-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Soft NFP Report Should Cement December Cut

MNI China Daily Summary: Friday, December 6

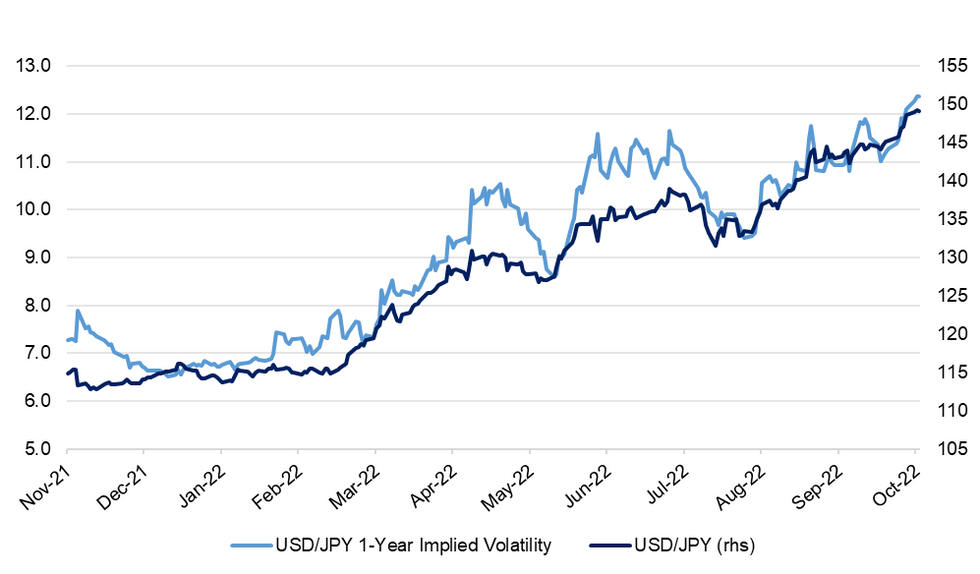

Intervention Talk In Full Swing With Y150 In Sight

USD/JPY kept advancing towards the Y150.00 threshold as participants were keen to test the MoF's intervention strategy, as top officials reaffirmed their well-documented policy stance in parliament. Price action was volatile, with the pair staging a 110-pip pullback after lodging fresh 32-year highs in the London morning. It quickly found poise and resumed gains, climbing to a new multi-decade high of Y149.38 post-WMR fix.

- Daily gyrations in relative yields took a back seat, as spot USD/JPY got no reprieve from marginal narrowing in U.S./Japan spreads. The gap in yields on 2-year debt shrank 1.1bp, while 10-year differential tightened by 0.5bp.

- One-year implied volatility refreshed its best levels since March 2020, while its spread with one-month volatility rose to new monthly highs.

- FinMin Suzuki doubled down on intervention rhetoric this morning, vowing to increase the frequency of FX markets monitoring. Yesterday's bout of abnormal volatility served as a reminder that stealth interventions remain an option.

- Spot USD/JPY last seen -10 pips at Y149.16. Technically, trendline resistance drawn off Apr 28 high intersects at Y149.60, providing a tentative layer of resistance ahead of the psychological Y150.00 level. Bears look for a retreat towards Oct 5 low of Y143.53.

- BoJ Gov Kuroda will appear in parliament today, while Policy Board member Adachi will speak at a meeting with local leaders in Toyama later today.

Fig. 1: USD/JPY 1-Year Implied Volatility vs. USD/JPY

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.