-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

ISM Starting To Tell A Different Services Story From PMI (Again)

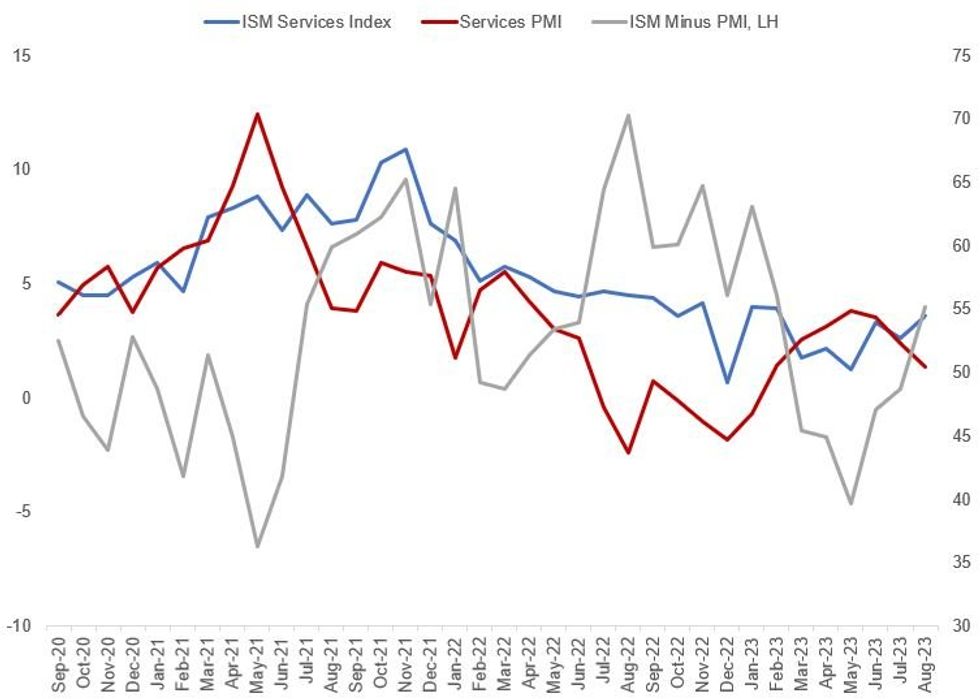

The unexpected downward revision to the final reading of September's US Services PMI reading to a 7-month low 50.5 (from what was a 6-month low in the 51.0 flash print) was put in stark relief by the unexpected rise in the ISM Services PMI reading 15 minutes later (54.5 vs 52.7 prior). This has spurred some client questions about why the reports seem to be telling a different story about the US services sector.

- The S&P Global PMI report described in its words a "deteriorating picture in the service sector" in August while noting waning demand. However the ISM report showed a bounceback from a dip in July with strong readings across subcategories, including a noticeable jump in New Orders to a 6-month high (vs PMI's note of a renewed decline in new orders).

- While these reports are painting different pictures, this isn't the largest recent divergence between the two - a year ago in the summer of 2022 MNI looked through the difference between the two surveys, which ultimately resolved in favor of the ISM edition (our report is here). At that time, the ISM (at above 56) exceeded the PMI by over 12 points.

- August marks the 2nd month of divergence in the ISM's favor and the biggest (4 points) since Feb 2023.

- We made three observations in that report a year ago: the ISM PMI is likely to be resilient because it has a wider range of industries, of which some have benefited from higher commodity prices; the ISM may have a bias towards larger firms that are more insulated from cost pressures; and the S&P Global index is a business activity (output) index alone vs ISM’s weighted approach which includes the public sector activities.

- Some of these factors may be at play again, though it's difficult to determine from just one report. Arguably the ISM was more "right" in late 2022 and the PMI was slightly more "right" in 1H 2023. Eyeing the chart, there may even be some basic seasonal factors at play, with ISM performance picking up vs PMI in the past few of summers.

- Especially given that the gap is still narrow, we would caution not to draw any conclusions from the nascent August divergence besides that US services activity continues to expand in Q3. But the divergence is one to watch.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.