-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY716.5 Bln via OMO Wednesday

MNI: PBOC Sets Yuan Parity Lower At 7.1693 Weds; -1.18% Y/Y

MNI BRIEF: Japan Dec Positive Real Wages Widen To 0.6%

Is The FOMC Getting Worried About Shelter Prices Again?

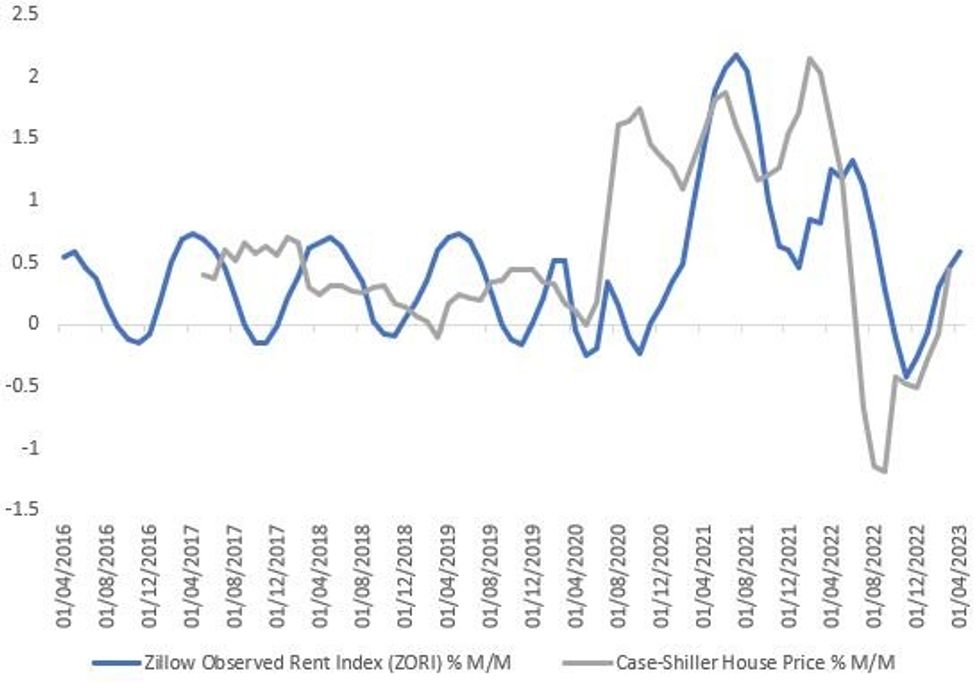

Speeches today by Gov Bowman (here), and last week by Gov Waller (here) highlighted concern that one of the key pillars of the FOMC's disinflation narrative - a softening housing market - may not be playing out quite as well as expected.

- Granted, those Governors are the most hawkish two members on the Board - but Bowman summed up the concern by saying "while we expect lower rents will eventually be reflected in inflation data as new leases make their way into the calculations, the residential real estate market appears to be rebounding, with home prices leveling out recently, which has implications for our fight to lower inflation."

- Powell last year said higher mortgage rates would help "reset" the housing market. And since Powell laid out the "three buckets" approach to the projected 2023 inflation moderation, softer goods and shelter prices have been taken almost for granted, with ex-housing services expected to be the toughest to tame.

- So it has proven so far - Powell barely discussed shelter prices at the May FOMC press conference, and the May meeting minutes showed no concern over a potential stubbornness in rents (saying that participants saw the lower prices for newly-signed leases continuing to feed into lower measured housing service inflation).

- By some measures, the housing market is bottoming sequentially, with Zillow showing observed rents +0.6% in April (highest since last August), with Case-Shiller house prices +0.5% in Mar (highest since May 2022), potentially suggesting softness is past the worst.

- The housing disinflation narrative is unlikely to change quickly, but it's clearly on the minds of some senior Fed officials - at least the concern that the shelter component can't be taken for granted in H2, which if not translating into further hikes, would play into the "higher for longer" theme.

Source: Zillow, Case-Shiller, MNI

Source: Zillow, Case-Shiller, MNI

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.