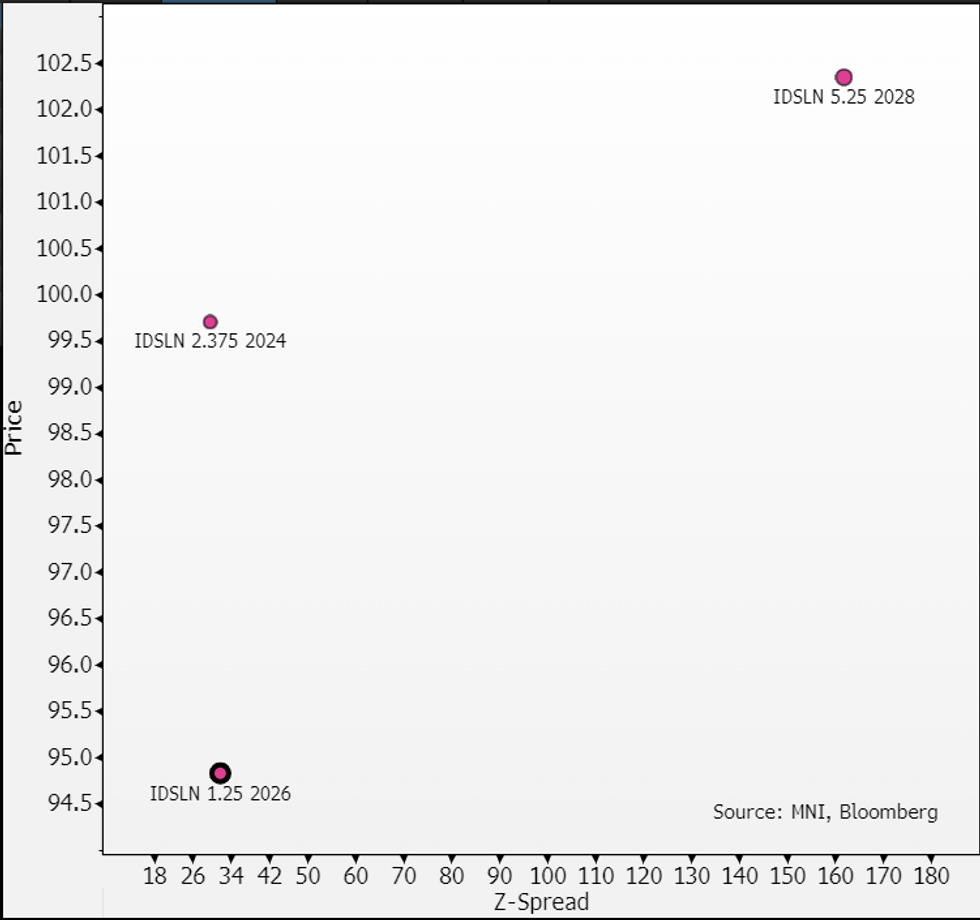

- Focus for us is on the 26s that are at €94.8 still (longer €28s and £30s 2pts+ above par). Note if it is already in HY (looks unlikely) before the deal is announced, it will only require a one notch downgrade. Time for downgrade to happen is from the date of CoC announcement (can include announcement for potential of a upcoming CoC) to +120 days after the actual CoC.

- FT reports EP group will have till end of tomorrow to firm up the offer under UK rules. Reminder IDS rejected the initial offer in April at £320p/share - 26s rallied in 45bps/+1pts then & have held onto gains since. We see about -1pt downside if par call fails and it remains IG rated (i.e. reversion to FV) +5.2pts on par put.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.