-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

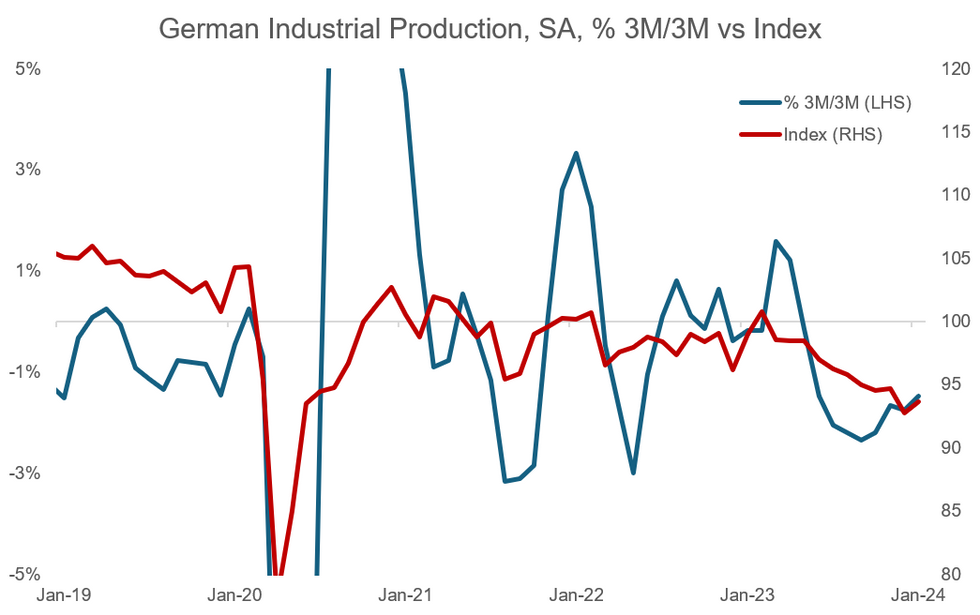

Free AccessIP Y/Y Growth Seen Negative Until Q4; 3M/3M Measure Uptick In Feb

German industrial production exceeded expectations in January on the monthly measure at +1.0% M/M (vs +0.6% cons; -2.0% prior, revised from -1.6%) but is still cleraly in negative terrirory on a yearly comparison at -5.5% Y/Y (vs -4.8% cons; -3.5% prior, revised from -3.0%).

- Cagetory weightings were updated. Particularly, the manufacturing industry weighting decreased by -4.6pp to 75.2%, which was made up for by increases in the weighting of the energy supply and construction industries (+1.9pp to 7.2% and +3.0pp to 17.1%, respectively). Within manufacturing, car (and car parts) manufacturing saw the strongest decrease, by -2.0pp to 12.2%.The reweighting likely allowed for the simultaneous miss on the yearly measure and beat on the monthly measure.

- On total production, the less volatile 3M/3M measure ticked up in January, coming in at -1.5% Y/Y, the highest since May 2023, but still printed in negative territory for the 9th consecutive month.

- Interestingly, energy intensive industries were a strong upside driver at +2.8% M/M (vs -4.1% prior), the highest increase since January 2023. On a longer-term view, the sector is still in a very weak condition, however, with the 3M/3M measure below 0 for the 23rd consecutive month.

- Looking at individual components of production excluding the energy and construction industries, intermediate goods production increased by +4.4% M/M (vs -5.0% prior), its highest increase since January 2023. Investment goods production decreased by -2.1% M/M (vs -1.3% prior), durable goods came in at +1.7% (vs -1.1% prior), non-durable goods at +4.7% M/M (vs -0.3% prior), consumption goods at +4.0% M/M (vs -0.4% prior).

- A split across industries showed a mixed picture in January. Production in the construction industry inclined by +2.7% M/M (vs -3.1% prior), both the chemical and food industry also saw positive developments, at +4.7% M/M and +5.9% M/M, respectively. Vehicle production was very weak, however, coming in at -7.3% M/M (vs -2.5% prior), the lowest monthy rate since March 2022.

- Looking ahead, there are little signs of a speedy recovery in German industrial production. The manufacturing PMI has ended its 6-month uptrend in February (42.5 vs 45.5 Jan) and the government's plans on fiscal measures to combat the ongoing weakness are expected to only provide limited impact.

- MNI's proprietary conensus estimate for industrial production, consisting of analysts from large sellside institutions, was revised downwards during the last month by an average of -0.4pp for each quarter in 2024, and currently sees growth negative on the yearly rate until Q3'24 (currently at -5.2% Y/Y Q1, -3.4% Q2, -0.3% Q3, +1.9% Q4).

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.